The ABCs of BrokerSold Funds

Post on: 24 Июль, 2015 No Comment

Brokers have several different ways to sell mutual funds to investors, all with one thing in common: They take money out of your pocket.

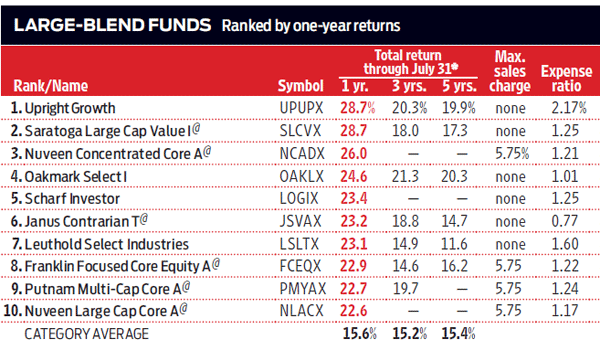

There’s a good reason why no-load mutual funds are the best way to buy mutual funds — they save you money. Historically, mutual funds that charge sales loads simply haven’t been able to match their cheaper no-load counterparts. In fact, of the 100 top-performing funds of the past 10 years, more than three-fourths didn’t charge a sales load.

But if you’re working with a broker, you’ll probably hear a sales pitch for a mutual fund. It’s crucial for you to understand the fees and costs associated with various options of broker-sold funds before you buy.

Easy as A-B-C

Full-service brokers like Morgan Stanley ( NYSE: MS ) , Merrill Lynch ( NYSE: MER ). and JPMorgan Chase ( NYSE: JPM ) sell mutual funds in several different classes. Generally, each class of a given fund buys the same investments with your money. But the class of fund shares you buy can greatly affect how much you pay in fees and expenses.

Class A fund shares, also known as A shares, are what most people think of when discussing funds with sales loads. When you buy A shares, you pay an up-front sales charge based on how much you invest. For instance, if you buy A shares of a fund that charges a 5% load, every $1,000 you invest will result in only $950 in your fund account. The remaining $50 pays your broker’s sales commission.

Another class of mutual fund shares — B shares — doesn’t charge an up-front sales fee. But there’s a trade-off: B shares usually come with higher annual fees, including 12b-1 fees that can go to compensate your broker. In addition, if you sell your shares within a certain number of years, you’ll have to pay a deferred sales charge, which again can be as high as 5%. Once you’ve held them long enough — typically 5-10 years — B shares automatically convert to shares with lower costs.

Avoiding loads. at a price

The prospect of paying a big sales load, either when you buy or when you sell, isn’t very attractive to fund investors. That’s why C shares became more popular in recent years, offering investors a way to reduce those charges substantially. In fact, many fund companies don’t charge any loads at all on C shares.

However, the annual costs associated with C shares are much higher than A shares. You’ll often see a 1% 12b-1 fee on top of the fund’s normal expenses, which can total 2% or more. And unlike B shares, with their automatic conversion feature, you never stop paying those higher costs with C shares.

You may also find some other special types of shares. You’ll sometimes see R-class shares in retirement plans; they can have 12b-1 fees that go to the people who sold the plan to your employer. Similarly, 529 plans can have special share classes that compensate brokers. All told, funds paid $11.8 billion in 12b-1 fees during 2006.

Just say no

Fund companies make millions with these fees. For instance, Franklin Templeton ( NYSE: BEN ) earned more than $277 million during its 2007 fiscal year on shareholder servicing fees, including 12b-1 fees. Blackrock ( NYSE: BLK ) earned $123 million last year on service-related revenues.

Yet with thousands of no-load funds available, there’s really no reason why you need to buy a fund with any type of sales charge. If you’re working with a broker, be careful. Even if you don’t have to pay an up-front fee, you might still be paying more than you have to.

For more on investing with mutual funds, read about:

If you want help finding the best mutual funds. sign up for a free 30-day trial subscription to the Fool’s Champion Funds newsletter. You’ll get in-depth analysis, hard-hitting commentary, and market-beating fund recommendations, with no strings attached. Start your quest to beat the indexes today with Champion Funds.

Fool contributor Dan Caplinger learned about broker-sold funds the hard way. He doesn’t own shares of any companies mentioned in this article. JPMorgan Chase is an Income Investor recommendation. The Fool’s disclosure policy has no hidden fees.