Stay Away From Leveraged ETFs

Post on: 16 Март, 2015 No Comment

Buying stocks, selling stocks, shorting stocks. Playing options, hedging, going to cash. Buying a brick of gold and hiding it underneath your bed. In turbulent times like these, everyone and his grandmothers have advice on how to profit from the insanity in the market, including me. But the absolute worst move you could make right now to nuke your portfolio is investing in a leveraged ETF.

A quick and dirty guide to leveraged ETFs for those not familiar with them: Like vanilla ETFs, they track the returns of a specific index. They then dial up the juice on those returns 2x or 3x by levering their assets using derivative instruments. Every leveraged ETF that tracks an index has an inverse twin that shorts it. For example, the Direxion 3X Small Cap Bull (NYSEARCA:TNA ) is a triple leveraged ETF that tracks the Russell 2000 Small Cap Index, and its inverse, the Small Cap Bear (NYSEARCA:TZA ), provides an opposite return. Other ETFs in this family include the ProShares Ultra S&P 500 2x (NYSEARCA:SSO ) and the Direxion 3x Financial Bull (NYSEARCA:FAS ).

These vehicles became extremely popular after the financial crisis; in fact, many of the most heavily traded ones didn’t even exist before 4Q 2008. It’s not hard to see why. Because of the leverage they employ, if you back the right horse, you end up locking in supersized profits every time the market twitches. If you had bought TNA at the market bottom in March 2009, you would be sitting on a big, fat 400% gain right now, even after the massive correction we’ve just eaten. If you had bought the Vanguard Small Cap ETF (NYSEARCA:VB ), you would be up just 84%.

However, there’s a dark side to this story: If you had bought TZA, the bear version, your entire capital basically got wiped out. That’s why, in the wrong hands, these ETFs can be financial weapons of mass destruction that can easily devastate your portfolio. Some may ask, So what? After all, since all these ETFs co-exist with an inverse, for every loser there must be a winner. Maybe you think you’re good enough to be that winner.

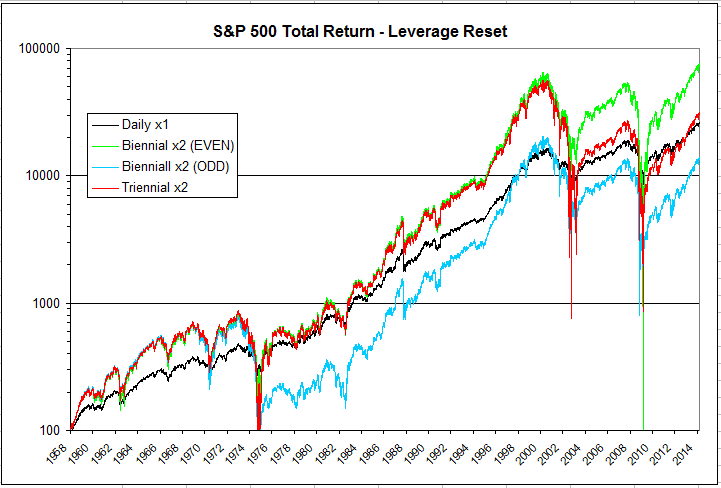

Sorry, but no dice. In the long run, all of these ETFs are losers. The reason this is true is because of a nifty trick the operators of these instruments use called daily asset rebalancing. A leveraged ETF has to constantly maintain its leverage ratio in order to be able to continue to generate the returns it promised on the packaging. That means when it goes up, it has to borrow more funds and take on more leverage. When it goes down, it has to delever and sell off some of its assets. It does this at the end of every trading day.

Rebalancing is necessary for these ETFs to maintain their returns when they appreciate, and it protects them from going bust when the market crashes. However, it does mean that when the market goes down, they have to lock in losses; if this happens frequently enough over a short enough time period, they would’ve sold off so many assets that it becomes almost impossible for them to get back to their starting point, even when the market as a whole advances. Combined with other frictional costs like management fees and borrowing costs (almost all leveraged ETFs come with significantly higher expense ratios than their unlevered cousins), it’s not hard to see why these are not investments you want to hang on to for an extended time. If you had bought FAS and its Financial Bear inverse (NYSEARCA:FAZ ) two years ago, you would be down on both your positions today.

All this is old news to experienced players of these instruments, who tend to be high stakes traders with huge appetites for risk. They know that these aren’t long term investment vehicles. What is less well known is the impact market volatility has on the leveraged ETF, even for the short term holder. One of the quirks of rebalancing is that the more volatile the market is, the more frictional costs eat away at your returns. This can be shown with a simple mathematical calculation. Let’s assume Bob invested $10,000 in FAS. Over the next week, the index moves like this:

Monday: -1.5%, Tuesday: +1%, Wednesday, -1.5%, Thursday +1%, and Friday +1%. Total Return: 0%.

After a week, the index would have been pretty much flat. Note to the less mathematically inclined: you arrive at total returns by multiplying, not adding the movements. In our example above, it would be 0.985 x 1.01 x 0.985 x 1.01 x 1.01 =

Anyway, Bob’s triple leveraged returns would’ve looked like this:

Monday: -4.5%, Tuesday: +3%, Wednesday: -4.5%, Thursday: +3%, and Friday: +3%. Total Return: -0.34%.

Since rebalancing preserves downside risk on an up day and reduces upside potential on a down day, a leveraged ETF will always produce inferior returns in a flat market. However, let’s take a look at what happens when the market becomes more volatile, while still staying flat overall. Here are the index returns:

Monday: -5%, Tuesday: +5%, Wednesday, -5%, Thursday +5%, and Friday +0.5%. Total Return: 0%.

And here are Bob’s returns: Monday: -15%, Tuesday: +15%, Wednesday, -15%, Thursday +15%, and Friday +1.5%. Total Return: -3%.

The conclusion is obvious: When it comes to leveraged ETFs, the more volatile the market, the worse the returns. And that’s not even taking into consideration the huge risk of total capital destruction you run if you end up backing the wrong horse. One investor I know opened up a large position on FAS when it hit $20 last week. His reasoning was that it was at a 52-week low, and financials were already doing so bad that there’s no way they could get much worse. As of yesterday, he’s lost almost 40% on his position.

The allure of juiced up returns make leveraged ETFs attractive for a certain type of investor, but the reality of how these instruments work make them mouse traps waiting to clamp down on investors foolhardy enough to move in for the cheese. The wise investor would be best served taking his money elsewhere, especially in today’s extremely turbulent and utterly unpredictable economic environment. Don’t be greedy. Buy a regular ETF like the SPDR S&P 500 (NYSEARCA:SPY ) or the Financial SPDR (NYSEARCA:XLF ). Buy solid blue chip stocks trading at rock bottom valuations like Apple (NASDAQ:AAPL ), Kraft (KFT ), or Wal-Mart (NYSE:WMT ). Buy bargain bin throwaways like Research in Motion (RIMM) or Bank of America (NYSE:BAC ). You can even buy ridiculously valued momentum stocks like Amazon (NASDAQ:AMZN ) or Sirius XM (NASDAQ:SIRI ). Whatever you do, just make sure to stay far, far away from leveraged ETFs. Your portfolio will thank you for it.