Stock Trading Strategies

Post on: 12 Июнь, 2015 No Comment

Choosing between different stock trading strategies can be a difficult decision.

In this section I’ll briefly go over some of the most common types I’ve come across over the years. It’s a good idea to make yourself familiar with several different types, and then select which one’s you find work best for you.

The type of stock trading strategies you choose are part of your complete stock trading plan. They are a particular focus that you can use to narrow down your choices for stock selection.

By using a particular strategy which includes research tools at your disposal such as technical analysis or fundamental analysis, you can increase your probability of success.

While there are people who invest for the long term with some type of Buy and Hold strategy, the following examples are geared more towards Short Term Investing /Trading but often can be applied to longer term scenarios as well. Read more about Short Term Investing/Trading here. and for a primer on the topics below, read what is a stock trading strategy .

Check out a new addition, daily market updates from Market Club. which will be updated around 1:00 p.m. Monday through Friday with a look at what’s going on in the stock and commodity markets.

- Diversification With Profitable Results. Don’t just expect to diversify and sit back while the profits roll in, consider making some adjustments along the way to boost potential profits. Momentum Stock Trading: Sometimes called Trend Trading, this type of trading is based on doing research and finding stocks or sectors that are moving in a direction with some sort of strength.

- Hot Stocks To Buy. Seeking out which stocks are hot, and which are not. How To Recognize a Breakout. Setups which momentum traders love.

Penny Stock Trading. Trading low priced securities with a small market capitalization generally priced under $10.00 per share.

- What Are Penny Stocks?. An introduction into various definitions you may come across while researching penny stock trading in general. Learn How To Trade Penny Stocks. Some brief, important points about this type of trading. Benefits of Penny Stock Trading. Learning about both the benefits and pitfalls is highly recommended before making your first low-priced stock trade.

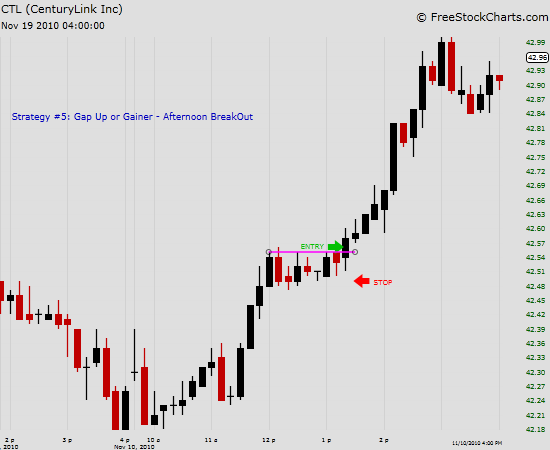

Insider Following Trading System. This type of trading involves doing research on major insider trade transactions which are filed with the SEC. It can be used in any type of trading. Shorting Stocks. Shorting is merely a procedure to profit from a decline in a stock price. Shorting has been given a bad name in the past. I believe this is mostly due to the lack of specific regulations, or complying with regulations. Not because it is terribly wrong as people have been given the impression. News Trading. This type of stock trading strategy is designed to place trades based on real-time news releases. It is usually geared towards Scalping or Day Trading. Gap Trading. Gap Trading can be described as placing trades at the level of extremes during an opening gap, either higher or lower, while looking to profit as the stock price reverses to fill the Gap. It can be geared towards Scalping, Day Trading or Swing Trading.

- Trading an Opening Gap Down. Opening gaps down provide good trading opportunites if you have a plan of action in place before they occur. This article goes into some of the possible outcomes along with an actual trading example.

Extended hours Trading:

- Pre Market Stock Trading. Pre-Market Trading is a trading strategy used in Scalping and Day Trading. Pre-Market Trading hours are from 7:30 a.m. to 9:30 a.m. and is done most often in combination with News Trading. The hours accessible for trading are specific to your broker. After Hours Trading. After-Hours Trading is also used in Scalping and Day Trading. After Hours Trading is from 4:00 p.m. to 8:00 p.m. and is available depending on your specific broker.

ETF Trading System: ETF investing is designed to spread out risk because an ETF contains a basket of stocks in a particular sector. ETF trading is usually combined with a Momentum Trading System. Dividend/Income Stock Trading Strategy. Some people buy high Dividend producing stocks or exchange traded funds, to produce a steady income. Dividend trading is usually done by a long term investor.

- Dividend Paying Stocks. High quality dividend paying stocks can help build a portfolio which produces passive income if done correctly.

Elliott Wave Principle. Ralph Elliott lived from 1871-1948. The Elliott Wave principle is based on a theory that investor psychology, which moves stock prices, goes from being pessimistic to optimistic and back again, forming patterns that can be recognized. Once you learn a little about how this works, you will be amazed at what you can see in different charts.

- How a ZigZag Differs From a Flat Advantages of Trading with the Wave Principle. Learn to help determine entry points and where to place protective stops using pre-determined price levels.

Fibonacci Trading Strategy: Leonardo Fibonacci was an Italian mathematician who lived from 1170-1250. One of the most common uses of Fibonacci in trading, using Fibonacci Retracement Levels, is a form of technical analysis that is based on the belief that a stock’s price will retrace part of its recent move to specific support or resistance levels. Trading Stock Options: Stock Options are basically contracts giving you the right but not the obligation, to buy or sell stock shares at a specified price.

- How To Buy Stocks at a Discount. Learn how to lower your initial cost of purchasing your favorite stocks, or get paid trying. Managing a Short Put Position. After learning how to buy stocks at a discount, you’ll want to learn how to manage a short put position as well. How to Use the Elliott Wave Principle to Improve Your Options Trading Strategies — Vertical Spreads. Normally sells in EWI’s online store for $79, is available for free, exclusively to our readers here, for a limited time only. Here’s a good resource that will help explain Option Trading from the basics up through real trading examples and coaching services.

Intraday Trading Strategy — One Big Asset Class: Trading an individual stock or ETF using multiple asset classes for analysis.

- 123 Reversal Pattern The 123 Reversal Pattern is an example of a simple intraday trading strategy that occurs on a regular basis.

End of Day Trading. A lesson learned from End of Day Trading, and a reminder of the increased difficulties trading during this time period that exist. End of Year Trading. Different than above, end of year trading is different than usual due to the low volume that typically occurs. Mechanical Stock Trading System. You can use a Mechanical Stock Trading System to help eliminate, or at least minimize, the emotional and human interaction involved with stock trading.

Using Trendlines. Trendlines can help with just about any type of stock trading strategies mentioned above. Once you know the trend, you should be able to select entry and exit points with better overall results. Buy and Hold Forever vs. Having an Exit Strategy

Be sure to read my article on Stock Trading Strategies Are Not Always One Size Fits All to gain some insight into a tip that many people wind up learning the hard way.

All of these stock trading strategies are widely used in everyday trading. The more you learn about each of the different techniques they use, the better prepared you will be. Every time I learn more about any one of them, I always remember seeing the particular patterns or the opportunities that existed, that I missed out on because I didn’t know at the time.