Taxmanaged fund comparison

Post on: 30 Апрель, 2015 No Comment

Vanguard offers three mutual funds which are explicitly tax-managed. However, index funds and exchange-traded funds (ETFs) are inherently tax-efficient, and are sometimes less expensive; therefore, the tax-managed mutual funds may not always be the best options even for taxable investors.

Contents

General recommendations

Vanguard Tax-Managed Small-Cap Fund and Vanguard Tax-Managed Capital Appreciation Fund are worth holding if your taxable account needs a separate large-and-mid cap or small cap fund (and, in the case of TM Capital Appreciation, you don’t mind its slight growth bias, say because you have a value bias in your IRA .) Except in the top tax bracket, TM Capital Appreciation is probably not worthwhile as a substitute for a large-cap-only fund; use 500 Index.

Total Stock Market is still better than a combination of tax-managed funds, except in the top tax bracket, and even then it is just as good.

Vanguard Tax-Managed Balanced Fund has no tax advantage but a small cost advantage over the individual funds, in addition to the simplicity. However, you may lose that to extra tax costs if you have to sell the fund.

Vanguard also used to have a Tax-Managed International Fund; the Developed Markets Index fund is being merged into this fund. Post merger, the current Developed Market Index fund will cease to exist, and the revamped Tax-Managed International fund will be renamed Developed Market Index Fund. [1] If you previously had TM International, you should keep these shares rather than selling for a capital gain because the additional cost is trivial, but Total International is better as the core of a taxable international portfolio.

Comparisons

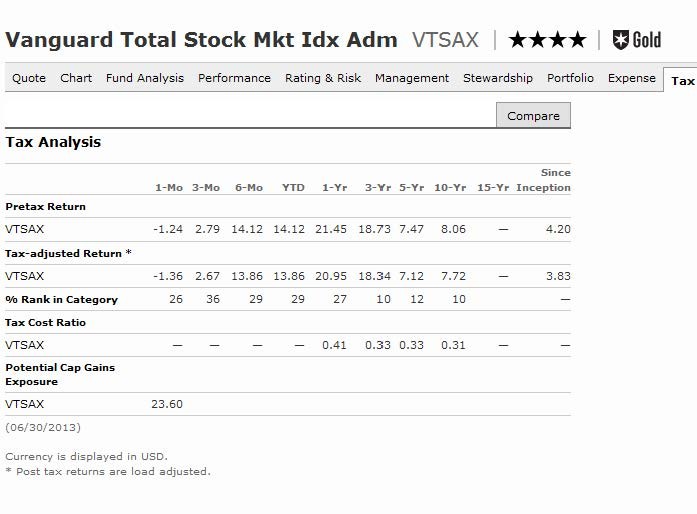

All of these calculations depend on assumptions about taxes and dividends. and may not represent the actual taxes or dividends of any fund. (Dividend yields are based on SEC yields as of February 27, 2014.) Consult your tax advisor for tax advice.

These comparisons are based on the total costs, including both taxes and expenses. Calculations will be done with three tax assumptions: 15%/25%/top tax brackets. In the 15% tax bracket, qualified dividends and long-term gains are taxed at 0%. In the 25% tax bracket, qualified dividends and long-term gains are taxed at 15%. In the top tax bracket, investment income is taxed at 43.4% (including the 3.8% Affordable Care Act surcharge) and qualified dividends and long-term gains are taxed at 23.8% (including the surcharge).

Your actual tax cost will be higher if you owe state taxes (add your state tax rate on the dividend yield, reduced by your federal tax rate if you itemize deductions) or are in the phase-out range for some tax benefit such as the child tax credit (add 5% to all tax rates) or the personal exemption phase-out for the Alternative Minimum Tax (add 7% to all tax rates, but your overall tax on non-qualified dividends is 28%).

All calculations assume Admiral or ETF shares of the alternative funds; given the $10,000 minimum for the tax-managed funds, you should have Admiral shares, and for multiple-fund combinations, the cost of waiting for Admiral shares is trivial. Expense ratios are adjusted for the acquired fund fees and expenses from business development companies ; the SEC requires these fees to be included in the reported ratio but they are misleading in a comparison of indexes.

Tax-Managed Small-Cap

TM Small-Cap tracks the same index as the S&P 600 ETF. Currently, TM Small-Cap has 0.03% lower expenses, but the S&P 600 ETF may reduce its expenses as it gets larger. The reported yields are almost equal, and neither fund is likely to distribute a capital gain. The advantage of TM Small-Cap is from its 100% qualified dividends, versus 75% assumed for the S&P 600, and the current lower cost.

If you do not use ETFs, Small-Cap Index has an expense ratio 0.02% less than TM Small-Cap, but a higher cap range, so you need more of Small-Cap Index to get the same small-cap exposure. In addition, it has a 0.20% higher yield, which causes dividend taxes to cancel out the cost savings.