Strangle v Option Trading Strategies

Post on: 9 Сентябрь, 2016 No Comment

Want to learn how to build your own trading strategies? Let Adam help by taking his free courses at FX Academy.

By: DailyForex.com

If you are interested in trading binary options instead of or in addition to trading spot Forex, you need to think about the fact that what you need to do to achieve success is completely different between the two.

When you are trading spot Forex, things are very straightforward. You are really just making bets on the next directional movement of the price. If the price is at 1.00 and you expect it to reach 1.01 before 0.99, you enter a long trade with a stop at 0.99 and a take profit at 1.01.

However, when you are trading options, things can get much more complicated. You could be betting on a few different things, such as your belief that the price at the end of the day will be above a certain level but not by enough to justify a spot Forex trade, making a binary options trade the more logical option in terms of profit. Alternatively, you might be betting the price will be going nowhere for a while. Very often, Binary Options are most useful as trading instruments for drawing an envelope around the price, beyond which you do not expect the price to go. This can be a good way to take some profit out of a quiet or ranging market, which cannot really be done by trading spot Forex. Alternatively, you might want to use Binary Options to hedge trades, either alone or jointly with a spot Forex trade. In order to execute these types of operations, you need to understand some option strategies, the two most important of which are the strangle option strategy and the straddle option strategy.

Strangle Option Strategy

The Long Strangle

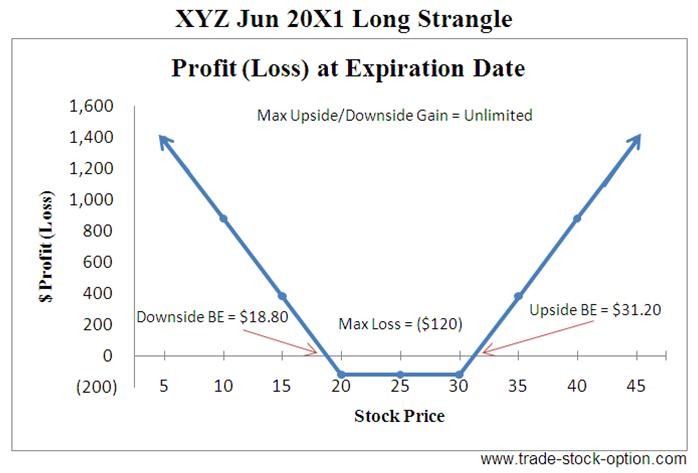

The long strangle option strategy is a strategy to use when you expect a directional movement of price, but are not sure in which direction the move will go. In this strategy, you buy both call and put options, with different strike prices but with identical expiry times. Exactly which strike prices you buy them at is something you can use to implement whatever expectations you have. For example, if you think a breakout with an increase in price is more likely, you can make the strike price of the call option relatively low and the strike price of the put option relatively high. The most you can lose is the combined price of the two options, whereas your profit potential is, at least theoretically, unlimited.

The Short Strangle

The short strangle option strategy is a strategy to use when you expect the price to remain flat within a particular range. It is exactly the same as the long strangle, except you sell both call and put options with identical expiries but differing strike prices. The problem with this strategy is that your losing trades are usually going to be much bigger than your winning trades. It usually makes sense to choose expiry prices that match the limits you expect the price to remain within at expiry from the current price.

Straddle Option Strategy

The long and short straddle option strategies are just the same as the strangle strategies described above, with one key difference: the call and put options bought or sold should have identical strike prices, as well as expiry times. With the long straddle strategy, as long as the price at expiry is far enough away to ensure a profit on one of the options that is larger than the combined premiums of the options, the combined expiry will be in the money. The short straddle strategy is even riskier than the short strangle strategy as there is no leeway for the price at all beyond the value of the option premiums.

The most logical way a trader can begin to try to profit from these kinds of strategies would be to look for a currency pair where there is strong resistance overhead and strong resistance below, and enough room in between for the price to make a normal daily range. A short strangle with the strike prices just beyond the support and resistance levels could end with a nice profit.

Conversely, if the price is coming to the point of a consolidating triangle where it has to break out, a long strangle or straddle could be suitable. If the triangle shows a breakout to one side is more likely, you can adjust the strike prices accordingly to reflect that.