Stock Splits

Post on: 15 Август, 2015 No Comment

I n the 1990’s the top technology stocks were spectacularly successful and their prices had meteoric rises. Some companies, like Warren Buffet’s Berkshire Hathaway, don’t have a problem with their stock being priced out of the reach of ordinary investors. Berkshire Hathaway class A shares are over 125,000 a share today and B class shares are just over $85.00 a share today.

In 2010 the B class shares were over $3,000 a share until a recent stock split; yes Warren Buffet’s company announced a Stock Split just recently.

The tech entrepreneurs wanted to make money – lots of it – and so they split their stock. Companies like Dell, Microsoft and Qualcomm split their stock every 6 to 12 months in the late 90’s, making shareholders richer with every split.

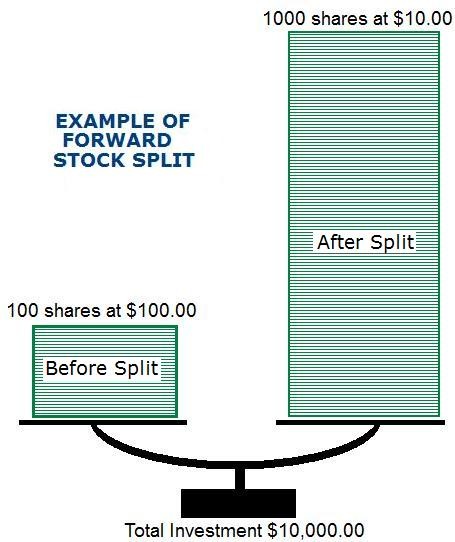

So, how does it work? Let’s say a stock has 200 million shares in the market place, and the price of the stock is $10. When the stock splits there will be 400 million shares but they will be worth half as much, $5.

So how does this make you richer? Most stocks that split run back up to their pre-split price, which means that soon enough you’ll have twice as many shares at $10 each. Take a look at the wealth Bill Gates and his company directors made.

Since going public at $21/share on March 13th, 1986, Microsoft stocks have split 9 times and would be worth a staggering $8064 today. If you had invested $10,000 in Microsoft stocks in 1986, your stocks would be worth $3.8 million today or up to $7 million before the tech bubble burst in 2000.

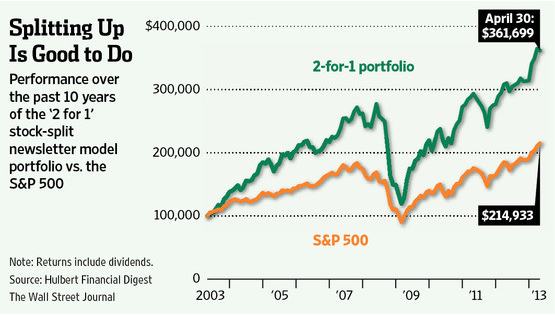

Take a look at the chart below:

Most of the richest men, from Michael Dell of Dell Computers, to Larry Ellison of Oracle, David Filo and Jerry Yang from Yahoo and Paul Allen of Microsoft made their money through stock splits.

Company directors are still getting rich today.

Stock splits are great but that ain’t all folks!

What if you don’t have the money to buy stock? You’re just starting out, you’ve got $5000; what can you do? You can use options.

What are options? Options are called derivatives because they are derived from the stock they are connected to. Put simply, an option is the right, but not the obligation, to buy or sell a particular stock at a particular agreed price within a particular time frame.

I’ll explain more about options in detail later. Here I just want to show you what happens to options when a stock splits. Below you can see a chart showing the price movement of shares of Qualcomm between 1999 and 2000.

In January 1999 Qualcomm shares were at $60. If you had bought 100 of them, that would have been a $6000 investment.

By May 1999 the stock was at $218.75. It split 2-for-1 and the post-split value was $109.25.

So now you would have had 200 shares at $109.25. A total value of $21,850.

In December 1999, Qualcomm split again. That time 4-for-1.

Your holdings would then have been 800 shares at $140 each.

A total value of $112,000! That’s an 1866% profit! In less than a year! What’s more, you have sold pre-split as the shares ran up to over $700 each. That would have made the value of your 200 shares $140,000.

That’s pretty impressive, but if you had used options, your profit would have been even greater because they offer you more leverage. How? When a stock splits, the options split as well.

So do companies split their stock today? They sure do. One company I am trading split their shares last month for the second time and are already on the rise.

See chart below:

Options are sold in contracts, and in the US, 1 contract gives you rights over 100 shares. So when Qualcomm split 2-for-1, if you had 1 contract before, you would have had 2 contracts after, giving you rights over 200 shares. Options are a fraction of the price of the underlying stock, but they have an expiry date anywhere up to 3 years. Used correctly they can provide a lot of leverage to multiply your profits

The Option to be Wealthy Stock splits using Options

As I said earlier, a call option is the right, but not the obligation, to buy a particular stock at a particular agreed price within a particular time frame.

Instead of buying 1000 shares at $25.00 and spending $25,000 for the next 6 months, you can own the call option at the $25 strike price for $2,500. As I mentioned before, options are sold in contracts of 100, so buying 10 contracts x $2.50 = $2,500, so that’s all I have at risk. These options give you the right to buy the stock at $25 even if the price goes up to $30. If bad news comes out and the shares fall to $20 buying the stock, you would have lost $5,000 but buying the option you have lost only $2,500.

Options were first introduced as insurance on stock. Now they are traded daily as a leveraged tool for short or long term gains.

It’s a bit like a lay-by where we leave a deposit on goods say a new fridge which costs $2,000. We put down a $200 deposit. If we don’t pick it up in the 3 months time we forfeit our deposit.

If, all of a sudden, there was a demand on this particular fridge and the value increased to $2,400 then theoretically we could resell it at this price. In real life the shop owner won’t usually buy this back from us, but in the stock market they will. What’s more, they have to. It’s a signed agreement with the Securities Exchange Commission (SEC) to insure all option sales.

Options are traded on the Chicago Board of Options Exchange (CBOE) a market set up specifically to trade options. Created by the Chicago Board of Trade in 1973, the CBOE essentially defined for the first time standard, listed stock options and established fair and orderly markets in stock option trading.

Options are based on a percentage of the stock price giving you a small exposure to investing with a potentially large reward.

The Australian Stock Exchange (ASX) has had an options market since 1976 and is ranked amongst the top 10 options exchanges (by contract volumes traded) in the world.

So as you can see, trading Stock Splits using options can be a great way to start trading.

Lyn Summers

Only once a year we hold a 3 Hour Stock Splits Training Webinar teaching you a very useful advanced Option Strategy from our E-learning course. This is an excellent opportunity to expand your knowledge and have another strategy available to make you a more profitable trader. As you know, successful trading is dependent on education. We will share the stock split companies we are trading today.