The China Analyst

Post on: 4 Апрель, 2015 No Comment

A knowledge tool for executives with a China agenda

China’s Construction Industry: Strategic Options for Foreign Players

User Rating: 5 / 5

Within the next decade, China’s construction industry will account for nearly one-fifth of all global construction output. Although entering the Chinese market presents challenges to potential foreign entrants, opportunities exist for those with high-tech capabilities and for those willing to look beyond China’s borders to take on projects in the emerging economies of Asia and Africa. By William Dey-Chao

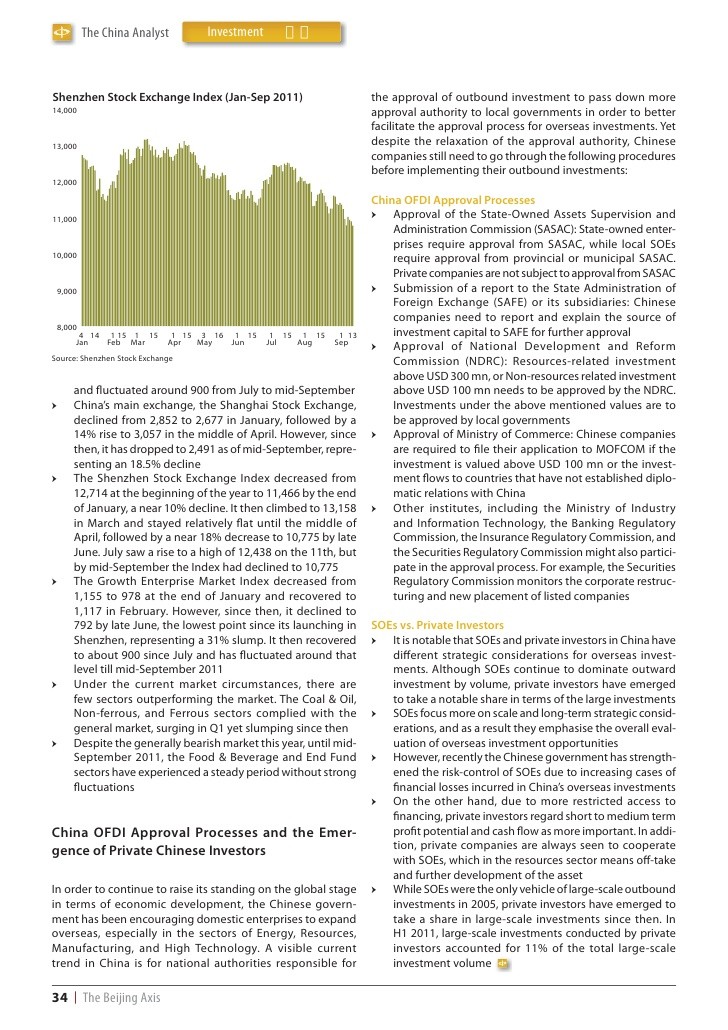

China’s construction industry has been a driving force behind the nation’s economic growth ever since it was targeted during the reform period of the 1980s as one of the cornerstones of China’s plan for modernisation. After nearly three decades, construction activity in China continues to boom (see chart below), with the industry’s output currently representing 24% (USD 1.4 trillion) of China’s GDP.

China’s sustained demand for residential, industrial and infrastructural expansion has generated the need for a multitude of new construction projects. The number of Chinese households grew by 9% from 2005 to reach 420 million in 2010, corresponding with population growth and less extended family living units. Industrial output has also expanded dramatically, and infrastructure needs have multiplied. Other drivers such as rising real per capita incomes, greater urbanisation and more investment in fixed assets have propelled China’s construction market to its current place as the world’s second-largest, accounting for nearly 14% of the global market (see table below). By 2020 China’s construction industry is expected to obtain the top spot at 19% of global construction output.

Entry barriers

The challenge then for foreign construction firms is how to access this booming market. Although China’s economy has become increasingly open, the construction industry remains relatively protected, with most construction activity undertaken by state-owned enterprises. As many as 9,000 state-owned enterprises are involved in Chinese construction, yet only 400 foreign-invested firms have registered activity in China. Foreign firms are only allowed to perform construction projects financed by international organisations such as the World Bank, the Asian Development Bank and by foreign governments, or those projects which are wholly financed by foreign companies. In addition, the government does not allow foreign-owned enterprises to undertake design, construction or consultation independently within China. To participate in projects that are subsidised by the Chinese government or by domestic banks, foreign firms are required to form joint ventures or corporations with domestic firms.

A case in point of the challenges faced by foreign construction firms is China’s housing sector. There is certainly a lot of potential here. As of 2009, around 620 million people, or 46% of China’s population, lived in cities. Some estimates anticipate that by 2020 the urban population will rise to nearly 50% of China’s total population, and that by 2050 the percentage will rise further to 75%—a level comparable to that of developed economies. Accommodating this demographic shift will require even further expansion of China’s already enormous cities, with equally impressive infrastructural upgrades necessary to facilitate the massive movements of people and goods that are to follow. However, due to the support of China’s government for domestic companies, as well as the general inability of foreign players to compete in terms of cost, foreign companies remain at the fringes of China’s housing construction. The greatest potential for international companies lies in energy conservation, environmentally friendly building techniques and in the adaptation of modern materials—primarily in a consultant-type role.

Niche industries

Nonetheless, according to China’s National Bureau of Statistics, there are around 400 foreign-invested joint ventures in China. These companies targeted China’s civil and heavy engineering sectors. By partnering with domestic players, international companies have entered the Chinese market leveraging their intellectual property and value-added services—competencies which Chinese firms have not yet fully developed. Foreign companies have achieved the best results in providing some of China’s power generation, transportation, water distribution and industrial needs.

Power generation has been an area of relatively heavy involvement by foreign players. China has doubled its power output in the last decade. Yet with per capita electricity consumption levels still well below that of developed nations, the coming decade will likely see further increases to China’s power output. Such expansion requires the expertise of foreign construction firms, as do plans to diversify away from coal-dominated power generation by means of nuclear and renewable energy sources, areas in which foreign firms are more experienced.

An early example of international involvement in China’s power generation was the work of Hochtief, a German company, which completed a 154-metre high rockfill dam near the city of Luoyang with a volume of 50 million cubic metres. The project was part of a larger commission from the Yellow River Water and Hydroelectric Power Development Co. and was completed in 2001. A more recent example is US-based First Solar, which announced a partnership with China Guangdong Nuclear Solar Energy Development Co. to build one of the world’s largest solar power plants in Inner Mongolia in northern China. The plan is to install 2 GW of power generation capacity—the equivalent of two coal-fired plants—by covering 64 square km with solar cells to be built in stages through 2020.

Transportation is another promising area for foreign firms in China, particularly railway construction. Projects set forth in China’s 11th Five Year Plan (2006-2010), which allocated USD 183 billion for railroad infrastructure, are still ongoing. This massive allocation of funds contributed less than half to the USD 441 billion worth of spending dedicated to railways in the five years up to 2010, all part of the government’s goal to complete 90,000 km of operational railway track. The 12th Five Year Plan for 2011-2015 has allocated even more funding. This initiative has earmarked about RMB 3.5 trillion (USD 526 billion) for further railway construction, of which investment in urban rail transit is expected to surpass RMB 700 billion (USD 108 billion). According to China’s Ministry of Railways, future railway construction will focus on the refurbishment of old railways and on the building of high speed rail lines.

It is this shift in focus to high speed rail that provides the greatest opportunities for foreign companies. In 2009 it was estimated that foreign companies were awarded around USD 10 billion worth of contracts related to China’s high speed rail system. Canada-based Bombardier Inc. one of the world’s largest rail equipment manufacturers, is one such company set to profit from this trend. In 2010 it was awarded a contract valued at USD 761 million to provide 40 high speed trains as well as signalling systems. The company operates in China through a joint venture, Bombardier Sifang (Qingdao) Transportation, and will be a key beneficiary of the 27,500 km in new high speed track planned by the Chinese government.

Then there is water distribution. Here, the Chinese government has earmarked USD 303 billion for water infrastructure projects over the next five years to secure access to safe drinking water for millions of rural residents. Urban areas too will benefit. USD 3 billion will be spent in 2011 on Beijing alone for water projects to sure up the city’s water supply. A foreign player who is looking to act on water distribution opportunities in China is Suez Environment SA of France, Europe’s second-largest water utility, which announced in 2010 that it was looking at expanding its operations in China through joint ventures. Opportunities exist in China’s water distribution for companies willing to invest in concession-type structures, particularly in build, operate and transfer (BOT) projects. Opportunities also exist for international equipment providers to meet China’s increasing water quality requirements via sales of high technology equipment.

