The 7 Most Common Investing Money Mistakes to Avoid

Post on: 2 Апрель, 2015 No Comment

The 7 Most Common Investing Money Mistakes to Avoid

Sunday, December 14th, 2014 by Mike

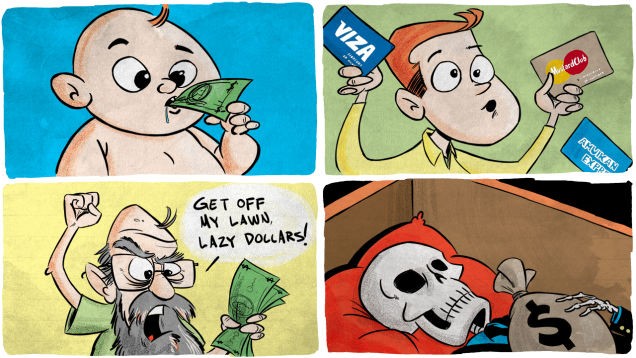

Investing money into profitable various financial tools is a solid way to use money wisely for the future. Being aware of its profitability, however, does not ensure that you actually are making wise choices. Here are some common problems that investors fall into when making financial investment decisions.

1. Financial Investing Requires Thinking

A common trap that many people fall into is to invest the same way that others around them are investing their money. While it may be successful, it also may not bring about the results that you want. This mentality simply does what the herd does and it will never do better than the herd.

Real investing experts will often tell you to go against the herd. This will, however, mean that you will have to learn more from those who have made their money from investing. Do a little more study and be willing to invest outside the box – once you know what you are doing – and why.

2. Remaining Confined to Limited Risk Options

Making money from investing will mean that you cannot be afraid to invest in new types of investment tools. If you are fearful because of being uncertain, more learning, as well as successful experience, will help you to overcome that natural reluctance that some people experience.

3. Diversifying Your Portfolio Too Narrowly

While many investors new and otherwise know that they should diversify their investment portfolio, they do not do it in the wisest way. This places their investment capital in a riskier position than it should be after all, the purpose of diversification is to provide a greater level of protection to your investment money and assets.

This may mean that you need some investment advice from an investment advisor in order to ensure that you are not on the verge of losing them unnecessarily.

4. Trading Your Investments Too Often

Good investment strategies are based on tactics that have been proven to work. Making changes in your investments just because someone else does or because you feel that you ought to make changes to take advantage of slight upswings in the performance of some investment products is not a sound strategy. Careful investigation is always needed in order to make the right decisions.

5. Selling Winners and Keeping Losers

This common mistake is made because many people have heard the saying about selling high and buying low. They have no idea how to apply it and use it for real profit no investment strategy.

6. Investing On Past Performance

Many new investors who are learning to spread their wings some tend to focus on the past

performance of stock before buying. Not realizing that the stock may already be nearing its peak performance, they buy into it and fail to see the results they expected.

Another form of this is to buy into some investment because of the recommendation of a friend or financial advisor. Chances are rather good that it also has come close to reaching its best days, too. To avoid this scenario, more investigation into the stock or fund is needed before buying.

7. Letting Others Make Investment Decisions for You

A final mistake is to let someone else invest your money for you who may have conflicting interests. Unless you really know and trust your investor or investment company, you need to realize that the other person may not really have your best interests (your profit) at heart, neither do they necessarily have the time that is needed to focus on your investments individualized performance. An alternative that may also help you learn more investment information faster would be an investment club, where information is shared. By learning more about investing, and what to watch for to ensure solid growth, you can get the performance you need out of your financial investments.