The Basics Of Options Trading

Post on: 29 Июль, 2015 No Comment

The Basics Of Options Trading

1.1 Introduction

buying and selling choices is ceaselessly viewed as a excessive risk task, which right away conjures up a vision of Nick Leason and the ruination of Barings financial institution. In observe, trading options can also be anything between notably excessive possibility and really low risk, decrease in truth than trading shares or indices immediately. The goal of this guide is not to be an choices trading direction, however to provide some route to make it easier to study this attention-grabbing and regularly misunderstood house of buying and selling for yourself. it is important to do numerous your own research. a whole lot of background reading, and be prepared to work at it in the identical way as you may some other type of buying and selling mission.

1.2 Index choices

A excellent position to start out is trading Index options, the FTSE100 most likely, or the S&P 500 or DOW. Index options have an a variety of benefits over share options, which will also be summarised as follows :-

1. Does no longer require consistent screen observing.

2. Indices tend to maneuver extra easily than person shares.

three. tend not to “spike” up or down, and in the event that they do, typically return to the mean.

4. No take-overs or profit warnings.

5. Spikes down are likely to recover, at the same time as shares can elevate on falling to zero.

6. month-to-month contracts to be had.

7. Tighter spreads than share options.

8. extremely liquid.

1.three Share options

Share choices have a tendency to provide “extra bang for the buck” than index options, and likewise help you unfold risk across a variety of trades. Volatility might be larger than for index choices, which could be a merit if used as it should be.

2. FAQs

- Q1, Aren’t options very excessive possibility?

- Q2, Do ive to learn all that “greeks” stuff?

- Q3, So how do I get started?

Aren’t choices very excessive risk?

They without a doubt will also be for those who dont make the effort and bother to learn to trade them with discipline and data. but used correctly, the risks concerned may also be decreased except they are lower than in case you were to change the underlying index or share right away.

Do ive to analyze all that “greeks” stuff?

A working information of the primary factors that impact options pricing will include time and observe, and will indubitably support your trading outcomes.

So how do I get began?

1. learn a just right options primer. there are a lot of good ones available in the market. by way of option, i would choose “options simple and easy” by way of Lenny Jordan. Then apply that up with choice Volatility and Pricing by way of Sheldon Natenberg.

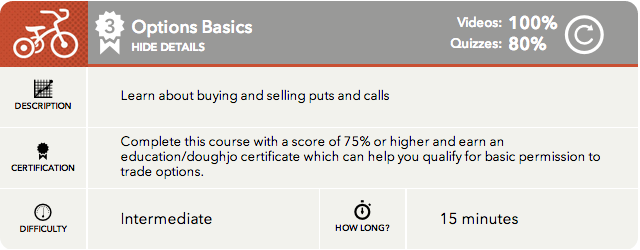

2. Use the resources of this web page and the web. There is a superb free on line training path run with the aid of 21st Century training

three. discover ways to construct and interpret profit/loss pay-off diagrams. Use appropriate software. There is a wonderful free plug-in to Excel97 and higher, options strategy evaluation variation available from Peter Hoadley.

four. Paper-trade the use of free 20 min delayed knowledge from Liffe for UK share and index choices, or CBOE which is the equivalent web site for share options in the usa.

3. really useful discussion board subject matters

options trading Thread

one of the most first options threads on T2W. comprises an evidence of ratio call spread, and the way to flip it into a butterfly.

option technique