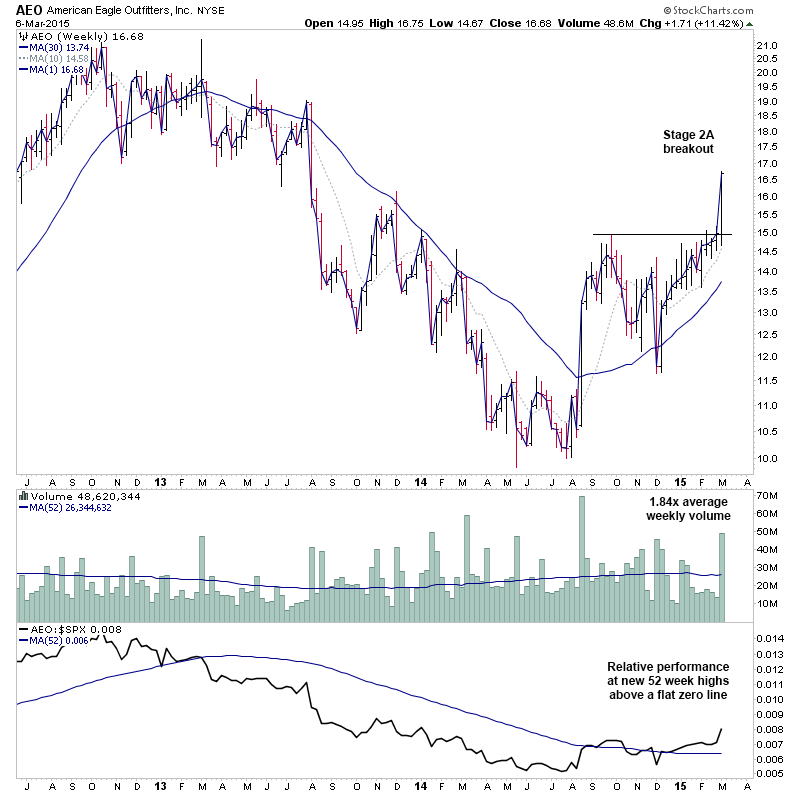

Stage Analysis finding the breakout shares

Post on: 16 Март, 2015 No Comment

Alan Saunders

A study by Alan Saunders of ShareHunter.com on the successful share selection techniques promulgated by Stan Weinstein in his best selling book “Secrets for Profiting in Bull and Bear Markets”

Most trading systems that I come across are given to using too much jargon or gobbledegook and are complicated — unnecessarily so in my opinion. And that is why I appreciated – and now benefit from – the brilliant simplicity of Weinstein’s ‘Stage Analysis’ approach to the buying and selling of shares.

‘STAGE ANALYSIS’ is straightforward, simplified, technical analysis.

There is nothing new in using technical analysis (TA) to identify shares for investment yet the truth is that TA is considered by many private investors as akin to black magic. But it need not be confusing or complicated and can, of itself, identify real potential winning shares.

All of the ‘fundamental’ information about a company, its products, its market share, its dividend policy, its management and, when relevant, its takeover or merger potential is factored into the share price and, therefore, it is already in the chart waiting to be deciphered. And that is where the straight forward simplicity of Weinstein’s ‘Stage Analysis’ technical approach can help us all.

If you can read what the chart is telling you (and that is not difficult as this article intends to show you) then you have no need of sourcing your share buys from newspapers, hours of study of the ‘fundamentals’ or from tipsters but rather from the information that the chart is giving you. And that comes from the simple TA provided by Weinstein which identifies those dynamic shares which are in a ‘breakout’ mode.

Weinstein has given us the gift of simplifying TA down to a few basic truths. He created a set of rules which, when followed, allows for the identification of top performing shares that are likely to produce explosive profits irrespective of whether the market is in a ‘bull’ or ‘bear’ phase. This makes for share trading which is not just profitable and predictable but which also is a lot more enjoyable.

I am going to outline three of Weinstein’s master techniques which, when applied consistently, simultaneously and conservatively and when used in conjunction with sensible money management and exit-stop procedures (the subject of a later article) will develop your recognition abilities and hone your trading skills so that you can make profits – and potentially large profits — year after year.

First of all, let us agree on some of the basic terms used in technical analysis –

Let me also add that Stage Analysis, dynamic though it is, is not for the adrenalin junkies who trade intra-day. Weinstein emphasizes how important it is not to overtrade and always to allow sufficient room for a share to ‘breath’ normally and so his system is based on weekly prices. My own experience is that it is far more profitable to trade shares based on their weekly price history than trading shares based on daily prices (where the volatility is comparatively greater and trend changes more numerous). That is why the ShareHunterSelect service is also based on weekly prices.

Let us begin with the first of Weinstein’s analytical trio –