The Big Debate #1 401(k) or Roth IRA The Simple Dollar

Post on: 21 Август, 2015 No Comment

This week, The Simple Dollar is taking a deeper look at five common personal finance debates.

One of the most common questions I get asked about retirement plans is whether or not a person should be putting their money into a 401(k) or a Roth IRA for retirement. The answer isnt as straightforward as it might seem.

What Are The Options?

A 401(k) is a employer-sponsored deferred contribution retirement plan, so named because its defined under section 401(k) of the IRS code. In a nutshell, it works like this. You sign up for a 401(k) plan in your workplace and choose investment options within the plan. Your workplace takes money out of your paycheck before income taxes are taken out and deposits this in your plan. In some workplaces, your contributions are matched by the employer. Then, when you reach retirement age, you can take money out of the 401(k), but those withdrawals are subject to income tax since you didnt pay it earlier, you have to pay it later on. Currently, there is no upper income limit on who can contribute, but an individual can contribute at most $15,500 to his or her 401(k) in 2008 and the maximum amount that can be contributed total between employer and employee is $46,000 in 2008. You can find a lot more detail in the Wikipedia entry on 401(k)s .

A Roth IRA is an independent individual retirement account that you set up directly with an investment firm; its name comes from its chief legislative sponsor, Senator William Roth. With a Roth IRA, you set up an account with an investment house yourself, choose investment options with them, and then directly deposit after-tax money (from your checking account, for example) into the Roth IRA. Then, after meeting a few basic requirements (youre 59 1/2 years old or older and have had the plan for five years or more), you can withdraw both your deposits and gains completely tax free. In 2008, the maximum contribution you can make is $5,000 a year (unless youre over 50). There is one big caveat: there are income limits on who can contribute if you make more than $99,000 individually or $156,000 jointly, you cant contribute the full amount (and may not be able to contribute at all). You can find out a lot more detail in the Wikipedia entry on Roth IRAs .

What Are The Big Differences?

The big differences between the two are employer contributions, investment options/management, and taxes. Lets look at each aspect.

Employer contributions With a 401(k) retirement plan, an employer may match contributions made by an employee up to a certain percentage. For example, one 401(k) program I know of offers a 2:1 match for every dollar contributed to a 401(k) up to 5% of the salary. So, if you contribute 5% of your salary to your 401(k), the employer also puts in an extra 10% of your salary, effectively tripling your contribution. In short, if your employer offers matching contributions to your 401(k), that likely trumps any other concern and you should use a 401(k) . Its free money, after all dont turn it down.

Investment options/management With a 401(k), youre tied into whatever management and investment options are made available to you by the plan your company offers. That often means the investment choices are relatively weak. Things to look out for in your investment plans are expense ratios (if theyre high, thats bad) and investment options (the more choices, the better). With a Roth IRA, you are allowed to choose your management and thus also your investment options you pick the investing house you want to use. I chose Vanguard because the expenses they charge me are very low and they offer a huge number of index funds, my investment of choice. Roth IRAs offer an advantage in that they allow you to choose your plans manager, though if your 401(k) offers good options, this may not be a big advantage.

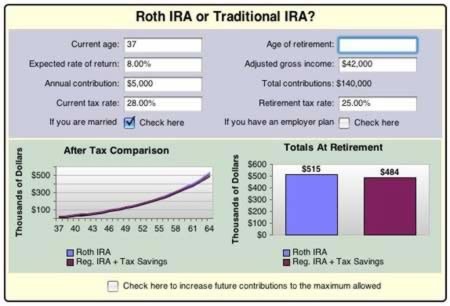

Taxes This is really the sticky wicket out of the three because it involves some prediction of what the future holds for you. Heres the deal: if you think your income tax rate will be higher at withdrawal time than it is now, a Roth IRA is a better choice and will save you money in the long run. If you think your income tax rate will be lower at withdrawal time than it is now, a 401(k) is a better choice and will save you money in the long run.

How can you know which rate will be higher? Here are a few things to ask yourself.

Will my income grow vastly between now and retirement? If the answer is yes, youll likely be in a higher tax bracket when you retire, which favors the Roth. If youre near your peak, youll probably be in the same bracket or lower, which favors the 401(k).

Will I be working in my retirement years? If the answer is yes, you have a much higher chance of at least being in the same tax bracket you are now. If the answer is now, likely your income will be lower.

Will the political landscape shift towards higher tax rates? This one, honestly, is complete guesswork. If I had to guess, I would speculate that tax rates will go up in the future, and that favors the Roth IRA. If you think theyll go down, that favors the 401(k).

Seem confusing, even overwhelming? Thats because it is. Its really hard to tell what will happen with the future and balancing different factors like that is hard. My personal opinion is that the Roth IRA has a slight edge in the tax department, but thats mostly because I believe taxes are going to eventually go up.

So What Should I Do?

The first step, to me, is pretty easy. If your employers 401(k) plan has matching funds, always contribute up to the maximum amount that receives matching. This is free money, and enough of it that it trumps the other concerns. Get it while you can.

The question really revolves around what to do with additional retirement money. Given all the factors above, and also assuming youre young and have many years of income growth ahead of you, I believe the best option is a Roth IRA but they take a bit more work. You have to find your own investment plan with a Roth IRA and set it up yourself (its not that hard, but it does take a bit of time up front), but that gives you the freedom to find an investment house that matches your philosophy and saves you money (for me, thats Vanguard).

If youre older, near the peak of your income potential, and expect to have a smaller income in retirement, then more contributions to your 401(k) is probably your better choice .

No matter which path you decide to follow . simply by the act of putting money away youre putting yourself ahead of the game. Dont let this debate keep you from starting to save if all else fails, simply start making contributions to one or the other now and then make up your mind later on you can always change your contributions around later.