Taxes on an Incentive Stock Option (ISO)

Post on: 15 Апрель, 2015 No Comment

Talk to a Local Pension and Profit Sharing Plans Attorney

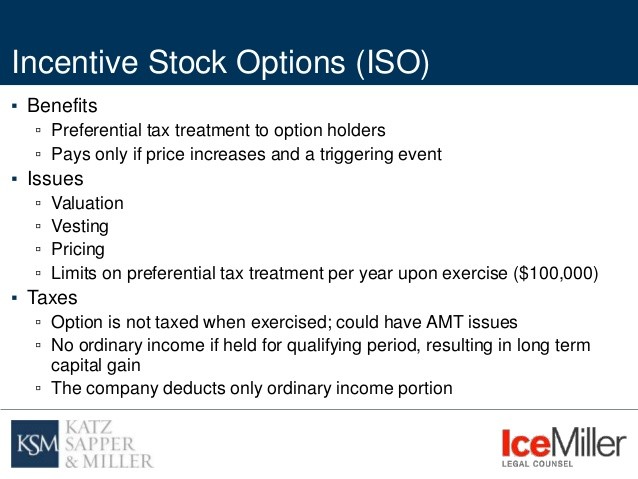

Many employers make incentive stock options (ISOs) a part of salary or compensation packages for their employees, especially key personnel, like top managers and officers. ISOs are a way for the employer to entice (or give an incentive to) such employees to stay with the company and to help the business be successful.

When you exercise an ISO, there are tax consequences for both you and your employer. For instance, sometimes you’ll get a lower tax rate on any gain you may have when you buy and then sell the stock. The employer, on the other hand, might be able to take a tax deduction in the amount you get when you sell the ISO stock.

Exactly What is an ISO?

An ISO is special form of option that can give you some tax advantages. In order to qualify as an ISO, it must meet several requirements:

- It can only be given by an employer to an employee, and in order to qualify for special tax treatment, you have to exercise the option, that is, actually buy the stock, within three months after your employment ends

- The ISO must be granted under a shareholder-approved plan that specifies the maximum number of shares of stock that the employer can offer and which employees are eligible to receive the options

- It must be granted within 10 years after the ISO plan is adopted by the employer or approved by the shareholders, whichever is earlier, and you have to exercise it within 10 years after it’s given to you

- The ISO must state the option price, that is, the price at which you can buy the stock. The option price stated in your ISO can’t be less than the fair market value of the stock on the date that you were given the option

- Generally, you can’t own stock that represents more than 10% of the voting power of the employer-company’s outstanding stock

- The total fair market value (determined at the time that the option is granted) of the stock you can buy when the ISO is first exercisable in any one calendar year can’t be more than $100,000

- The ISO must state that only you can exercise the option and that it can be transferred to someone else only through your will or though your state’s intestacy laws if you don’t have a will

Taxes & the ISO

Unlike a regular (non-ISO) stock option, when you exercise an ISO, you don’t have to report any regular or ordinary income on your federal tax return when you get the stock option or when you exercise it. This can be a big tax advantage, especially when your option price is less than the market price when you exercise it. For example, if your ISO is for 1,000 shares at $10 per share, and you exercise it when the stock is worth $20 per share, you don’t have to report the $10,000 you made on the exercise (although you might have to pay the alternative minimum tax (AMT) on that gain). If you had a regular stock option, you’d have to report the $10,000 gain as income, which would be taxed at the regular tax rates.

The major tax issues for both you and your employer, however, come into play when you sell the shares you bought through the ISO. The ideal case for you is to sell the ISO stock at a time that will give you the best tax treatment. In a qualified disposition or qualified sale, you get capital gains treatment for any gain you realize on the sale of the stock. Capital gains are taxed at a much lower rate, with a current capped rate of 15%, than ordinary income, which can be taxed at a rate as high as 35%.

So, how do you make sure your sale qualifies for capital gains treatment? Generally, you have to hold the ISO stock for at least one year and one day after you bought it and at least two years after you were given the ISO. Your gain, if any, is the difference between the option price and purchase price, multiplied by the number of shares. For example, if your ISO is for 1,000 shares at $10 per share, and you exercise it at least two years after you were given the option and when the stock is worth $20 per share, and then you sell it at least one year and one day later at $20 per share, your $10,000 gain (($20 — $10) x 1,000 shares) is taxed as a capital gain.

If you don’t satisfy the time requirements, then you don’t get capital gains treatment, and any gain is taxed at your regular tax rates. This is called a disqualifying disposition. For example, if you sell the ISO stock in the same year as you bought it, or if you sell one year and one day after you bought them but less than two years after you got the ISO, it’s a disqualifying sale.

If you’re an employer. there are no tax consequences if your employee makes a qualifying sale or disposition. That’s not the case if the employee makes a disqualifying disposition or sale, however. If your employee makes a disqualifying sale, then you can take a tax deduction for the amount the employee receives from the sale. The amount received from the sale is treated as compensation paid to the employee.

Get Help

For employees especially, it’s a good idea to talk to your tax advisor or tax lawyer when deciding whether to exercise an ISO. If you get the right advice before you exercise the option, you should be able to avoid, or at least minimize, the taxes you may owe as a result of exercising the option and selling the stock.