Structured Products for Your Investment Portfolio For Dummies

Post on: 14 Апрель, 2015 No Comment

The humble structured product , otherwise known in the UK as a structured investment (the two terms are used interchangeably) is introduced here. Structured products contain within them a promise thats common to any hedge fund, namely, the potential for an absolute return in all markets and market conditions.

Making a profit when shares rise in value is, of course, par for the course; but imagine also being able to receive a positive return even when a market falls in price without getting involved in the complexity and risks of a hedge fund. If this possibility sounds too good to be true, read on.

See how structured products deliver on this promise of returns in most, if not all, markets, in a number of different shapes and guises, ranging from the humble synthetic zero and the auto-call to the racy accelerator.

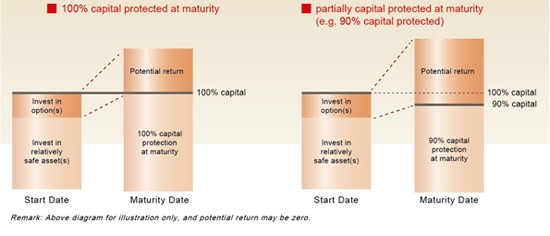

At its core a structured product involves a simple trade-off based on risk and return, which then translates into a series of options that are used to power the eventual payout. A good, well-thought-through structured product can deliver on nearly all the promises of a hedge fund or absolute return fund (a fund that aims to produce a positive return in every kind of market) but with a little less complexity.

Unfortunately not everyone is enamoured of the humble structured product. Many experts are keen to rubbish this class of investment as the work of the Devil or, at the very least, clever rocket scientists out to design complex toxic structured products that inevitably benefit them rather than their end investors.

US and UK regulators have also taken an interest in poorly constructed structured products from time to time, with the simplest incarnations sold on the high street through to the big retail banking networks receiving much close scrutiny.

Because structured products arent uncontroversial or universally popular, many supposedly sophisticated private investors eagerly hand their money over to expensive hedge fund managers who then end up investing in guess what structured investments! Dont be fooled; many hedge fund managers and professional investors make extensive use of structured products within their portfolios, and so ultimately no reason exists why you shouldnt also take advantage of the kinds of investment structures the professionals use.

The structured product you buy very much depends on what you want out of an investment, with your own requirements perhaps ranging from an annual income through to some upside (capital gains!) over a period of as much as six years.

Any upside inevitably comes with the potential for risk, and so like any strategy in this book, you can end up losing your shirt! The key is to understand the risk and then decide what works for you.

- Add a Comment Print Share