Tail Risk Hedging 101 Credit

Post on: 17 Июль, 2015 No Comment

With volatility so low and risk seemingly removed from any- and every-one’s vernacular, perhaps it is time to refresh our perspective on downside and tail-risk concerns. While most think only in terms of equity derivatives as serving to create a tail-wagging-the-dog type of reflexive move. there is a growing and increasingly liquid (just like the old days with CDOs, so be warned) market for options on CDS. Concentrated in the major and most liquid indices, swaption volumes have risen notably as have gross and net notional outstandings. Puts and Calls on credit risk — known as Payers and Receivers (Payers being the equivalent of a put option on a bond, or call option on its spread) have been actively quoted since 2006 but the last 2-3 years has seen their popularity increase as a ‘cheap’ way to protect (or take on) credit risk — most specifically tail risk scenarios. Morgan Stanley recently published another useful primer on these instruments — as the sell-side’s new favorite wide-margin offering to wistful buy-siders and wannabe quants — noting the three main uses for swaptions as Hedging, Upside, and Yield Enhancement. These all have their own nuances but as spreads compress and managers look for ever more inventive ways to add yield so the specter of negative gamma appears — chasing markets up into rallies and down into sell-offs — and the inevitable rips and gaps this causes can wreak havoc in markets that have momentum anyway. Given the leverage and average notionals involved, understanding this seemingly niche space may become very important if we see another tail risk flare and as the Fed knows only too well (as it suggested here ) like selling Treasury Puts. derivatives on credit are for more effective at establishing directional moves in the the underlying than simple open market operations .

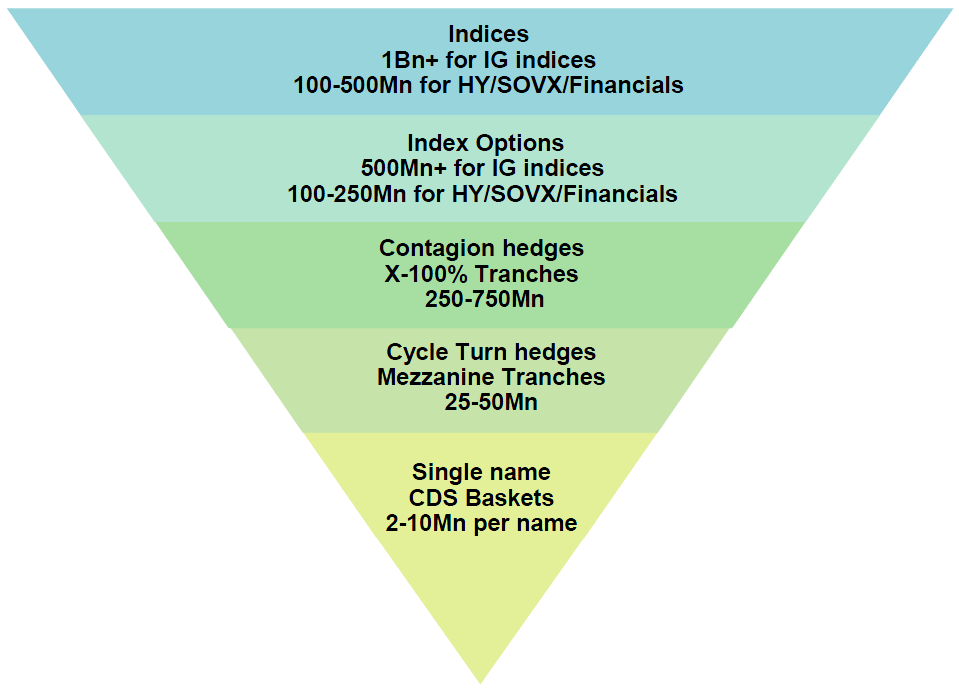

Credit indices: CDS indices, of which there are over 20 globally, remain the most liquid way to express a portfolio view in credit. The drawback is that the exposure is linear, meaning that the investor can lose money if the market improves, and hedging can be expensive if risk premium is already in the price.

Index options: Increasing liquidity, asymmetric payoffs and the ability to customize payouts define maximum costs at trade inception all have attracted investors to options for hedging. However, these are still very short dated instruments, with expiries in the 3m–6m range.

Credit tranches: Tranches are designed to express a view on defaults and risk premiums separately. Their long-dated nature makes them ideal when uncertain about the time-frame of events being hedged. These are also relatively liquid, and can vary in cost depending on the strategy. Unlike options these do have more than capped downside if the market improves.

Single-name CDS and baskets: Individual single name CDS and baskets are less liquid than the indices, but more “customized”. We like using this strategy to hedge exposure to highly specific exposures or risks.

The low cost and huge notional of credit options, while useful to hedge size, can lead to excessive moves exaggerating directional momentum — and perhaps helping to explain the consistent opening gaps in European (and US) credit markets during this rally. But getting a grasp on just how large a tail-risk move could be is a first step in deciding how much one is willing to pay for that protection.

Defining Hedge Scenarios: