Successful Backtesting of Algorithmic Trading Strategies Part I

Post on: 30 Май, 2015 No Comment

By Michael Halls-Moore on April 26th, 2013

This article continues the series on quantitative trading, which started with the Beginner’s Guide and Strategy Identification. Both of these longer, more involved articles have been very popular so I’ll continue in this vein and provide detail on the topic of strategy backtesting .

Algorithmic backtesting requires knowledge of many areas, including psychology, mathematics, statistics, software development and market/exchange microstructure. I couldn’t hope to cover all of those topics in one article, so I’m going to split them into two or three smaller pieces. What will we discuss in this section? I’ll begin by defining backtesting and then I will describe the basics of how it is carried out. Then I will elucidate upon the biases we touched upon in the Beginner’s Guide to Quantitative Trading. Next I will present a comparison of the various available backtesting software options.

In subsequent articles we will look at the details of strategy implementations that are often barely mentioned or ignored. We will also consider how to make the backtesting process more realistic by including the idiosyncrasies of a trading exchange. Then we will discuss transaction costs and how to correctly model them in a backtest setting. We will end with a discussion on the performance of our backtests and finally provide an example of a common quant strategy, known as a mean-reverting pairs trade .

Let’s begin by discussing what backtesting is and why we should carry it out in our algorithmic trading.

What is Backtesting?

Algorithmic trading stands apart from other types of investment classes because we can more reliably provide expectations about future performance from past performance, as a consequence of abundant data availability. The process by which this is carried out is known as backtesting .

In simple terms, backtesting is carried out by exposing your particular strategy algorithm to a stream of historical financial data, which leads to a set of trading signals. Each trade (which we will mean here to be a ’round-trip’ of two signals) will have an associated profit or loss. The accumulation of this profit/loss over the duration of your strategy backtest will lead to the total profit and loss (also known as the ‘P&L’ or ‘PnL’). That is the essence of the idea, although of course the devil is always in the details!

What are key reasons for backtesting an algorithmic strategy?

- Filtration — If you recall from the article on Strategy Identification. our goal at the initial research stage was to set up a strategy pipeline and then filter out any strategy that did not meet certain criteria. Backtesting provides us with another filtration mechanism, as we can eliminate strategies that do not meet our performance needs.

- Modelling — Backtesting allows us to (safely!) test new models of certain market phenomena, such as transaction costs, order routing, latency, liquidity or other market microstructure issues.

- Optimisation — Although strategy optimisation is fraught with biases, backtesting allows us to increase the performance of a strategy by modifying the quantity or values of the parameters associated with that strategy and recalculating its performance.

- Verification — Our strategies are often sourced externally, via our strategy pipeline. Backtesting a strategy ensures that it has not been incorrectly implemented. Although we will rarely have access to the signals generated by external strategies, we will often have access to the performance metrics such as the Sharpe Ratio and Drawdown characteristics. Thus we can compare them with our own implementation.

Backtesting provides a host of advantages for algorithmic trading. However, it is not always possible to straightforwardly backtest a strategy. In general, as the frequency of the strategy increases, it becomes harder to correctly model the microstructure effects of the market and exchanges. This leads to less reliable backtests and thus a trickier evaluation of a chosen strategy. This is a particular problem where the execution system is the key to the strategy performance, as with ultra-high frequency algorithms.

Unfortunately, backtesting is fraught with biases of all types. We have touched upon some of these issues in previous articles, but we will now discuss them in depth.

Biases Affecting Strategy Backtests

There are many biases that can affect the performance of a backtested strategy. Unfortunately, these biases have a tendency to inflate the performance rather than detract from it. Thus you should always consider a backtest to be an idealised upper bound on the actual performance of the strategy. It is almost impossible to eliminate biases from algorithmic trading so it is our job to minimise them as best we can in order to make informed decisions about our algorithmic strategies.

There are four major biases that I wish to discuss: Optimisation Bias. Look-Ahead Bias. Survivorship Bias and Psychological Tolerance Bias .

Optimisation Bias

This is probably the most insidious of all backtest biases. It involves adjusting or introducing additional trading parameters until the strategy performance on the backtest data set is very attractive. However, once live the performance of the strategy can be markedly different. Another name for this bias is curve fitting or data-snooping bias.

Optimisation bias is hard to eliminate as algorithmic strategies often involve many parameters. Parameters in this instance might be the entry/exit criteria, look-back periods, averaging periods (i.e the moving average smoothing parameter) or volatility measurement frequency. Optimisation bias can be minimised by keeping the number of parameters to a minimum and increasing the quantity of data points in the training set. In fact, one must also be careful of the latter as older training points can be subject to a prior regime (such as a regulatory environment) and thus may not be relevant to your current strategy.

One method to help mitigate this bias is to perform a sensitivity analysis. This means varying the parameters incrementally and plotting a surface of performance. Sound, fundamental reasoning for parameter choices should, with all other factors considered, lead to a smoother parameter surface. If you have a very jumpy performance surface, it often means that a parameter is not reflecting a phenomena and is an artefact of the test data. There is a vast literature on multi-dimensional optimisation algorithms and it is a highly active area of research. I won’t dwell on it here, but keep it in the back of your mind when you find a strategy with a fantastic backtest!

Look-Ahead Bias

Look-ahead bias is introduced into a backtesting system when future data is accidentally included at a point in the simulation where that data would not have actually been available. If we are running the backtest chronologically and we reach time point $N$, then look-ahead bias occurs if data is included for any point $N+k$, where $k>0$. Look-ahead bias errors can be incredibly subtle. Here are three examples of how look-ahead bias can be introduced:

- Technical Bugs — Arrays/vectors in code often have iterators or index variables. Incorrect offsets of these indices can lead to a look-ahead bias by incorporating data at $N+k$ for non-zero $k$.

- Parameter Calculation — Another common example of look-ahead bias occurs when calculating optimal strategy parameters, such as with linear regressions between two time series. If the whole data set (including future data) is used to calculate the regression coefficients, and thus retroactively applied to a trading strategy for optimisation purposes, then future data is being incorporated and a look-ahead bias exists.

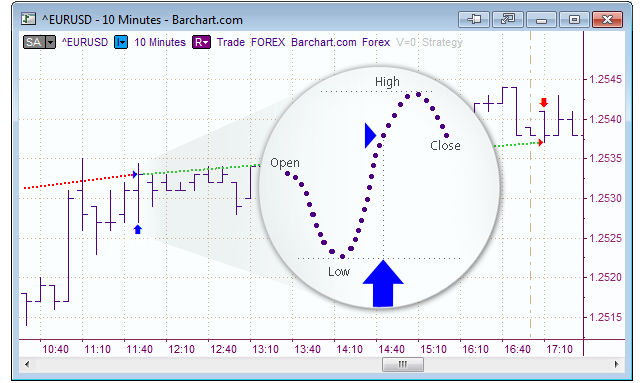

- Maxima/Minima — Certain trading strategies make use of extreme values in any time period, such as incorporating the high or low prices in OHLC data. However, since these maximal/minimal values can only be calculated at the end of a time period, a look-ahead bias is introduced if these values are used -during- the current period. It is always necessary to lag high/low values by at least one period in any trading strategy making use of them.

As with optimisation bias, one must be extremely careful to avoid its introduction. It is often the main reason why trading strategies underperform their backtests significantly in live trading.

Survivorship Bias

Survivorship bias is a particularly dangerous phenomenon and can lead to significantly inflated performance for certain strategy types. It occurs when strategies are tested on datasets that do not include the full universe of prior assets that may have been chosen at a particular point in time, but only consider those that have survived to the current time.

As an example, consider testing a strategy on a random selection of equities before and after the 2001 market crash. Some technology stocks went bankrupt, while others managed to stay afloat and even prospered. If we had restricted this strategy only to stocks which made it through the market drawdown period, we would be introducing a survivorship bias because they have already demonstrated their success to us. In fact, this is just another specific case of look-ahead bias, as future information is being incorporated into past analysis.

There are two main ways to mitigate survivorship bias in your strategy backtests:

- Survivorship Bias Free Datasets — In the case of equity data it is possible to purchase datasets that include delisted entities, although they are not cheap and only tend to be utilised by institutional firms. In particular, Yahoo Finance data is NOT survivorship bias free, and this is commonly used by many retail algo traders. One can also trade on asset classes that are not prone to survivorship bias, such as certain commodities (and their future derivatives).

- Use More Recent Data — In the case of equities, utilising a more recent data set mitigates the possibility that the stock selection chosen is weighted to survivors, simply as there is less likelihood of overall stock delisting in shorter time periods. One can also start building a personal survivorship-bias free dataset by collecting data from current point onward. After 3-4 years, you will have a solid survivorship-bias free set of equities data with which to backtest further strategies.

