Target Date Retirement Funds

Post on: 16 Март, 2015 No Comment

One of the biggest hurdles for most investors is just starting. There is an overwhelming amount of information available, and many people are simply frozen into inaction. If you are one of the many people who find the hundreds of different options available for retirement planning a bit overwhelming, you might be interested in learning more about target-date retirement funds, which can be a great investment strategy for beginners .

The best plan for retirement should reflect your personal situation and long term goals, therefore it is important to learn as much as possible about all options before making a final decision.

Target Date Retirement Funds

Target-date retirement funds, also known as Life-Cycle Funds, are designed to streamline the investment process and have often been termed set it and forget it funds. To put it simply, investors who opt to place their money in target-date retirement funds, do so with a specific retirement year in mind. For example, if you plan on retiring in 25 years, your target-date retirement fund should reflect that specific time frame.

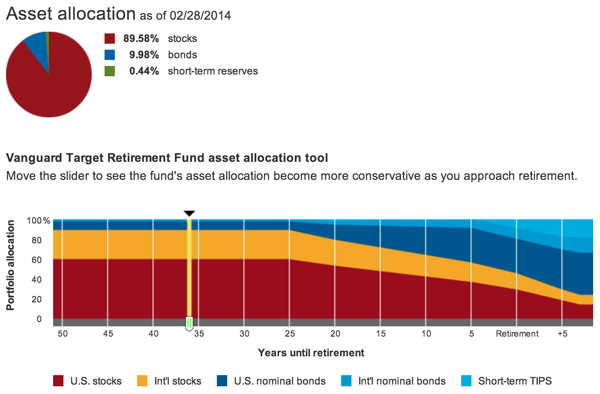

The set it and forget it concept reflects the fact that once you invest in your target-date retirement fund, you dont have to worry about the allocation of that fund as it will automatically change over the years to reflect a more conservative risk tolerance. This is a fairly common strategy for retirement investments where it becomes more important to save and protect your assets the closer you get to retirement, as you have fewer years remaining to recover should your investments take a turn for the worse.

This gradual reallocation over the years is known as the glide path. The target-date retirement funds glide path begins on a more aggressive level in the early years and changes toward a more conservative path with the intention of providing added security as the year of retirement approaches.

As with all other investment strategies there are both benefits and drawbacks that accompany target-date retirement funds. To determine if this type of investment is right for you it is important to understand these pros and cons and compare them to the advantages and disadvantages of other retirement vehicles. Here we look at what makes a target-date retirement fund a good choice and what might make it a bad choice.

Pros and Cons of Using Target Date Retirement Funds

- Hands off investment strategy. Since target-date retirement funds are set up to automatically adjust the allocation of investments, there is little effort needed on the part of the investor once the fund has been established. This may appeal to investors who do not have the time or confidence needed to actively manage their portfolio.

- Little to no maintenance. Due to the very nature of a target-date retirement fund, there is little if any maintenance required by the investor.

- Minimum investment requirements. This allows for a broader allocation to include various asset classes.

- There is no such thing as one-size-fits-all. You understand this concept when you buy clothing and you should certainly consider this when selecting an investment strategy. Each person is different with varying risk tolerance as well as financial goals. Unfortunately the very thing that makes target-date retirement funds hassle free also require that the strategy treat each portfolio the same way. This may result in an investment strategy that does not reflect your unique situation.

- Higher fees. Expect to pay slightly higher fees for this type of investment than you might for other investment vehicles.

Where can you invest with Target Date Retirement Funds?

Target-date retirement funds are a popular option for many company provided retirement plans, such as 401k plans or the Thrift Savings Plan . You can also buy into a Life-cycle fund through various ETFs or mutual funds, which can be purchased just about anywhere that you can open an IRA .

Should you invest with Target Date Retirement Funds?

Life-cycle funds arent for everybody, but they are a great place to start for people who dont know where to start investing, or and it can also be an investment strategy which appeals to individuals who prefer to not have to deal with managing their portfolio. Nevertheless, hands off doesnt equal risk free. As with any other type of investment there is always the chance the strategy will not work out as intended. When buying into a target date fund or life-cycle fund, you should do the research to fully understand where and how your money is invested and how it affects your asset allocation.