Sustainability Return on Investment (SROI)

Post on: 16 Март, 2015 No Comment

Triple Bottom Line Decision-Making

Today’s corporations and institutions are increasingly responsible for the environmental and societal impacts of their decisions. That’s why you need a decision-making methodology that incorporates broad social, economic and environmental forecasting – one that helps you minimize cost and maximize return on investment (ROI).

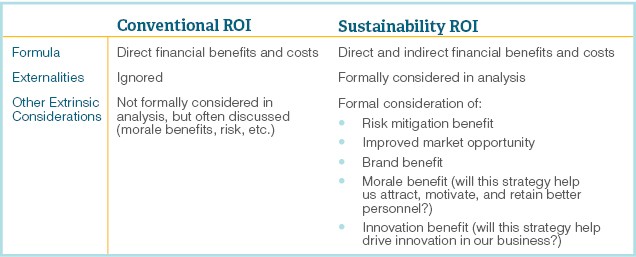

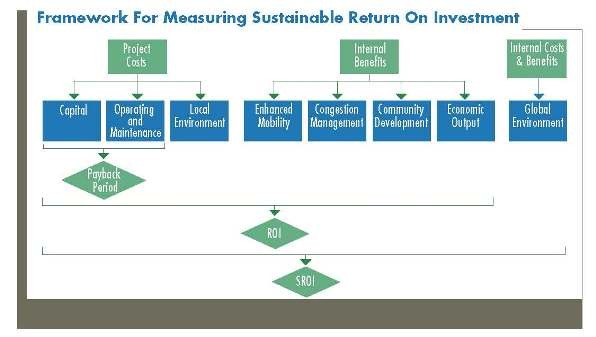

Sustainability Return on Investment (S-ROI) integrates the ability to measure the social, economic and environmental returns on sustainability initiatives. The methodology is designed to examine a decision-making process from the viewpoint of multiple expert stakeholders, while maximizing return for as many of them as possible.

The methodology allows for the enumeration of uncertain events with their concurrent costs and benefits. The decision-maker obtains a financial picture of the future of a decision that includes best case, worst case, and most probable ranges of return on investment. This methodology deals with both internal costs (those borne by the company) and external costs (those borne by society), allowing decision-makers to use both aspects as appropriate.

The output gives key decision makers across functions the actionable information they need to justify various forms of investment in socially and environmentally responsible activity, while avoiding “burden shifting,” where one harmful impact is simply traded for another.

The EarthShift Methodology

By enabling expert stakeholders to engage in a decision-making process, the S-ROI methodology is designed to avoid the bias that comes from completing decision analysis in a vacuum or optimizing a decision around one type of cost or benefit.

The EarthShift staff is comprised of experts who excel at helping clients to identify the true benefits of a change, as well as the risks of maintaining the status quo. Using both training and in-person workshops, our S-ROI methodology is designed to reduce the complexity inherent in assessing the business case for sustainability investments.

Our 3Pillars software simplifies the S-ROI engagement, enabling the traditional workshop brainstorming through a social networking environment so participants don’t need to be in the same room together. The tool calculates Net Present Value (NPV) for very complex scenarios so that brainstorming isn’t hindered by calculation capability.

When Should Your Company Use S-ROI?

In many cases, decision-makers use the S-ROI methodology to determine whether there is a business justification for initiatives that don’t show a positive ROI based on traditional costing methods.

Here are a few examples:

- The S-ROI methodology showed positive ROI for the Japanese government to support construction of a biogas factory.

- The S-ROI methodology showed positive ROI for a mining company in South Africa, where investing in HIV/AIDS education didn’t make sense from a traditional accounting perspective. When costs to society were included in the ROI calculation, the project was clearly net positive in its result, both for the company and for the surrounding communities.

S-ROI is also helpful when the decision may be affected by uncertainty: fluctuations in fuel prices, potential new regulations, changes in fads, etc. Other example decisions where S-ROI analysis can help ensure maximum benefits include whether to invest in pollution prevention devices, whether to make an acquisition, or even whether or not to expand a facility.

The next time you have a tough decision to make, or project to evaluate the feasibility of, let us help you understand the full costs and benefits ahead of time so you can get the most out of your efforts and chart your course with a triple bottom line in mind.

Lise Laurin explains the Sustainablity Return on Investment Methodology