We will now consider certain psychological phenomena that can influence your trading performance.

Psychological Tolerance Bias

This particular phenomena is not often discussed in the context of quantitative trading. However, it is discussed extensively in regard to more discretionary trading methods. It has various names, but I’ve decided to call it psychological tolerance bias because it captures the essence of the problem. When creating backtests over a period of 5 years or more, it is easy to look at an upwardly trending equity curve, calculate the compounded annual return, Sharpe ratio and even drawdown characteristics and be satisfied with the results. As an example, the strategy might possess a maximum relative drawdown of 25% and a maximum drawdown duration of 4 months. This would not be atypical for a momentum strategy. It is straightforward to convince oneself that it is easy to tolerate such periods of losses because the overall picture is rosy. However, in practice, it is far harder!

If historical drawdowns of 25% or more occur in the backtests, then in all likelihood you will see periods of similar drawdown in live trading. These periods of drawdown are psychologically difficult to endure. I have observed first hand what an extended drawdown can be like, in an institutional setting, and it is not pleasant — even if the backtests suggest such periods will occur. The reason I have termed it a bias is that often a strategy which would otherwise be successful is stopped from trading during times of extended drawdown and thus will lead to significant underperformance compared to a backtest. Thus, even though the strategy is algorithmic in nature, psychological factors can still have a heavy influence on profitability. The takeaway is to ensure that if you see drawdowns of a certain percentage and duration in the backtests, then you should expect them to occur in live trading environments, and will need to persevere in order to reach profitability once more.

Software Packages for Backtesting

The software landscape for strategy backtesting is vast. Solutions range from fully-integrated institutional grade sophisticated software through to programming languages such as C++, Python and R where nearly everything must be written from scratch (or suitable ‘plugins’ obtained). As quant traders we are interested in the balance of being able to own our trading technology stack versus the speed and reliability of our development methodology. Here are the key considerations for software choice:

- Programming Skill — The choice of environment will in a large part come down to your ability to program software. I would argue that being in control of the total stack will have a greater effect on your long term P&L than outsourcing as much as possible to vendor software. This is due to the downside risk of having external bugs or idiosyncrasies that you are unable to fix in vendor software, which would otherwise be easily remedied if you had more control over your tech stack. You also want an environment that strikes the right balance between productivity, library availability and speed of execution. I make my own personal recommendation below.

- Execution Capability/Broker Interaction — Certain backtesting software, such as Tradestation, ties in directly with a brokerage. I am not a fan of this approach as reducing transaction costs are often a big component of getting a higher Sharpe ratio. If you’re tied into a particular broker (and Tradestation forces you to do this), then you will have a harder time transitioning to new software (or a new broker) if the need arises. Interactive Brokers provide an API which is robust, albeit with a slightly obtuse interface.

- Customisation — An environment like MATLAB or Python gives you a great deal of flexibility when creating algo strategies as they provide fantastic libraries for nearly any mathematical operation imaginable, but also allow extensive customisation where necessary.

- Strategy Complexity — Certain software just isn’t cut out for heavy number crunching or mathematical complexity. Excel is one such piece of software. While it is good for simpler strategies, it cannot really cope with numerous assets or more complicated algorithms, at speed.

- Bias Minimisation — Does a particular piece of software or data lend itself more to trading biases? You need to make sure that if you want to create all the functionality yourself, that you don’t introduce bugs which can lead to biases.

- Speed of Development — One shouldn’t have to spend months and months implementing a backtest engine. Prototyping should only take a few weeks. Make sure that your software is not hindering your progress to any great extent, just to grab a few extra percentage points of execution speed. C++ is the elephant in the room here!

- Speed of Execution — If your strategy is completely dependent upon execution timeliness (as in HFT/UHFT) then a language such as C or C++ will be necessary. However, you will be verging on Linux kernel optimisation and FPGA usage for these domains, which is outside the scope of this article!

- Cost — Many of the software environments that you can program algorithmic trading strategies with are completely free and open source. In fact, many hedge funds make use of open source software for their entire algo trading stacks. In addition, Excel and MATLAB are both relatively cheap and there are even free alternatives to each.

Now that we have listed the criteria with which we need to choose our software infrastructure, I want to run through some of the more popular packages and how they compare:

Note: I am only going to include software that is available to most retail practitioners and software developers, as this is the readership of the site. While other software is available such as the more institutional grade tools, I feel these are too expensive to be effectively used in a retail setting and I personally have no experience with them.

Backtesting Software Comparison