Stop Loss Order Vs Limit Order

Post on: 16 Март, 2015 No Comment

Stop Loss Order Vs Limit Order: Which is Better?

Both stop loss and stop limit orders offer a trader the ability to be more specific in a stock order. Both options provide a way to get out of a position if things start to turn badly, although there are different advantages to each. Stop-loss orders are by far the more popular of the two options and the reason becomes clear after a bit of explanation.

Difference between Stop Limit and Loss Orders

Stop-limit orders can be thought of as a combination of the limit order and the stop market order. The stop limit order is placed above the current market price to buy or below the market to sell, similar to a stop-loss order. The difference between the two is this: stop limit orders are only filled when the price is equal to or greater than the set price. There is risk involved here that can mean an order will not be filled at all in a fast market.

Disadvantages of the Stop Limit Order

There are disadvantages to the stop limit order that make the stop-loss order more popular among traders. While stop-loss orders guarantee an exit from a bad position, stop-limit orders do not. If a trigger price is passed in a fast moving market, the order can go unfilled. A stop-loss order, on the other hand, will sell the stock automatically once the price is reached. Stop-limit orders are also not advantageous in a fast or liquid market because it is possible for the market to pass the trigger price completely without filling the order at all.

When Stop-Limit Orders are Useful

Stop-limit orders can be beneficial in a few situations. They usually work very well for individuals that are patient in their investments and are looking for a long-term investment goal. This type of order is ideal for a slow moving market with low liquidity because there is very little chance that the trigger will be passed by. Traders using the futures market also favor the stop-limit order. It allows the investor to get into the market without buying at a price worse than expected and is perfect when it is acceptable to miss the trade if an order isn’t filled at the right price.

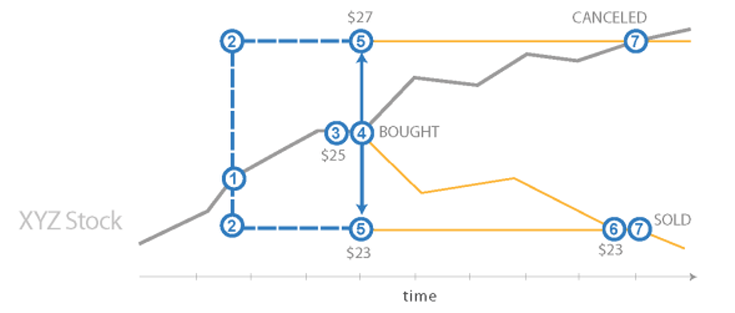

Stop Loss Order Example

An example can make the difference between the two options clear. Assume an investor holds 100 shares of XYZ and the current price is $23.20. It is possible to use a stop-loss order to sell all 100 shares at $23.00. In this scenario the broker will then attempt to sell the stock at or below the $23.00 point. An investor that holds 100 shares of XYZ with a current price of $23.20 will encounter a different situation with a stop-limit order.

Stop Limit Order Example

In this example, the investor may try to sell shares at $23.00 with a stop limit of $22.95. At this point the broker will try to sell the shares at, below or above the $23.00 price, but higher than 22.95. This limit placed upon the order may create a problem if the stock can’t be sold for $22.95, causing the broker to wait until the market rises back to at least this level.

The differences between a stop loss and stop limit order can appear subtle at first, although these orders are intended for very different situations. They each have advantages, although stop-loss orders remain the more common type. Choosing the type of stop order to use should be based on the pace of the market, the need for a guarantee and the individual goal of the investor.