Strip Strap Options Strategy

Post on: 20 Июль, 2015 No Comment

January 16, 2014 in Strategies

If you have been trading for a while, then it is time to implement some trading strategies to increase the effectiveness and success of your trades. As with all strategies, applying them at the right time and in the right conditions is key to their success. The same applies to the Strip Strap Option strategy which is classified as a neutral trading strategy. The goal of any strategy is to reduce the risks associated with trading or to increase the returns, and once you have mastered the Strip Option strategy and the Strap Option strategy, you too can enjoy in the financial reward achieved with lower risk.

Strip Options Strategy

In order to understand the Strip strategy for options, we need to have a look at the Straddle strategy. This strategy requires that the trader holds the same number of Call and Put option trades with the same asset and expiry time. The Long Straddle strategy is most effective when applied to volatile market conditions where the trader does not know which way the market will move, either up or down. As an extension and modification of the Straddle strategy, the Strip strategy for options is also effective in volatile market conditions, but here the trader has a bias towards a downward or bearish movement of the asset price. Based on this, the trader will buy one Call option trade and two Put option trades as opposed to an equal number of options as in the Straddle strategy.

In order to activate the Strip strategy, the trader will buy an at-the-money Call option trade and double the number of Put option trades. These trades need to be for the same underlying asset, the same strike price as well as the same expiry time. By using this strategy, the trader has the potential to limit risk and make profits and the reason for this is, if the asset price does make a big move downwards as predicted, greater gains will be achieved. That is, profit can be made when the price of the underlying asset ends lower than the strike price of the Call and Put option trades. The profit can then be calculated by subtracting the strike price of the asset from the price of the asset at the expiry of the trade less the amount the trader paid in order to purchase the Call and Put trade options. That is:

Profit = Closing price of asset strike price of the Call option trades – Cost to purchase the trades

or you can calculate the profit as:

2 x (Strike price of the Put option trades – price of the underlying asset) – Cost to purchase the trades.

When you use the Strip Options strategy, you will lose if the price of the asset at the expiry of the trade is trading AT the price of the purchased Put and Call option trades. In this case, the options will expire as worthless and the trader will only lose the initial amount invested to purchase the Call and Put option trades. This is therefore the maximum loss the trader can incur when using this strategy.

Let us look at an example of the strip strategy in action. For the purpose of this example, let us say that Microsoft stocks are trading at $50 in January. In order to implement the Strip strategy, the trader will buy two Put option trades for an expiry time of one month. The investment in each of these trades is $200 each. The trader will also purchase a Call option trade with the same asset, the same expiry time and the same strike price for $200. The total cost, therefore, to enter the three trades is $600 which also represents the maximum total loss. After a month, when the trades expire, Microsoft stocks are trading at $60. Based on this, the Put option trades will end out-of-the-money and are therefore worthless whereas the Call option trade will end in-the-money. This Call option trade has an intrinsic value of $1,000 which is calculated by the difference between the asset’s price and the strike price multiplied by the number of shares bought. Based on this, the actual profit is calculated by subtracting the cost of the purchasing the options of $600 from this intrinsic value of $1,000, leaving a profit of $400.

If the price of Microsoft shares drop to $40 by the expiry of the trade in February, the Call option trade will end out-of-the-money but the Put option trades will end in-the-money each with an intrinsic value of $1,000. With a Put option, the intrinsic value is the difference between the strike price and the asset’s price multiplied by the number of shares purchased. This means that the profit will be $1,400 which is calculated by subtracting the original cost of purchasing the trade options of $600 from $2,000.

If the price of the Microsoft shares end on $50 at the expiry of the trade, both the Call and Put option trades will expire at-the-money and the maximum loss, will be equal to the amount spent to purchase the trade options which was $600.

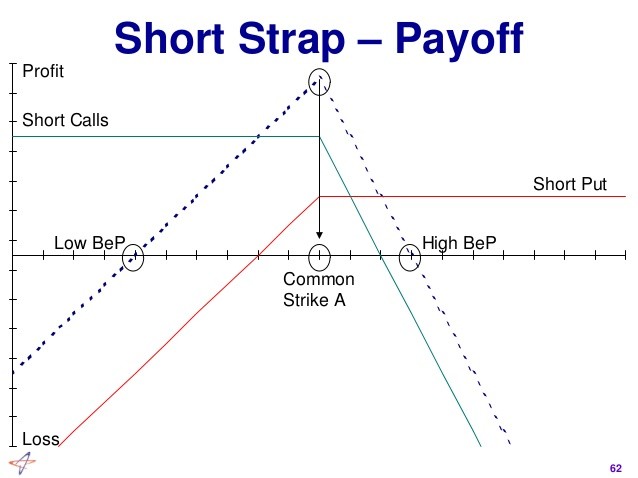

Strap Options Strategy

The Strap Option strategy is also a variation of the Straddle strategy except here, the trader believes that the price of the asset will move up or is bullish and so instead of only buying one Call option and one Put option, the trader will purchase two Call option trades and one Put option trade. All option trades must be purchased for the same asset, the same strike price as well as the same expiry time and they must also be purchased at-the-money.

The profit potential for this strategy is unlimited and if the price of the asset does in fact move up, the trader has the opportunity to increase these profits while maintaining limited risk. If the price of the asset moves down, the trader can also profit on the Put option trade. This means that profit can be achieved when the asset price is greater than the strike price of the Call and Put option trades. Profit is calculated by taking the strike price of the Put option trades less the price of the underlying asset, less the cost to purchase the Call and Put option trades.

When using the Strap strategy for options, you will lose when the price of the asset at the expiry of the trade is trading AT the strike price of the Call and Put option trades that were purchased. In this case, the options will expire as worthless and the trader will only lose the initial amount invested to purchase the Call and Put option trades. This is therefore the maximum loss the trader can incur when using this Strap strategy.

Let us look at an example where the price of Microsoft shares is $50 in November. In order to enter the strap, the trader will purchase two Call option trades and one Put option trade with the same expiry time and strike price. The cost to purchase these trades is $200, meaning that the total possible loss is $600. When the trade expires, if the Microsoft shares drop to $40, the Call option trades will be out-of-the-money whereas the Put option trade will end in-the-money with an intrinsic value of $1,000. If we subtract the original cost for purchasing the trades of $600, the total profit will be $400.

If the price of Microsoft shares is at $60 at the expiry of the trades, then the Call option trades will end in-the-money, each with an intrinsic value of $1,000. The Put option trade will end out-of-the-money and it will be worthless. The profit can therefore be calculated as the intrinsic value of the Call option trades less the original cost incurred when purchasing the trade options, leaving an overall profit of $1,400. If the Microsoft shares end on $50 at the expiry of the trade, both the Call and Put option trade will be worthless and the maximum loss is $600.

Using the Strap strategy is most effective when you are sure that the asset price will move up but you also hedge in case the asset price will move down. If you are correct about the bullish movement of the stock price, then you will make twice the amount of money from your two Call option trades. The money made on these Call trades will outweigh the loss from the Put option trade, leaving you with at least one profitable trade.

Conclusion

The Strip and Strap options strategies are most effective when the trader believes that an asset price will move significantly in a particular direction, either up or down. The benefit of this strategy is that even if your prediction is inaccurate, you still have an opposite trade option which will end in-the-money, thereby reducing your loss. While you may be spending more initially to purchase an extra Call or Put option trade, you can also double your profits if your predictions are correct.