The Basics of Shorting Stock

Post on: 16 Март, 2015 No Comment

A Quick Explanation for Beginners Explaining How Shorting Stock Works

Shorting stock is the process of borrowing stock you don’t own, selling it, and pocketing the proceeds. Later, you have to buy back the stock and return it to the owner from whom you borrowed the shares. This means a person who shorts a stock makes money when the stock declines, rather than appreciates. hh5800 / E+ / Getty Images

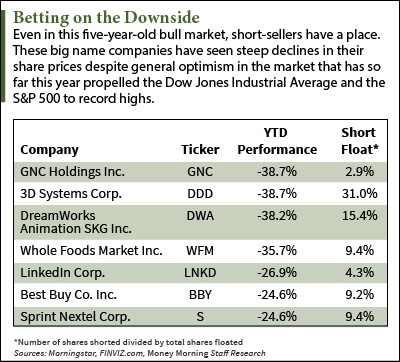

Arbitragers. speculators and many individual investors engage in a practice known as shorting stock. These shorts make money when the price of the stock they are shorting goes down.

The Basics of Shorting Stock

I own 10 shares of company ABC at $50 per share. You believe the stock price of ABC is grossly overvalued and is going to crash sometime soon. You are so convinced that the stock will crash, you come to me, and ask to borrow my ten shares of ABC and sell them at the current market price for $50. I agree to lend you my shares as long as you pay me back ten shares of ABC at some point in the future. You take the ten borrowed shares, sell them for $500 and pocket the money (10 shares x $50 per share = $500).

The following week, the price of ABC stock falls to $20 per share. You call your broker and tell him to buy 10 shares of ABC stock, at the new price of $20 per share. You pay him the $200 (10 shares x $20 per share = $200). A few days later, you pick up the shares of ABC and bring them by my office. Here are the ten shares I borrowed, you say as you put them on my desk.

Do you see what happened? You borrowed my shares of ABC, sold them for $500. The following week, when ABC fell to $20 per share, you repurchased those ten shares for $200 and gave them back to me. In the mean time, you pocketed the difference of $300.

The Speculative Nature of Shorting Stock

What if the price of ABC stock had risen? The person shorting stock would have had to buy back the shares at the new, higher price, and absorb the loss personally. Unlike regular investing where your losses are limited to the amount of capital you invest (e.g. if you invest $100, you cannot lose more than the $100), shorting stock has no limit to the amount you might ultimately lose. Famed investor

Ben Graham told us there is nothing stopping an overpriced stock from becoming more overpriced. In the unlikely event the stock had shot up to $1,000 (which actually happened to shares of Northern Pacific during a short squeeze in 1902), you would have had to purchase ten shares at $1,000 a share for $10,000. Taking into account the $500 you received from selling the shares earlier, you would have lost $9,500 on a $500 investment.

Some investors practice shorting stock as a hedge to protect their portfolio. In most cases, this is not required nor recommended for individual or institutional investors. If you have selected a company you believe has excellent prospects for the next decade, you should view a declining market as an opportunity to purchase more of a good thing, not something to be dreaded.