Swing Trading Trends

Post on: 9 Май, 2015 No Comment

Ways to capture gains and read trends for swing trading.

What Is Swing Trading?

Swing Trading is a short term trading method that aims to capture gains from a stock’s movement within a definable trend. You may be thinking that sounds like the answer to what is day trading Day Trading and swing trading are similar, but that’s a discussion for another day. The best stocks to swing trade are usually moving in either an uptrend or a downtrend. The swing trader typically trades with the trend. This means that if the swing trader has a bullish outlook, she will search for an up-trending stock. If the swing trader is bearish, he will seek out a stock in a downtrend.

Identifying the Uptrend

The prices of trending stocks typically move in a step-like manner, instead of in a completely straight line. For example in an uptrend, a stock may increase in price for five straight days, but then give back some of these gains over the following two days before resuming upwards. The first five days (up) are referred to as the uptrend. Days six and seven (down) are known as the bull pullback, or simply the pullback. Some may also refer to this part as the counter-trend move.

The high over this seven day period is called the swing high or the local high. On the eighth day the stock might resume its upward move and continue up for another several days. Once the second move upward occurs on day eight, the lowest down movement of days six and seven is referred to as the swing low or local low. Even though the stock declined in price over this period, the overall motion was up. When looking at a chart, an online trader may see a series of swing highs and swing lows strung together to form a step-like pattern.

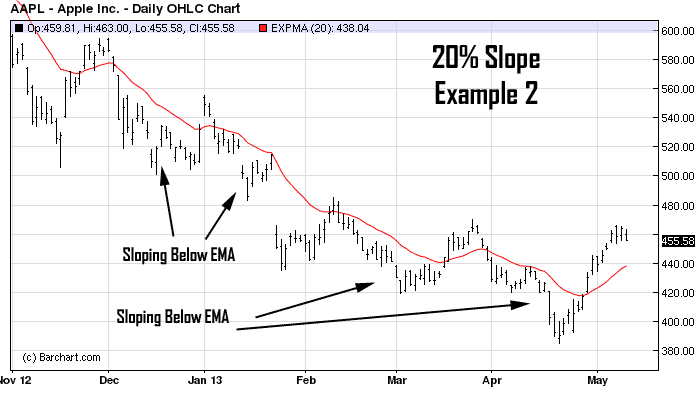

Recognizing the Downtrend

Swing Trading also allows online traders to take bearish positions. For example in a downtrend, a stock may decrease in value for four consecutive days, but then retrace and go up during the next two days before continuing down again. Days one through four (down) are called the downtrend. Days five and six (up) are referred to as the bear rally, or counter-trend movement.

The low over this six day period is the swing or local low. On the seventh day the stock could resume its down move and continue lower for a few more days. Once the downtrend resumes on day seven, the highest price on days five and six is the local or swing high. Although the stock retraced upwards during the course of these several days, the overall trend was down.

How to Find the Overall Trend

To help online traders recognize these patterns more easily, many online traders use Technical Analysis tools. This may include drawing trend lines on a stock chart, identifying support and resistance areas where reversals may occur, or using various technical studies to determine the strength and momentum of the current trend. TradeKing offers all clients free trading tools to help online traders learn and utilize Technical Analysis.

The duration of such movements is about two to six days and is therefore the average length of a swing trade. Swing trades can last up to two weeks. If the online trader is able to keep the position longer than two weeks, the trade has become a position trade.

Different ways to Capture Gains with Swing Trading

Swing Trading can be used with many different kinds of securities. Online traders swing trade not just with stocks, but also with call and put options. Swing Trading involves specific risks and commission costs different and higher than the typical investment strategies.

If the online trader is bullish, he will buy stocks after the pullback when the uptrend resumes. However, option traders have another choice. Purchasing an in-the-money call option would be a viable alternative to owning the stock.

All these different traders would exit their bullish trades when each determines that the upward trend has either slowed or stopped, hoping to capture a gain between the entry and exit trades. Placing these orders at the right time can be difficult. Therefore it is optimal for an online trader to use an online broker that offers sophisticated order entry. TradeKing offers all clients a full suite of Advanced Orders to take advantage of quick price movements.

However, the trend observed may not be an uptrend, but in fact a downtrend. In this case the online investor might enter a bearish position following a bear rally and after the downward movement continued. At the opportune time an online option trader may decide to buy in-the-money put options. An online stock trader may choose to short the stock when she deems the time is right to enter the bearish swing trade.

Once the trader recognized that the downtrend had ended or the security was hesitating to continue lower, the online trader would exit the bearish position in the hopes of locking in a profit. The Advanced Orders offered by TradeKing are of particular importance to the bearish trader. This is because downward moves tend to be faster than upward ones. Therefore the ability to have orders waiting to be filled is preferred as opposed to trying to submit the order at precisely the right time. An online stock trader may choose to short the stock when she deems the time is right to enter the bearish swing trade.

Getting Started at TradeKing with Swing Trading

Opening an account with TradeKing is a great first move to becoming a swing trader. TradeKing’s Education Center contains in-depth webinars on how to locate and place swing trades. TradeKing also has Technical Analysis tools to help online traders identify potential swing trades. Once the trade opportunity is recognized, the online trader can take advantage of it by using TradeKing’s Advanced Orders. Get started by opening an account now.