The butterfly options spread

Post on: 7 Апрель, 2015 No Comment

The butterfly spread, or to be more precise the long butterfly spread, is a relatively advanced neutral options trading strategy with limited loss and limited profitability. It is normally put on for a debit, which places it in the category of debit spreads. Let us have a closer look at what this spread has to offer the trader.

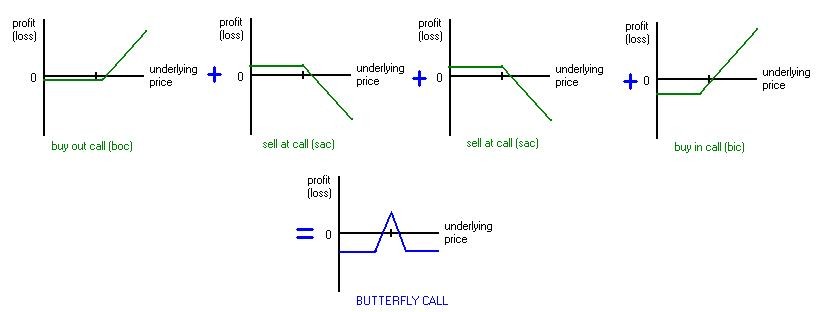

Below is a chart indicating the risk/reward scenarios for a Butterfly spread.

A typical butterfly spread is initiated by:

a) Selling two ATM call options

b) Buying an ITM call option with the same expiration date

As an illustration of the versatility of the butterfly spread, it has to be mentioned that this trade can also be executed using puts, in which case one would:

a) Sell two ATM put options

b) Buy an ITM put option with the same expiration date

c) Buy an OTM put option with the same expiration date

Profit zone

The profit zone of the butterfly spread is centred round the strike price of the short option. In this particular example the strike price has been chosen to be at the money. This implies that the underlying asset is expected to remain within a narrow range, close to its current price.

If one is bullish about the price, it is possible to restructure the Butterfly spread in such a way that the profit zone is shifted to the right in our chart. i.e. the maximum profit will be attained if the price of the underlying asset should increase. In that case OTM options will be sold and one would purchase one option with a strike price closer to the money and one with a strike price further away from the money – on different sides of the short strike price.

Risk

As with all options trades, there is an element of risk involved with the butterfly spread. Traders with a low risk appetite usually like this spread, however, because it has:

a) A fixed maximum risk which is known before one enters the trade (and)

b) The maximum risk is usually lower than the maximum profit which can be realised with the trade

Maximum profit

The maximum profit for this spread is attained when the price of the underlying asset (share, currency, commodity) ends up exactly at the strike price of the two short options on the expiry date. The maximum profit that is possible is calculated by:

a) Adding the sum of the premiums received from selling the two short call options and

b) Deducting the cost of the long OTM call options from this and finally

c) Adding the profit on the long ITM call option.

Example:

Assume the shares of company ABC are trading at $40 at the moment and that 3-month ATM call options can be sold for $3.26, ITM call options for the $39 strike price sell for $4.76 and OTM call options for the $41 strike price sell for $2.12

The net debit for entering this position is 2 x $3.26 $4.76 $2.12 = $6.52 $4.76-$2.12 = $0.36.

Since 1 options contract = 100 shares, the net debit (cost) for entering this trade = 100 x $0.36 = $36.00. This is also the maximum possible loss for this particular trade.

The maximum profit = $40 $39 $0.36 = $0.64 per option, i.e. $64 for this particular trade.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D90&r=G /%