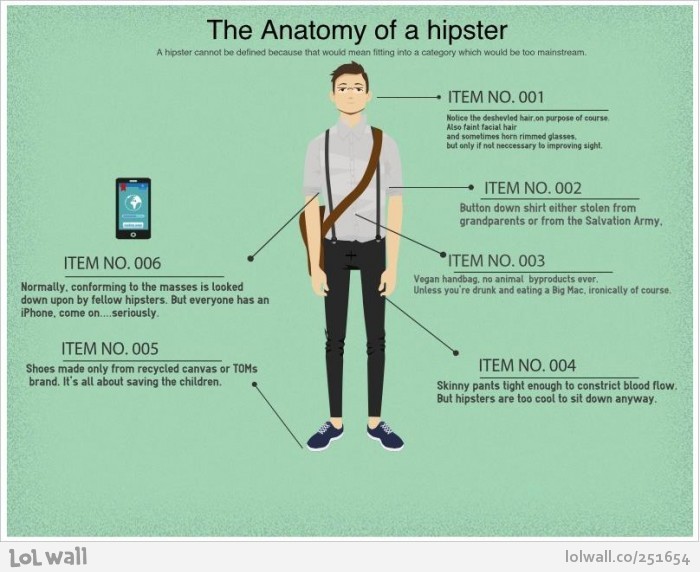

The Anatomy of a

Post on: 25 Июль, 2015 No Comment

Sometimes options are just too darn expensive.

Its frustrating. Youve done all the homework, crunched all the numbers, checked out the chart, and determined that XYZ stock is ready to pop.

So you rush over to the options market and look for a way to reduce your risk and increase your potential return, which is what options are designed to do.

But the prices are so expensive that even if the stock does exactly what you expect it to do, you cant make any money on an option trade.

So now you have two choices.

You can either abandon the trade altogether. Or you can call B.S. and design an option spread trade .

Spread trading is B.S. (buy, sell). You buy one option and then sell another. Its a more advanced strategy than just buying an option. or just selling an option (like I showed you yesterday). But its worth the extra effort.

Thats because it shifts the odds of a profit strongly in your favor. Let me show you a real-world example. Again, this is a little complicated. But bear with me.

Arena Pharmaceuticals (ARNA) is a clinical-stage biopharmaceutical company. An FDA advisory committee will be reviewing ARNAs weight-loss drug, Lorcaserin, for possible approval on May 10. A thumbs up from the committee would be a huge win for Arena and likely send the shares. currently trading at $2.15, soaring as much as 60% or more. A thumbs down would have the opposite effect.

For this example, lets just deal with the thumbs up side of the equation. Also, please understand: I am not recommending this trade. This example is for educational purposes only. So the prices listed may not reflect ARNAs current trading prices.

ARNA recently traded at $2.15 per share. A 60% pop to the upside gives us a target price of about $3.50. So we need to find an option trade that will profit off a move to that target.

The problem is the options are expensive. Traders have already bid up the price based on the probability of a big move in the stock. For example, the ARNA May 3 call options cost about $0.55.

This is a bad trade.

If the FDA panel doesnt recommend approving Lorcaserin, ARNA shares will fall hard. The May 3 call options will be worthless. If the FDA panel votes in favor of approval and ARNA shares rally to our target price of $3.50, the options will be worth only $0.50. Thats $0.05 less than they currently cost. This is a guaranteed losing trade because the options are just too expensive.

This is where a spread trade makes sense.

Yes, the ARNA May 3 call options are expensive. But so are all the other ARNA options. Since we think good news may only send the stock to $3.50 or so, why not sell the ARNA May 3.50 call options to someone else?

By doing this, well collect the premium, which will reduce our cost of the trade and give us a chance to profit.

Heres how this spread trade looks.

Buy the ARNA May 3 calls for $0.55.

Sell the ARNA May 3.50 calls for $0.41.

Net cost of the trade. $0.14.

Were spending $0.55 per share for the May 3 calls. But were collecting $0.41 per share for selling the May 3.50 calls. Our net out-of-pocket cost is $0.14 ($0.55 minus $0.41).

If ARNA receives approval and the stock rallies, well profit all the way up to $3.50 per share on the stock. Above that level, both the May 3 calls and the May 3.50 calls will increase penny for penny. Any gains in the May 3 calls will be offset by the gains in the 3.50 calls that we sold.

So well hit our maximum profit at $3.50 per share.

With ARNA at $3.50, the May 3 calls will be worth $0.50, and the May 3.50 calls will be worthless. The spread initially cost us $0.14 per share. We can now unwind it. Well sell the May 3 calls for $0.50. And we wont have to pay anything to buy back the May 3.50 calls. Weve made $0.36 per share. Thats a gain of 257% on the trade.

The spread allows us to do a few things.

First off, it lowers our out-of-pocket cost for the trade. Instead of paying $0.50 for the May 3 calls, the spread costs just $0.14. So our potential risk is reduced by 70%.

The spread also makes it possible for us to profit on the trade. It would have been a guaranteed loss if we just bought the ARNA May 3 call option .

At first glance, spread trading may seem a little complicated. But like I said, its worth the effort to learn.

Buying one option and then selling another reduces the risk of an option trade and increases the potential for a profit.

Its a good kind of B.S.