Strategies To Trade The Dow Jones Industrial Average (DIA DOG DXD)

Post on: 19 Июль, 2015 No Comment

The Dow Jones Industrial Average (DJIA) is one of the oldest and most widely-followed stock market indices in the world. Here are four strategies for trading this venerable index –

- Taking a long position in the DJIA . Perhaps the easiest and cost-effective way of taking a long position in the index is by buying units of the SPDR Dow Jones Industrial Average ETF Trust, which seeks to provide investment results that correspond to the price and yield performance of the DJIA. One of the oldest exchange-traded funds (ETFs ), its ticker symbol – DIA – has led to this ETF being better known as “Diamonds.” With the DJIA reaching record highs in July 2014, investors nervous about investing in the index at these levels could adopt a strategy known as dollar-cost averaging. This strategy requires making the same dollar amount of investment in an ETF like the DIA at regular intervals, such as at the beginning or end of every month or quarter. This will ensure that fewer DIA units are bought when the underlying index is at elevated levels, and more units are purchased when the index is at depressed levels, lowering the average cost of DIA units over time. Since the trajectory of the DJIA is generally upward over prolonged periods of time, the strategy may result in appreciable returns if it is followed over a lengthy investment horizon. (Learn more about ETFs in Investopedia’s great video on the subject.)

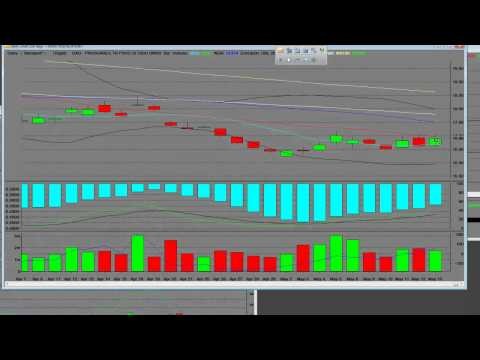

- Taking a short position in the DJIA . An investor who is bearish on the DJIA can take a short position in the index through the DIA ETF. Investors who have a short-term trading horizon can short the DJIA by taking positions in inverse ETFs like the ProShares Short Dow30 (DOG ), which seeks daily investment results that correspond to the inverse of the daily performance of the DJIA. More aggressive traders could consider the ProShares UltraShort Dow30 (DXD ), which seeks results two times the inverse of the DJIA’s daily performance. As with any short selling strategy, shorting the DJIA should only be attempted by experienced traders and investors who are familiar with the risks inherent in short selling .

- Trading the DJIA using options . The DJIA can also be easily traded through options on the DIA ETF. An investor with limited funds who is bullish on the DJIA could buy calls on the DIA ETF, while a bearish investor could buy puts on DIA. Note that DIA units trade at about 1/100 th the level of the DJIA. For instance, the closing price of DIA units on July 24, 2014 was $170.44, while the DJIA’s closing level on that day was 17,083.80 (DIA units do not trade exactly at 1/100 th the DJIA level because of the ETF’s fees and expenses). A bullish investor who thinks the index could gain at least 5% by the end of 2014 could buy the December $180 calls, which were trading at about $0.77. Similarly, a bearish investor who has the view that the DJIA could decline at least 5% by year-end could buy out-of-the-money puts like the December $162 puts, which were last traded at $3.04. Investors who already own the DIA units and think that additional upside in the DJIA is limited could consider writing covered calls to earn some premium income.

- Dogs of the Dow strategy . This strategy involves investing equal amounts in the 10 stocks on the DJIA with the highest dividend yield at the start of a year, and holding them until year-end, at which time the investor sells that year’s Dogs and deploys the proceeds into the new Dogs for the year ahead. This strategy has generally produced favorable results over time.

There’s a strategy available for trading the Dow Jones Industrial Average for investors of every persuasion, from beginners with limited capital to invest, to aggressive traders and high-net worth individuals with large pools of capital at their disposal.

Disclosure: The author did not own any of the securities mentioned in this article at the time of publication.