Support and resistance FREE Futures Trading Education Lessons Videos and Tutorials

Post on: 20 Июль, 2015 No Comment

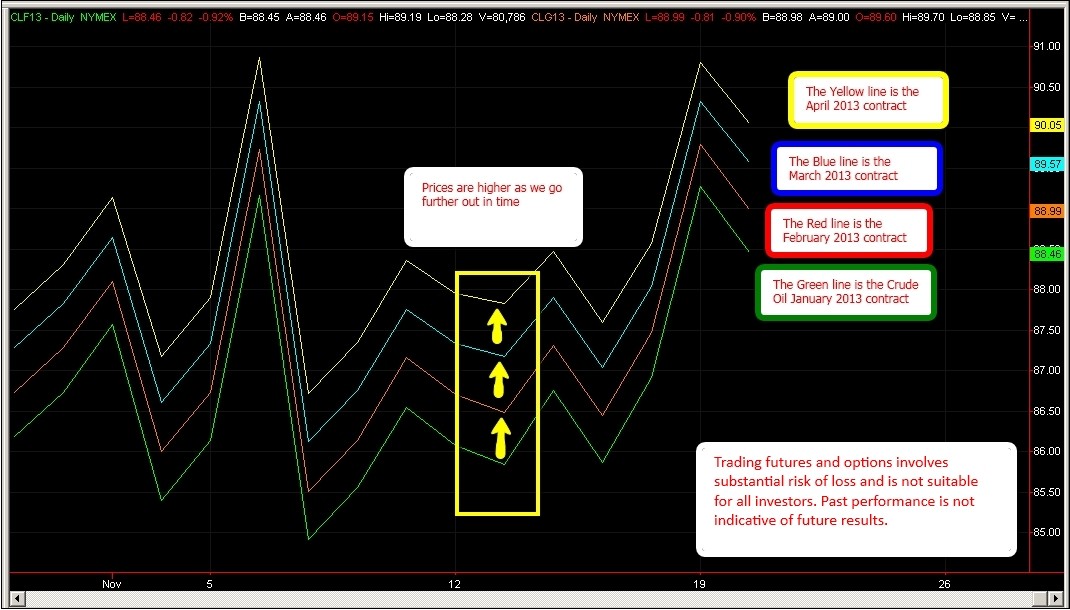

Day traders are continually confronted with split second decisions for entering and exiting trades.After talking with many successful day-traders over the years, I have compiled the simplest yet most effective day-trading method to assist new traders in their pursuit of financial independence. The charts below should be easy to duplicate with any trading platform.

In our example, well use the e mini S&P 500 index charts. First we setup a daily chart of the ES day session only (we are not interested in the overnight activity). On that chart we insert a 9 day moving average indicator and a regression channel indicator with 2 standard deviations.

The regression channel is a simple way to determine if support/resistance levels are penetrated. The purpose of the moving average is to simply determine whether were in an uptrend or downtrend.

Chart of Daily ES March 2013

As you can see by the chart above, the market is in an uptrend and had not broken support lines. Therefore we will next look at an intraday chart to help us make our buying and selling decisions.

As mentioned before, we insert the pivot lines with the understating that the market is moving higher. While most day-traders buy a pivot lows and sell at pivot highs, a more conservative way to trade an uptrend is to trade on the long side only.

So we would buy at the open of the next bar that has breached the 1 st and 2 nd pivot lows, and ignore any sell signals for the next session.

The 3 rd pivot low acts more like a stop point. If we were to go long at Low Pivot 1 or 2 and the market continued to drop, below the 3 rd pivot low, we would be stopped out and be done for the day.

If we enter long with only 1 position, we exit at the 1 st Pivot High.

If we add a 2 nd position at the 2 nd Pivot Low, then our profit target becomes the 2 nd pivot High.

If reached, were done and start the process all over again. If the 1 st profit target is reached, the stop for the 2 nd position becomes the 1 st Pivot Low.

The chart below illustrates the points discussed above.

ESH13 Intraday 5 min. Bars

If you have any questions about applying this method to your day-trading, pleaese call Chad at 1-800-771-6748

Chad Geraigiri 1-800-771-6748

Trading Futures and Options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of futures results.