Stock Market Risk Indicator

Post on: 12 Июнь, 2015 No Comment

Stock Market Risk Indicator

The Downside Hedge Stock Market Risk indicator was developed to give warning of significant market corrections or sell offs. Its intended use is to signal the proper time to firm up any existing hedges and add some aggressive hedge instruments to a portfolio. When it signals we fully hedge our portfolio with put options or a volatility ETF like XVZ. The hedge is meant to be insurance against sell offs of 10% or more.

The Market Risk Indicator has many small false signals so its best use is to identify suitable times to hedge a portfolio. If you try to use it as a long / short signal you will under perform the market substantially. Using it as a long / cash signal provides acceptable results, however, it lags the market over the long run and especially during the last phase of strong bull markets.

The most appropriate action to take when it signals is to add put protection to your portfolio as insurance against a small correction escalating into a major sell off. Keeping the long portion of the portfolio and protecting it with a hedge reduces the losses sustained in a market correction. When the market rallies after the Market Risk Indicator signals (a false signal), the long portion of a hedged portfolio can participate in the rally. During rallies the hedge reduces the gains from the longs or produces an overall loss.

If you are not comfortable with options, other forms of protection that can be used are dynamic volatility (XVZ), mid-term volatility (VIXM or VXZ), or actively managed bear funds like HDGE. The relatively new dynamic volatility ETN XVZ is the instrument we like the best. Here is a back test showing the performance of using XVZ to hedge a portfolio when our market risk indicator warned. When hedging it is important that you understand the instrument used. Be sure to read the prospectus and never use hedging instruments that you dont understand.

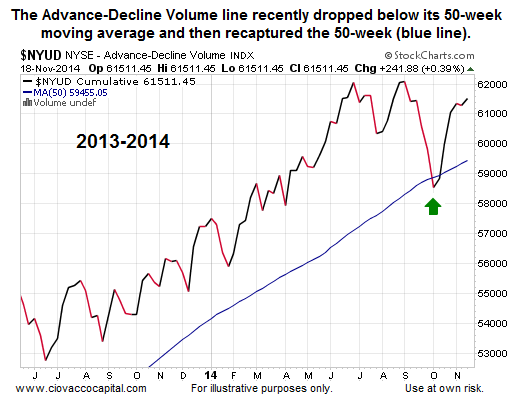

The following chart shows signals during a volatile market. The red lines represent warning signals. The blue lines represent an end to the warning.

If a warning signal is false it is usually short in duration and causes a small loss in our portfolio (we paid for insurance). Good warning signals generate profit in the portfolio as a sell off becomes severe. We use the profit generated by our hedge instrument as the market is falling to buy more of the stocks we want to own in our portfolio. Our general approach is to soften the hedge as the market falls by taking profit generated from the rising implied volatility of put options when the market falls.

As an example of softening a hedge, during the 2008 bear market we took off 1/3 of our aggressive hedge on 10/6/2008 and replaced it with a simple short of the S&P 500. We rebalanced the portfolio by taking the profit from the hedge to buy more of the long stocks we wanted to own. On 10/9/2008 we took off another 1/3 of the aggressive hedge (also replacing it with a short of SPX and buying more longs). On 11/18/2008 we replaced all but a small portion of the aggressive hedge with a short of SPX. We left a little on simply to protect against an Armageddon type event. The short of the S&P 500 provided fairly good protection for the rest of the ride down.

Current Market Conditions

Volatility Hedged Portfolio

Long / Cash Portfolio