Tax Treatment of Covered Call Writing in NonSheltered Accounts

Post on: 16 Март, 2015 No Comment

President Obama has brought to the forefront the issue of taxes as a major part of his economic stimulus package. With that in mind, I thought it appropriate to discuss some of the tax issues that face covered call writers. First and foremost, let me state the obvious: I am not a tax expert . However, I do make every effort to be as informed as possible on issues that effect my hard-earned money. This article is a brief and highly simplified introduction to the tax issues, not tax advice which should be addressed with your attorney, accountant or tax preparer.

Short-term versus long-term capital assets :

Under the current IRS regulations, both stock and stock options are considered capital assets, and any gain on their sale is taxable. If the stock or option is held for less than a year. then short-term capital gains (STCG) apply. This rate would be your ordinary income tax rate up to 35%.

If the stock or option is held for at least a year. the gain is taxed at a long-term capital gains rate which is 15% for taxpayers in the 25%, 28%, 33% and 35% tax brackets. For stocks, holding periods can be affected when selling deep in-the-money strikes. This discussion is beyond the scope of this article and consultation with your tax advisor is appropriate. Since we sell predominantly 1-month options, short-term capital gains rates would apply in all non-sheltered accounts. As a matter of fact, most stock options have a duration of nine months or less, so tax rates will usually be at the short-term rates. The exception to this rule are LEAPS. These are options contracts with expiration dates that are longer than one year. Structurally, LEAPS are no different than short-term options, but the later expiration dates offer the opportunity for long-term investors to gain exposure to prolonged price changes without needing to use a combination of shorter-term option contracts. The premiums for LEAPs are higher than for standard options in the same stock because of increased time value as the later expiration date gives the underlying asset more time to make a substantial move and for the investor to make a healthy profit.

What is a Capital Gain?:

This is an increase in the value of as capital asset, such as a stock or an option, that gives it a higher worth than the purchase price. It must be claimed on income taxes in non-sheltered accounts.

Rules for Covered Call Writers :

Premiums received for writing a covered call is not included in income at the time of receipt, but is held in suspense until the writers obligation to deliver the underlying stock expires or until the writer either sells the stock as a result of the call assignment or by closing the option position (buy-to-close). With that in mind, here are three possible scenarios that may occur after the sale of the option:

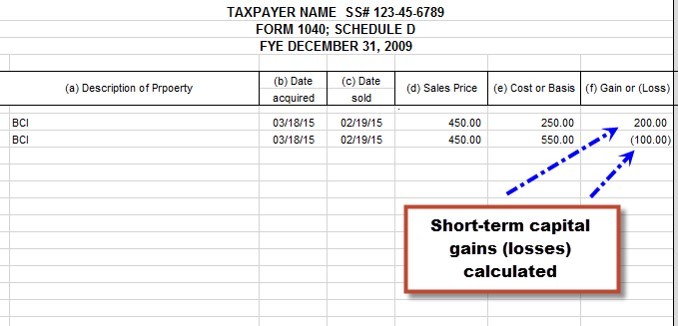

1- An expired option ( we sold the call, we didnt close the position by buying back the option and the holder did not exercise the option) results in a short-term capital gain. For example, we sell an Apple April 90 call for $4.50 in March. The proceeds are $450. Since the cost is $0, the short-term capital gain is $450. The acquisition date will be LATER than the sales date and the word Expired should be written in column e, the cost basis column.

2- If we buy back the same option in the above example to close the position (usually to invoke an exit strategy), the difference between the sale profit and the buyback cost will represent a capital gain or a capital loss. As in example 1, above, the acquisition date will be LATER than the sales date.

Capital gain example. We close our position by buying back the option for $250. The capital gain is $200 ($450 $250).

Capital loss example. We close our position by buying back the option for $550. The capital loss is $100 ($550 $450).

3- If the option is exercised, the option transaction becomes part of the stock transaction. The option premium is added to the strike price received, less commissions. If the stock has been held for less than one year, the entire transaction will be treated as short-term. If the stock had been held for one year or more. the entire transaction will be treated as long-term as the option holding period is ignored .

I avoid these tax issues by trading covered call stock options predominently in tax-sheltered accounts. The only exception is an account I set up specifically to neutralize a negative cash flow property I own in Florida. Last year I wrote a three-part series explaing how I do this. Here are the links to those articles: