The Basics Pros Cons Points to Consider and The Modelling of Convertible Notes_1

Post on: 23 Апрель, 2015 No Comment

UPDATED (Nov 11, 2013) Notes added on: Conversion Triggers section & attached Cap Table in folder updated to v2 to fix some bugs.

The Convertible Note gets lots of attention in the blog-o-sphere as an alternative to traditional equity financings; some of this attention is good and some of it bad. Some investors refuse to use them, while others love them as a quick way of getting a company the capital it needs.

Convertible notes are sometimes viewed as a “best of both worlds” compromise from both a company perspective as well as from an investor’s perspective: on the one hand, a note is a loan, so the investor enjoys more downside protection than would an equity holder in the event the company is forced to wind up or dissolve for whatever reason; on the other hand, if the company eventually raises money by selling shares to later investors in a typical early stage financing round, then rather than pay back the outstanding amount in cash, the principal and interest are “converted” into shares of stock in the company (usually at some sort of discount off the price offered to new investors – I’ll discuss that below). In other words, the investor enjoys the downside protection typically associated with debt lenders, but is also positioned to enjoy the upside opportunity typically enjoyed by equity holders.

As with any tool, before you use it effectively, its best to understand the pros and cons of each of its features and how they can be used for your individual circumstances. Fortunately, convertible notes typically have fewer moving pieces than do equity instruments (which explains, in part, why they’re sometimes favoured by early stage companies and investors – the negotiation and documentation for a convertible note round is likely to be far less time-consuming and costly than for an equity round), but before we proceed any further in dissecting this tool, lets look at the headline basics of a convertible note:

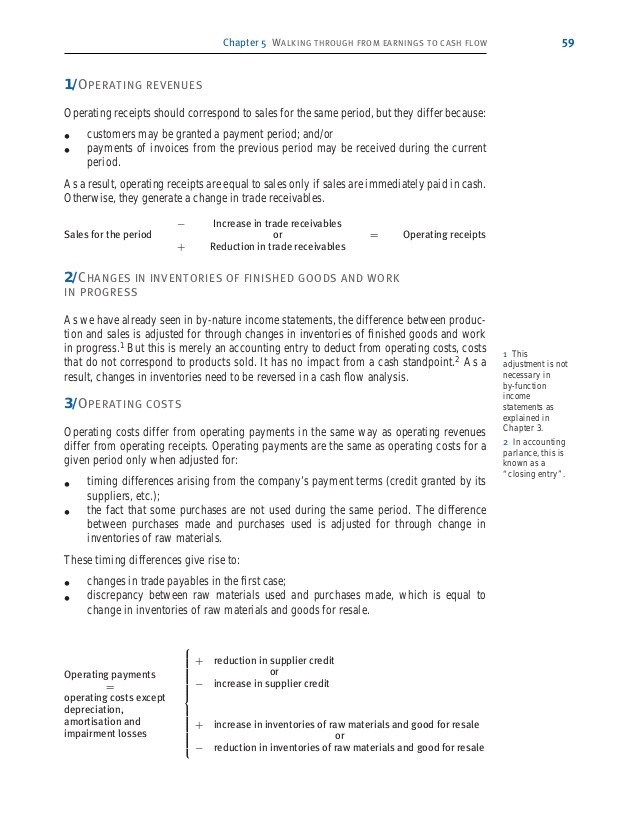

1) Total Amount Raised by the Note – This amount does have a natural limit. Think about it this way… you have an amount outstanding on your cap table, that will be part of an upcoming round. If a new round in the future isnt particularly big, having too much money outstanding can create a problem with your convertible note holders taking up too large a portion of that round. Example: a 300K convertible which converts as part of a total 600K seed round would loosely mean that the convertible note holders would have 50% of the round. If the round was supposed to be for 20% of your equity, that means your new investor will only get 10%, an amount that may not excite him that much… and also you only get 50% new money in the door. To limit the extreme cases of this being done, investors usually create a qualified round definition within the Notes terms for conversion (see bullet #5 below) which reduces the likelihood of this amount being disproportionally larger than a new investors amount as part of a new round.

