Taxmanaged Equity Funds Perspective Matters

Post on: 3 Май, 2015 No Comment

Evaluating tax-managed equity funds: Perspective matters

We have written in the past on this blog about the need for advisors to focus on after-tax returns for taxable accounts. In that context, we’ve talked about some of the criteria to consider in trying to evaluate after-tax returns. For instance:

- Is the fund designed to be tax-efficient ?

- What is the capital loss carry-forward situation?

- How material is the undistributed capital gain within the fund?

Advisors will often listen to this and come back with: Your points about tax-efficiency make sense, but when I look at two funds – my current fund and a fund that is designed to be tax efficient my current fund has a similar or better after-tax return over the last 5 years. Why would I change?

That is definitely a fair question. Allow me to try an analogy to help make the point on evaluating tax-efficient choices.

Suppose you are about to drive across the Mojave Desert in August. It’s a 450 mile journey with no gas stations or rest stops. For this drive, you are given the following choice of cars:

Which car do you select? Based on the facts as presented, you may be indifferent to which car you select since they both achieved the same miles per gallon / distance on a tank of gas. Most of us would likely pick Car A – comfort is good.

Before you head off, what if I told you that on the prior trip when both cars recorded 45 mpg and traveled 450 miles the entire trip had been downhill AND had a 45 mph tailwind .

Knowing this, you would likely revise your decision about which car to take. You may now prefer the car that is explicitly designed to go further on a gallon of gas. After all, the possibility of being stuck on the side of the road in the Mojave Desert short of your goal is not attractive .

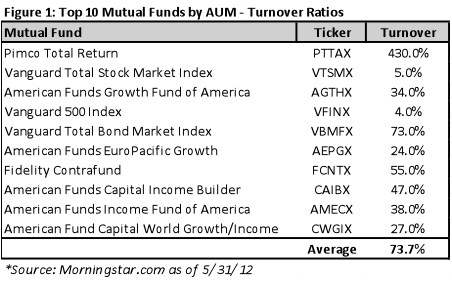

How does this relate to the selection of tax-managed equity funds. Looking at the after-tax returns of mutual funds over the last 5 years, many have benefited from similar tailwinds:

blog.helpingadvisors.com/2013/01/15/whos-paying-more-in-2013 /)

The bottom line

As we move into the New Year and you are evaluating tax-efficient investment options for your clients, make sure you understand how each fund’s after-tax return was achieved. Does the mutual fund prospectus explicitly mention tax-aware investing? Has the mutual fund used up its capital loss carry-forward? Is the after-tax return by design or incidental? Understanding this may help your clients achieve their financial goals and not be caught short on the side of the road.