The Best Ways to Rollover a 401k – Some Good Advice

Post on: 11 Июль, 2015 No Comment

The Best Ways to Rollover a 401k – Some Good Advice

Published: August 28, 2010

By: FinanceHeaven Blog

If you are looking for the best ways to rollover a 401k. here is a bit of advice. Learn the legal definition and the differences between rollovers and transfers. This article provides that information and more.

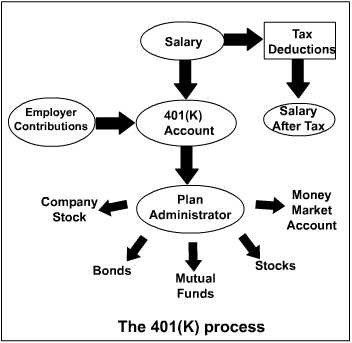

Rollovers and transfers are two ways to move funds or holdings from one account to another. Rollovers require liquidation of assets. Transfers do not always require liquidation. In many cases, holdings can be transferred from one institution to another. That could be the wisest choice.

Rollovers can only be taken once during a 12 month period and the investor has only 60 days to choose a new institution and redeposit the fund. There is no limit to the number of transfers that can occur during a 12 month period.

If you find that you are unhappy with a new provider and you transferred the fund initially, you can transfer it again, without incurring IRS penalty. If you take two rollovers, you will pay taxes on the entire account value during the applicable tax year.

The terms are used interchangeably by many institutions. Many people that are looking for the best ways to rollover a 401k are actually interested in transferring the fund. Regardless of the term that you use, if you are about to make a change, it could be time to consider self-investing.

On the average, account holders that self-direct their investments in options other than stocks or bonds earn more. Mutual funds are simply a group of stocks. Their value is affected by stock market fluctuations, just like a single stock holding would be.

Many of us experienced investors believe that one of the best ways to rollover a 401k is to set up a self-directed account. It’s a lot easier than you might think. There are a number of different financial institutions that allow self-directed investing, including Equity Trust.

For the experienced investor, self-directed IRAs are not a big change. For the not so experienced investor, it can be challenging. Luckily, there is a lot of information available on the internet and much of it is free.

You can learn how to identify potentially profitable investments. You can learn how to become a millionaire. You can decide if self-directing is right for you, before you ever call your current financial institution.

One of the best ways to rollover a 401k is to find a provider that allows the real estate option. There has never been a millionaire that did not invest in real estate at some point in his career. Of course, you don’t want to invest in the McMansions. Their time has come and gone.

But, there are still lots of middle class Americans that need affordable housing. Finding it has become the challenge. Practically every American strives for the dream of home ownership. You might be able to help them fulfill that dream.

If you are still fuzzy about the best ways to rollover a 401k plan, take the time to read more. If there is one thing that you can never get too much of, it is knowledge.