2) Discount Percentage – Simply put, if shares are worth $1 a 20% discount percentage would mean that an investor would get the shares for 80 cents. For cases where the next rounds valuation is below your convertible note holders cap as set in point #3 below, a discount factor will yield the convertible note holder a marginally cheaper price for having taken a risk on you. Typically this discount percentage is likely to be between around 15-25%. Another Example: a round closes at 3M. Your cap is at 5m. Your convertible note holders have a 20% discount, so they get to convert into the next round at a valuation of 2.4M.

3) Limit On Company Valuation At Conversion (the so-called “Valuation Cap”) – In order to calculate the number of shares into which the outstanding balance on a convertible note will convert, you must know the price at which the next round’s equity securities are being sold. Price per share, as you may or may not know, is calculated by taking the company’s pre-money valuation (negotiated at the time of the equity financing between the company and the investors) and dividing that number by the total number of outstanding shares in the company (the company’s “fully diluted capital”). Recall, however, that convertible notes are typically entered into in anticipation of an equity financing round – thus, at the time a convertible note is issued, no one knows what the negotiated pre-money valuation will be if/when the company undertakes an equity financing. Consequently, no one knows exactly what the price per share will be at the time the notes are issued. This creates uncertainty and is a cause for some investor anxiety, particularly for those investors concerned that that the number of shares into which their note may convert may be insignificant relative to the other shareholders, particularly in the event the pre-money valuation at the time of conversion is especially high.

The valuation cap is intended to ease investor concerns by placing a maximum pre-money valuation on the company at the time of conversion. with the use of a cap, an investor can effectively set the minimum amount of equity an investor is willing to own as part of having participated in your convertible note round. For example, if you have a 200K note on a valuation 5m cap, then the worst case scenario for that convertible note holder, would be 4% equity after the new round is over. A typical valuation cap for very early-stage companies will be around $4m $6m, with most companies at the Series A level settling on $10m valuation caps or more. For more statistics on caps and other components of a convertible note, I have included a link at the bottom of this post to an article with additional stats.

One thing to note, is that in the USA, there is a rising prevalence of uncapped notes. Clearly this is a founder friendly outcome, and if possible, always nice to get. The flip-side, is that for the investor, the may feel a bit unprotected in the case of where the company does exceedingly well and thus their amount converts to a much smaller percentage than originally hoped.

4) The Interest Rate on a Note – A convertible note is a form of debt, or loan. As such, it usually accumulates interest, usually between 4-8% between the point when you sign it and when it converts. This amount is usually converted as part of overall amount at the next round. For example, if you have an annual interest rate of 8% and you have a Loan Note of 100, then youd convert 108 after a year.

Note: In the US, it’s highly advisable to include an interest rate, even if it’s simply a nominal amount equal to the applicable federal rate (most recently at less than 1%), b/c if not, then any amount that could have been earned via interest is taxed to the company as gain. So it’s not really an option to exclude it in the USA. In the UK, you don’t necessarily need to include it should you wish to omit it.

5) Conversion Triggers – The point of a convertible note is for it to convert at some point in the future, not for it to stay outstanding indefinitely. As such, it will likely have a series of triggers for conversion. One I mentioned earlier is the next qualified round. Basically this means that the round is big enough to accommodate the amount in the note (without washing out new investors) and also is the type of round that is typical for the next step in the companys growth and will give the note holders the types of rights theyd expect for their shares once converted from loan to equity. Another conversion trigger is an expiration maturity date, whereby the note holder typically can either ask for their money back (although this rarely happens) or basically seek to convert the outstanding amount at that point. There are more types of conversion triggers that note-makers can add to a note, but these are the basic ones. Update: upon a change of control event in the future and before the convertible is converted, investors can sometimes ask for a multiple of their loan back as payment in lieu of converting to ordinary shares prior to the completion of the change of control event. You can see some examples of this in the wording of the attached examples later in this post.

Again, these are the headline terms of a convertible note, and not representative of all the terms. However, for early discussions with potential investors, youll rarely have to talk about anything more than 1-4. Beyond that, you usually start having to involve lawyers (or experienced deal drafters) to help you finalise the document.

Now that weve reviewed the basics of a Convertible Note, take a look at a recent report that has statistics of what common terms have been given to Valley based companies. If you are not in the Valley, you will likely have a different set of averages, so be mindful of that.

