Start Saving With A Roth 401(k)

Post on: 16 Июль, 2015 No Comment

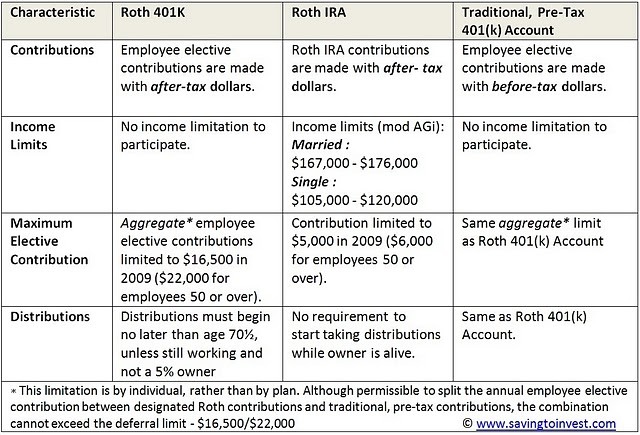

When you read about 401(k) qualified retirement plans. it’s mostly assumed that it’s a traditional 401(k). Some employers also offer a Roth 401(k). In many ways, the two plans are similar; one big difference is how you’re taxed.

Tax Treatment

A Roth 401(k) is like a Roth IRA in its tax treatment. Instead of paying taxes when you withdraw money from your account – once you reach retirement – you’re taxed in the year you make the contribution.In other words, the money you put into a Roth 401(k) comes from your after-tax earnings. (By contrast, with a traditional 401(k), your contributions come out of pre-tax salary; that’s why you’re taxed on them when you withdraw the funds.) If you believe that you will be in a higher tax bracket once you reach retirement, a Roth 401(k) might be a better choice.

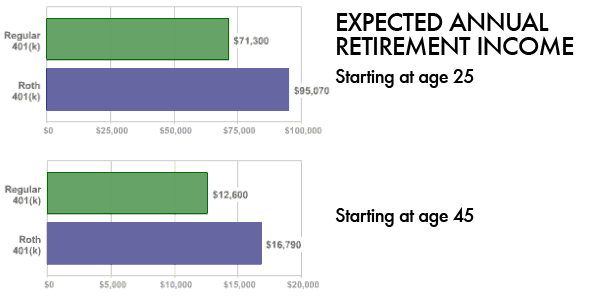

If you’re early in your career or unsure of how tax rates will trend in the future, the Roth 401(k) is probably a good way to go. Should your employer offer both, it’s best to talk to a financial professional about the differences between the two types of accounts before you decide which route to take. If you’re already investing in a Roth 401(k), here are a few ways to get the most out of your contributions.

1. Contribute up to the employer match

Many, though not all, employers match some portion of your 401(k) contribution. Even if your plan isn’t as attractive as you would like in terms of low-cost funds, the fact that your employer is giving you free money makes it worthwhile. Once you reach the maximum your employer will match, you can also contribute up to $5,500 to a Roth IRA as long as you don’t go over $17,500 in total contributions in a single year (2014 limits). This means that if you contribute $5,500 to your Roth IRA, you can contribute up to $12,000 to your Roth 401(k).

2. Speaking of an IRA

Many financial advisers suggest contributing some portion of your retirement dollars to an IRA because there are more investment options than you get in a 401(k), where the investment options are set by your employer. On the other hand, the larger range of options means that an IRA requires more financial knowledge on your part. If you don’t feel comfortable managing the account yourself, get help from a fee-only adviser who can help you find low cost investment products to maximize your return.

3. Think lower cost instead of higher return

Even the most brilliant financial minds can’t predict what the world’s economies will do in the future. The funds offered to you in your Roth 401(k) will have past performance data, but the past doesn’t predict the future. You can, however, predict the impact of fees. Look for options with low fees.

Many advisers suggest index funds over actively managed funds. Target date funds are convenient, but require the fund manager to pick the right investments to perform well just like any other actively managed fund. (For more on this, see An Introduction to Target Date Funds .) Novice investors should look at the fee structure first and stay away from funds with fees higher than 1%.

4. If you’re older, contribute more

The IRS allows for catch-up contributions for people over 50. For 401(k) plans, you can contribute an extra $5,500 making your limit $23,000 annually until you reach retirement age. Remember, any IRA contributions will lower the amount you can contribute to a 401(k).

5. Don’t make a lot of changes

A retirement account isn’t designed for short-term trading. Unless the markets are crashing around you, stay the course and let your investments ride out the natural up and down motion of the financial markets. Once per year, review your allocations and fund choices preferably with the help of a trusted professional.

The Bottom Line

A Roth 401(k) is perfect for people who believe they will be in a higher tax bracket upon retirement. Not all employers offer the Roth option. Check with your employer and if your company does offer a Roth 410(k), make an informed choice.