Strategic Diversification of Employer Stock

Post on: 27 Апрель, 2015 No Comment

By Bill Briggs, CEO Net Worth Strategies, Inc.

The following case study, illustrated using StockOpter Pro. describes a four step process that enables financial advisors to secure immediate and recurring company stock diversification transactions and assets under management. The four steps are:

- Establish necessity of diversification from concentrated employer stock positions

- Establish strategy for “dollar cost average” diversification

- Secure agreement to proceed with the first step of diversification

- Periodically update the strategy and secure agreement on an immediate implementation action

Step 1 is to educate your client on the virtue of diversification if he/she is not already convinced. This can be done by a “worst case” illustration using several examples from recent history. With StockOpter Pro, you can project your clients net worth using the annual stock price changes of several companies that have had poor stock price performance over the past 15 years. Unfortunately, there are many examples to choose from. Starting with the current value of the client’s stock holdings, the following chart projects future value using the annual price changes of three well known companies over the past 15 years compared to the performance of the S & P 500 over the same period.

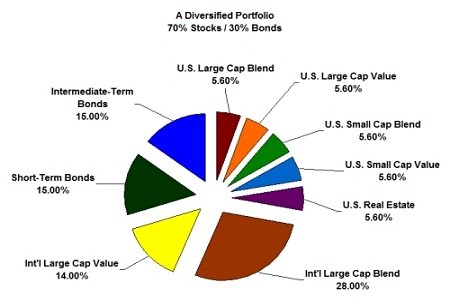

In addition, you can easily illustrate the impact of diversifying from the simulated company stock performance to a diversified portfolio. The chart below compares the hypothetical performance of the company holdings indexed to Intels performance over the past 15 years (red line) and a scenario where the company stock (indexed to Intel) is diversified to an S & P 500 index over the same period at the rate of $150,000 per year (grey line).

In this example, the percent that is diversified increases from zero in 2014 to 80% by 2028.

Step 2 is to develop a diversification strategy. Since most companies place restrictions on the extent to which their employees can sell company stock, the strategy will probably need to be a “dollar cost averaging” approach over time. Using the StockOpter Pro “Strategy Wizard” various strategies can be easily illustrated with either dollar or percentage diversification amounts.

In the example below, the concentrated company position is diversified 5% per year, and the diversified proceeds are invested in a low risk portfolio with a presumed return of 4% plus or minus 2%.

Depending on the client’s decision making process, you may want to run multiple cases by varying the diversification rate, company stock index, investment account index, etc. With StockOpter Pro, these additional illustrations can be created in a matter of minutes.

“You’ve got to think about big things while you’re doing small things, so that all the small things go in the right direction.”

Alvin Toffler

The value of the Strategic Diversification Plan, is that it defines the action to be taken now (or at the next trading window) in order to achieve the strategic goal. Once the client has agreed to a diversification strategy the current implementation action is outlined in the StockOpter Pro “To Do Schedule” table as shown below.

In this illustration, the shares to be sold are from Lot 3 in order to minimize the capital gain.

Step 4 consists of updating the analysis based on changing circumstances and obtaining the client’s decision to take appropriate exercise and sale decisions. This should be done whenever there are substantial changes but at least annually. This updated analysis is accomplished with a minimum amount of effort as it merely consists of updating assumptions from the prior analysis.

Summary: If you have clients or prospects with concentrated positions in employer stock, restricted shares or units, and/or options, this 4 step process is a powerful and easy way to acquire new clients and generate recurring asset inflows from timely and periodic diversification.

Bill Briggs spent 26 years with the IBM Corporation serving in management positions in sales, marketing, product development and financial and strategic planning. Bill spent seven years providing financial planning services in the Bend, OR area prior to founding Net Worth Strategies, Inc. in 1999. Bill is currently the CEO and President of Net Worth Strategies and spearheaded the development of StockOpter Pro. For more information and a free demo visit www.stockopter.com .