Stock Options Strategy Buy Butterfly Strategy

Post on: 8 Апрель, 2015 No Comment

Stock options are investment options enabling the purchaser the right, but not giving the obligation, to purchase (known as Call) or sell – (known as Put) a stock at a specified price within a specified time period with an expiry date. There are two types of stocks options – the American and the European – with American options exercisable anytime between the date of purchase and the expiration date. However, European options are only redeemable at the date of expiration. By far, nearly all exchange traded stock options are of the American kind.

The appeal of stock options to investors is down to the fact that the losses are limited to the amount that is paid for the stock options should the underlying stock price go in a direction that is against their prediction. The profit potential for gains in stock options are however, theoretically unlimited. It is also important to note that the premium for a stock option is far less than the cost of the actual stock itself; especially in the case of a high priced stock like Apple Inc. This enables the investor to leverage their capital in a far more efficient manner.

Stock Options Strategy The Buy Butterfly Strategy

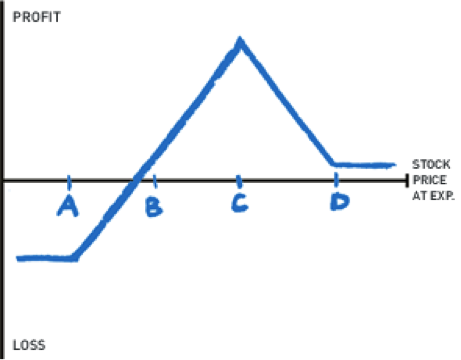

The buy butterfly strategy is regarded as a comparatively complicated way of hedging against a possible losing prediction. It is a neutral strategy that is a combination of a bull spread and a bear spread. It is regarded as a limited profit strategy with limited risk. In this strategy a trader will purchase a call option with a low strike price at a higher premium. The premium is higher as there is reduced risk that the option will not hit the strike price before its date of expiry. The investor will then sell off two call options with strike prices that are medium range. Lastly, the investor will buy one final call option with a high strike price, at a lower premium as there is less probability of the stock increasing to or above the strike price before its date of expiry. However having the ability to buy the option at its current market price when the option was purchased and should the value of the stock rise before its expiration date; offers the investor the potential for large profits.

When Best Used?

It is a strategy that is best used by an investor when they believe that there will be a fluctuation in the stock price, but only a limited fluctuation within a limited range. This means that the trader is investing in the fact that the low strike price and the high strike price are at the limits of the range. The two options sold at the medium strike price aid in mitigating the potential loss by giving the investor the premiums for disposing of the options.

Profit for investors is limited using the buy butterfly strategy as the most the profit can be is when the stock price reaches the high strike price. However, losses are also limited in this strategy with the maximum loss being realized when the final stock price settles lower than the low strike price or above the high strike amount. The full amount of loss is limited to how much was paid to create the spread the butterfly. The final amount is the total cost of the premiums paid for buying the high and low strike price options, minus the premiums received when the medium strike price options are sold, as well as all the commissions paid for the cost of the transactions. It is important to remember that the commission charges can have a significant effect on the overall profit or loss in stocks option spreads strategies. Even more so for the butterfly spread as there are 4 points involved in this trade compared to simpler strategies such as the vertical spreads which only combines 2 legs.

Overall, this is an advanced trading strategy considered not suitable for novice or inexperienced investors, even though there is the appeal of limited loss. It is a difficult task for novice traders to ascertain the acceptable ranges for stock price fluctuation and good understanding of technical analysis and the study of historical data is required.