Stock Options A Strategic Weapon For Growth

Post on: 2 Август, 2015 No Comment

On a regular basis, I am asked by startup business founders how to develop a thoughtful employee stock option plan. Most entrepreneurs are looking for information to guide their thinking and action on this very critical business component. They wonder why they would share ownership with employees, what constitutes stock options, what are the stock option and purchase plan choices they should implement, how much stock they should offer, who should receive options and when they should be granted and vested. They also want to understand any pitfalls that might be troublesome. They all ask, “What’s a normal approach to this noteworthy topic?”

If handled carefully, employee stock options can be an incredible tool.

In addition to entrepreneurs seeking information on company stock, I also hear from employees who wish to enjoy the benefits of ownership. They, too, want to understand the fundamentals of stock options and how they might obtain them.

With this in mind, I am pleased to provide a high level overview to answer a few questions on the matter.

With investments in more than 40 companies, I always encourage business builders to establish a clear and concise plan of action. Please note the following points of interest:

- Options. which are a right to purchase shares at a future time at a fixed price, can be a form of compensation to be used by cash-strapped companies to hire key employees they could not otherwise afford. In sum, salaries can be lower when options are granted.

- Options can provide a significant financial incentive to employees to reach predetermined goals and in time, if the company is successful, enjoy the upside monetary benefits of ownership.

- An additional motivation is available through the vesting of stock option grants that require employees to remain employed for a certain period of time before the shares can be issued and sold.

- As options are granted, the company should establish appropriate vesting provisions. While these can be tailored to individual circumstances, the most common vesting arrangement is for an option to become exercisable for a portion of the shares after one year (commencing from date of employment or other triggering date, and often in the range of 25%) and for the remainder of the shares to vest on a monthly basis over the next three or four years. But depending on a person’s role and time of service, vesting triggers may be accelerated or tied to specific performance goals.

- Certain types of stock options can also provide employees with the ability to convert part or all of the potential compensation package into capital gains for tax purposes.

- How much stock should be allocated to stock option plans? While there are no hard and fast rules, option pools for early stage companies with high-growth potential often provide for a pool of option shares that would represent between 15%-20% of the total outstanding shares of the company.

- Once the size of the option pool is set, the company needs to determine which key employees it has or needs to attract at different levels of responsibility, and what number of shares it can/should allocate for each level of highly prized employee.

In establishing a careful plan, there are a few issues that will require utmost care:

- Employees need to remember that at some point their stock options must be purchased at the exercise price set forth in the grant document.

- Though options generally have a lengthy exercise period to allow the holders to see if the shares are increasing in value, upon termination of the employment relationship or as the option nears expiration, the holder may have to make a quick investment decision. The lack of a public market for the shares at the time of exercise may prevent a contemporaneous sale to produce cash to cover tax liabilities or to immediately recoup the exercise price paid by the option holder.

- Furthermore, either regular income tax or alternative minimum tax may be payable at the time of exercise, even if the underlying stock is subsequently sold at a loss. If the stock appreciates in value, an additional tax will be assessed at the time of sale.

- Of special note, you should avoid at all cost the back-dating of option grants to enable employees to take advantage of lower prices that prevailed before a recent appreciation in company value. Legal authorities now focus considerable attention on exposing such abuses and are increasingly imposing sanctions.

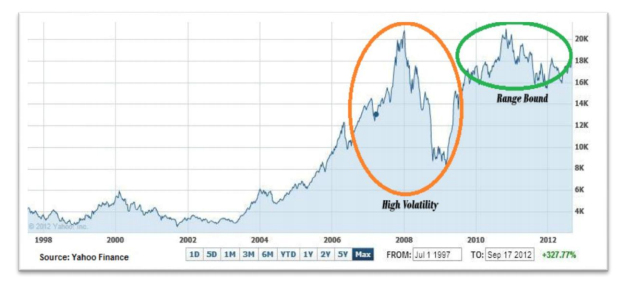

- The upside of options can be tremendous. If a company succeeds, employees can be richly rewarded based on the increased value of the shares they are entitled to purchase. However a lack of liquidity in shares, or a languishing or reduction in share value can make employees wish they had opted for higher wages or another form of incentive compensation. And even if the company is successful, the unanticipated tax consequences of an option exercise or vesting of restricted shares, or the inability to immediately sell shares to pay taxes may create challenges for the employee. And if no liquidity opportunity is presented, the employee may have to hold shares indefinitely, or the company could be required to repurchase shares, which may significantly impact cash flow.

There are several major types of stock option and purchase plans, and within each type the structure of individual plans may vary widely. Since each form of a plan has its own strengths and weaknesses, a company should engage an attorney to assist in carefully examining its own incentive goals and the characteristics of its employees and projected business growth, before adopting any plans.

The most basic forms of stock options are commonly referred to as either incentive stock option plans (ISOs) or non-statutory stock options (NSOs). It is important to note that ISOs may only be granted to employees, the option exercise price must be no less than the fair market value of the underlying shares on the date of grant, and various other limitations, as well as holding and approval requirements apply.

No income is recognized by an employee when an ISO is granted or exercised (but the excess of the fair market value of the stock at the time of exercise over the option price is a tax preference item subject to the alternative minimum tax). If the stock is held for at least one year after exercise and two years following the grant, the difference between the exercise price and the amount realized on the sale is taxable as long-term capital gain.

With respect to NSOs, there is no tax consequence at the time of grant, as long as the exercise price is equal to the fair market value on the date of grant. Upon exercise of an NSO, the holder is treated as having received ordinary income in an amount equal to the difference between the exercise price paid and the then fair market value of the purchased stock. Profits resulting from any subsequent sale will be taxed at capital gains rates.

Chris Anderson is an attorney for Ballard Spahr

In conclusion, employee stock options can foster the twin goals of increasing worker productivity by providing economic stakes in the success of the company while at the same time enabling employees to achieve a substantial reward without a cash burden to the company. However, keep in mind, there are many alternatives to wisely consider ensuring a high level of employee engagement and corporate success. I recommend company leadership should retain the services of a competent and seasoned attorney for guidance on this important topic.

I thank my good friend, attorney Chris Anderson. of Ballard Spah r for his contributions to this column.

Do you have experience or questions with employee stock options you’d like to share? You can post them here, or you can reach me at my personal website at www.AlanEHall.com. Thanks for reading.