Strike Price and Intrinsic Value of Put Options

Post on: 16 Март, 2015 No Comment

Intrinsic value

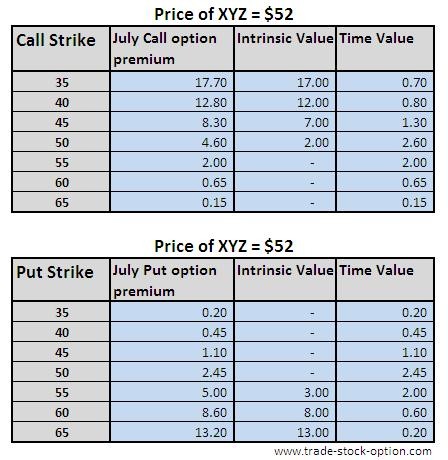

In the article about strike price and intrinsic value of call options we learned that intrinsic value is the difference between the market price of the underlying stock and the options strike price. It moves together with the stock price, but cant be negative. However, we only talked about calls.

Put options are different

With put options. which give their owner a right to sell the stock, the relationship is different, or, as you would probably expect, just inverse. Lets review the Microsoft example from the call options article. Its OK to spend some time on this, as the concept of intrinsic value and call vs. put difference is crucial for understanding options and discovering the vast possibilities they offer in terms of trading.

Strike 25, stock at 20 = put intrinsic value 5

Lets now consider a put option with a strike price of 25$. In the beginning, Microsoft stock price is 20$, so it is lower than the strike. But remember, this is a put option, which gives you a right to sell (not buy) the stock for the strike price. Would you like to sell the stock for 25, when in the stock market you can sell it for 20? Definitely you would, because you would make 5 dollars more. These 5 dollars are the value that the put option has hidden inside it, the intrinsic value .

Strike 25, stock at 28 = put intrinsic value 0

If stock goes up to 28, you would now get 28 dollars for selling the stock on the stock market. By exercising the put option. you would only get 25. Is there any intrinsic value in the option now? It isnt, because you would give up 3 dollars by exercising it. But remember, the intrinsic value cant be negative, as you always have the choice. In this case, the best thing is to do nothing and throw the option away (or using the correct terminology, let the option expire without exercising it).

Strike 25, stock at 17 = put intrinsic value 8

The more the stock price declines, the more attractive it is to get rid of the stock by exercising the put option, relative to selling the stock on the stock market. With stock at 17 and strike at 25, intrinsic value is 25 less 17, or 8 dollars. Note that the relationship between the move in the stock price and intrinsic value is just opposite with calls and puts. The intrinsic value of put options declines when stock price rises, and vice versa.

Intrinsic value formulas

To sum up, quantify, and highlight the difference between call and put options and their intrinsic value, you can have a look at the basic intrinsic value formulas .