New technology

As China’s economy advances it is adopting new technologies in which foreign companies have been the forerunners, and hence have the ability to profit by conferring their knowledge to nascent Chinese industries. Bechtel of the US is one firm that has done just that. It has participated in various Chinese projects over the years, including as a management contractor during the construction of 11 chemical plants. One was a major petrochemical project, an 800,000-ton-per-year naphtha cracker together with downstream plants, utilities, and infrastructure that was completed in 2005.

Siemens AG, a German company, also serves as an example in how to target emerging industries in China. The company is expected to finalise an agreement to supply charging infrastructure for electric vehicles to a still undisclosed Chinese city. The deal would see the engineering company install charging points for electric vehicles throughout the city as well as expansions to various green technologies throughout China such as wind farms, medical equipment and high-speed trains. The projects underway by Siemens AG symbolise the future of foreign involvement in Chinese building activity—it will be a shift away from the basics to technology intensive processes involving clean energy, environmental protection, technical controls and automation processes for machinery, logistics, and project management services to elevate China to the next level in its economic development.

Thinking beyond borders

Ultimately, when attempting to access China’s construction prowess, foreign companies would miss many opportunities by narrowly focusing on China’s domestic market. The real opportunities for partnering with Chinese construction companies are in developing markets, where Chinese players are expanding their presence. Chinese builders are not just expanding the infrastructure and housing blocks of their own cities but are some of the top international contractors in the developing economies of Asia and, even more so, Africa. Truly forward-looking international construction firms are now harnessing this trend for their benefit.

The Korean major Hyundai E&C has plans to do just that. It is currently considering opening several branch offices in China, and its CEO recently visited the country to forge closer relationships with Chinese builders and equipment suppliers. Hyundai E&C’s Chinese branches, expected to open sometime in 2011, will seek cooperation with Chinese development companies and EPC contractors specialised in the development of oil, gas and renewable energies and in technology-intensive civil works. Through this heightened Chinese presence, the company also hopes to join forces with Chinese companies for projects in Africa, the CIS and in Latin America. Although China’s government has impeded foreign companies from openly engaging in China’s construction market, these restrictions stop at the Chinese border. Perhaps the best opportunities exist for foreign firms which incorporate China into broader, global-oriented strategies.

Building a synergistic relationship

Once an international company has determined that accessing the potential of China’s construction industry is an essential component of its forward-looking strategy, the challenge of engagement then remains. A few critical success factors must be heeded in order to ensure successful execution both within China and abroad, and I include a few of them below.

Locate the right partner – In order to succeed in China’s construction market, given domestic regulatory constraints, it is imperative that foreign companies establish a good relationship with the appropriate Chinese partner. Access to capital, political influence, and operational capabilities are aspects to consider when identifying potential partners. Although most of the Tier 1 players (Major state-owned enterprises) will be difficult to approach given their size and influence, Tier 2 (medium-sized provincial and semi-public companies) and Tier 3 (smaller private companies) are more readily approachable and to find synergies with.

Leverage core competencies – Foreign companies should utilise their core competencies in order to create synergies with Chinese companies (from Tiers 2 and 3) that will enable them to create value and directly compete with Tier 1 companies.

Employ a diversified China strategy – Incorporating strategic sourcing from China into the mix will allow foreign players to become more competitive global entities able to leverage China’s status as a low cost country. In this way they will be able to utilise the partnership to engage reliable suppliers to obtain a competitive advantage through low cost sourcing.

Conclusion

For foreign construction companies, profiting from China’s ongoing construction boom is essentially a question of partnership. There are distinct (and profitable) roles for foreign firms to play in specific niche industries in China, namely power generation, high speed rail, and water distribution, as I have outlined above. Various foreign firms have fulfilled such roles in China in the past, and more will do so in the future. Yet not only in China, but also in emerging markets in Asia and Africa where Chinese companies are so active, crafting the right partnership with the appropriate synergies with Chinese firms is the underlying challenge for foreign construction firms.

All the while, China’s construction industry and those of other emerging markets are changing rapidly. The success of today’s international companies relies on their ability to adapt to this phenomenon and the ability to craft new collaborative models to ensure success in the years to come.

William Dey-Chao, Manager

This email address is being protected from spambots. You need JavaScript enabled to view it.