Ten Trends Influencing Asian Wealth Management and Private Banking

Post on: 16 Март, 2015 No Comment

SunGard is one of the world’s leading software and technology services companies. SunGard has more than 17,000 employees and serves approximately 25,000 customers in more than 70 countries. The company provides software and processing solutions for financial services, education and the public sector. SunGards Ambit is a banking solution suite for retail, commercial and private banks. It provides banking professionals with solutions that support front-, middle- and back-office operations, as well as solutions for financial management, risk and performance. Ambit helps banks retain and acquire customers, improve staff efficiency and effectively measure and allocate their capital.

Edward Lopez is the Executive Vice President of SunGard’s Ambit Wealth & Private Banking business line, responsible for business development, sales and account management, with a specific focus on the Asia Pacific markets. Originally from the US, Edward relocated to Hong Kong in 2012 to focus on growing SunGard’s wealth and private banking business in APJ after having been based in London since 2006. Edward has been instrumental in launching SunGard’s wealth management business in EMEA and Asia, and currently oversees teams in China, South Asia, Japan and Australia.

Prior to 2006, Edward was based in New York and responsible for SunGard’s Tier 1 Wealth Management organisations in North America and Asia Pacific. Having worked with or directly for SunGard for more than 20 years, Edward has been in a direct sales or sales management role for over half of that time. In a previous role, Edward has also been responsible for managing major financial software implementation projects at Tier 1 organisations in North America, Europe and Japan.

On the subject, Lopez, said, “Today Asia houses the world’s largest high net worth population*: this new revenue stream has made it one of the world’s most attractive banking regions. As a result, competition is intensifying, client demands are growing and regulatory pressures expanding. Wealth managers and private banks in the region will need to boost their operational efficiency to more effectively respond to these widespread changes and capitalize on new opportunities in order to help secure long-term profitability.”

SunGard has identified ten trends shaping the Asian wealth management and private banking industry:

1. With domestic retail players expanding into wealth management, and international counterparts and new entrants such as family offices, competition is diversifying.

2. As the Asian high net worth individual sector matures, demand increases for more sophisticated investment products.

3. Asian banks moving towards advisory-based services face challenges in building client trust and confidence, complicated by client propensity to invest a small portion of their wealth with any one advisor.

4. To deliver better, more competitive client service, relationship managers will play a more advisory-based role, which requires a single client view across the bank and process efficiency.

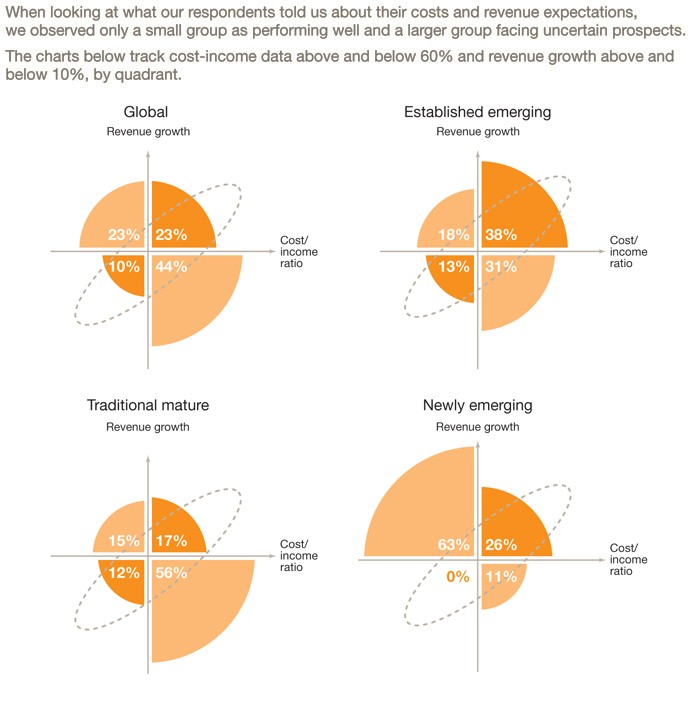

5. With margins under pressure, staff productivity is under greater scrutiny as banks strive to reduce cost to income ratios.

6. Banks are increasingly investing in front-office tools to help empower advisors to establish deeper, sustainable and more targeted relationships.

7. Banks are seeking more control of client relationships through better management of customer information as competition intensifies staff attrition.

8. Local banks need strategies to help entice and retain wealth onshore, while regional retail players need private banking strategies to help capture new opportunities.

9. The shift towards mobility of services and information means relationship managers are required to interact and provide account updates to clients ‘on the go’ with relevant, real-time information.

10. An increasing focus on governance, risk and compliance around sales, product suitability, appropriate disclosures and advisor competency standards, will help Asian private banks better manage counterparty risk.