Now, lets look at the headline pros and cons of using a convertible note.

- Typically less involved and less paperwork than equity rounds; can cut down on time and legal fees

- Investors enjoy downside protection as debtholders during the earliest stages of the company when company is at critical growth stages

- Company can defer the negotiations surrounding valuation until later in the company’s lifecycle (i.e. for very early stage companies at the earliest stages of planning and preparation, valuations can be more difficult to define)

- At conversion, note holders typically receive discounts or valuation caps on converting balance, thereby rewarding the earliest investors appropriately for their early investment in the company but without causing valuation issues for the company

- If a convertible note is made to be too large, it can negatively impact your next round because itll convert to a disproportionally large portion of your next round, effectively crowding-out your next rounds potential investors from having the equity stake they may desire.

- If a convertible notes cap is made too low, in order to accommodate a larger round later, the Founders may need to take the additional dilution that would happen if they exceeded the convertibles cap.

- Because a convertible note can be made to be quite versatile, sometimes investors can add clauses in there that have greater implications down the road, such as being able to take up more of a future round than the actual amount theyve put in, for example.

- If not careful, you can accumulate various too much convertible debt which may burden you at a conversion point

- Doesnt give your investors (in the UK) SEIS tax relief, thus making it less attractive than an equity round. There may be some workarounds, but generally SEIS and Convertible notes are not seen as compatible.

- Notes give convertible note holders the investor rights of future investors (say in a future Series A Preferred Shares), which may include more rights than those they would take for the amount of money they put in had they simply done an equity deal on Ordinary Shares with you today.

- If the convertible note automatically converts at the next equity raise (i.e. the investor has no choice), investors may wind up being forced to convert into securities shares despite not being happy with the terms of the equity financing. The note holders may unfortunately have less influence in negotiating the terms of the equity financing, which partially explains why some investors are reluctant to invest with convertible notes.

- Finally, while convertible notes allow the company to defer the valuation conversation until a later time (see discussion under “Pros” above), any inclusion of a conversion cap will raise a similar conversation, which defeats some of the purpose for why companies and investors alike originally favoured the convertible note as a quick-and-easy financing solution to begin with.

Now lets explore a few more core concepts in detail.

Seniority - A convertible note is a form of debt or loan. Although its not too common to hear about investors asking for their money back, they in fact, do have that right… additionally, one of the privileges that having the Note act like debt is that it acts senior to equity in the case of a liquidation. What this means in practice, is that Loan holders will get their money back first.

Subscription Rights Some investors like to have more equity than their invested amount would likely yield them upon conversion. So one thing to look out for is how much they want to take up of the next round as part of having been in the convertible note. Example: An investor gives you 50K, which converts at your next round of 1m on 2m Pre at 1.6% -> next to nothing for the convertible investor. However, that investor had a Subscription Right for up to 30% of the new round, so that allows him to participate on the 1m round with up to 300K thus affording him a larger seat at the table in excess of the 1.6% he would just have without this right.

To conclude and to provide you with some practical examples, in the following Google Drive Folder I have added an excel sheet with an example cap table as well as UK & USA termsheet templates from Orrick* that are uberly simple, for review purposes only (they may not be fit for what you need, but give you an idea). A comment on the example cap table it isnt designed to be fully realistic per se, as in, your cap table will likely not look like this in terms of founders and shareholders and number of rounds before a convertible comes in, but it serves well for you to play with the variables that make up a convertible note so you can see how they affect your fully-diluted stake after a round.

I hope this helps you decide what the best options may be for you. As usual, please give me feedback on all these materials as with software, there are likely bugs somewhere. Thanks in advance!

*Regarding the Convertible Note Documents, a disclaimer from Orrick: The linked documents have been prepared for informational purposes, and are not intended to (a) constitute legal advice (b) create an attorney-client relationship, or (c) be advertising or a solicitation of any type. Each situation is highly fact specific and requires a knowledge of both state and federal laws, and anyone electing to use some or all of the forms should, prior to doing so, seek legal advice from a licensed attorney in the relevant jurisdictions with respect to their specific circumstances. Orrick expressly disclaims any and all liability with respect to actions or omissions based on the forms linked to or referenced in this post, and assumes no responsibility for any consequences of use or misuse of the documents.