Stock Options and Tax Loss

Post on: 29 Май, 2015 No Comment

Call and Put Options

Call options (calls) are contracts on particular stocks and indices (such as the S&P 500) that allow them to benefit from price increases within a fixed amount of time. If the stock or index does not go up within that time frame, the option expires worthless and the holder can deduct that loss on Schedule D, Form 1040. Put options (puts) work in the opposite way, allowing investors to benefit from declines. Those with large portfolios may also sell options without having owned the stock to back them up, which can lead to outsized gains and losses.

Offsetting Gains

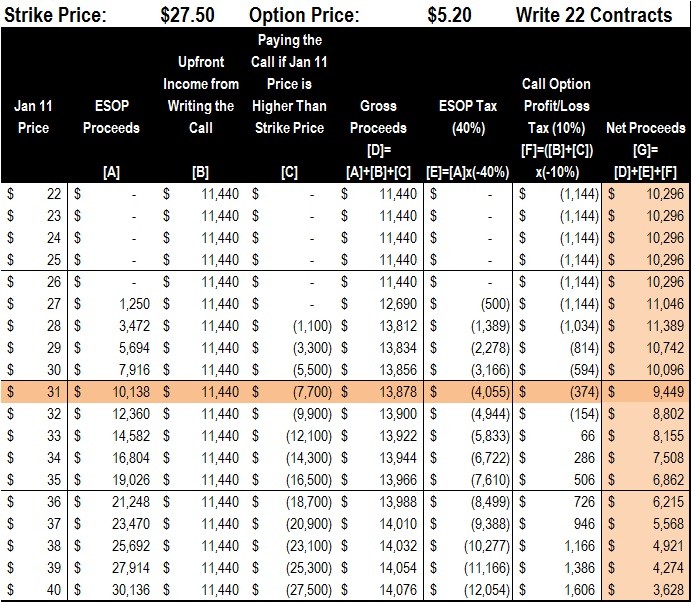

Investors may purposely choose to take losses on options positions to offset gains elsewhere and reduce their capital gains tax burden. They may also hope a particular option expires worthless, thus providing the tax deduction while reflecting a larger profit on the underlying stock. As the capital gains tax takes a chunk of the gains, especially for trades concluded within a one-year time frame, investors must carefully consider the tax ramifications for each trade as part of a disciplined, long-term investment plan.

Tax-Loss Limits

References

Resources

More Like This

How Soon Can I Buy a Stock I Have Sold?

Maximum Tax Deduction for Stock Losses

What Is a Wash Sale in the Stock Market?

You May Also Like

In the world of finance, two species of stock options exist: employee stock options, which are limited options that cannot be resold.

Stock options provide investors with the future privilege of either buying or selling a security at a set price. If you choose.

Taxes on Covered Call Options. An investor who understands the tax consequences of selling covered call options will know to avoid costly.

Stock options make up a different market than the stock market, but these instruments are tied directly to shares of real stock.

An unprotected portfolio can be as dangerous as driving your car without insurance. Hence it is important to hedge your longs with.

The short answer is yes. Worthless stocks are tax deductible if they are truly worthless according to the Internal Revenue Service (IRS).

If you trade options, you know that there are numerous types of options and an equal number of outcomes to options transactions.

To reward key employees for either current or future performance, a company may give them shares of that company in the form.