Solar Industry Snapshot A Volatile Sector Still in Search of Stability NJ Spotlight

Post on: 15 Июль, 2015 No Comment

Among solutions suggested by consultant, “Green Bank” to help finance new development — or doing nothing

How can New Jersey avoid the boom-and-bust cycle that has afflicted the state’s solar sector in recent years?

That is a question being debated by state officials, solar energy executives, and clean-energy advocates, all of whom are trying to figure out how to stabilize the sector, once one of the few fast-growing segments of New Jersey’s economy. At one time, it employed at least 6,500 people.

But with solar development slowing in early 2012, the state Legislature enacted a law to try to reduce market volatility, ordering state officials to see if they could determine how to smooth out the turbulence that drove off investors.

It is not an easy question to answer, as was made clear in a draft report prepared by the Boston-based Meisters Consulting Group. for the Rutgers Center for Energy, Economic and Environmental Policy.

The report recommended that the state look at a range of options — from doing nothing to establishing a Green Bank to help finance new solar installations to promoting more competitive procurement of long-term contracts — among other suggestions given less credence.

New Jersey once ranked second the nation in the number of solar installations, but its status has dropped in recent years, depending on various studies. The draft report said the state ranked third in the cumulative number of solar installations, but a recent assessment by the Solar Energy Industries Association. an industry trade group, found it had slipped to fifth in the nation.

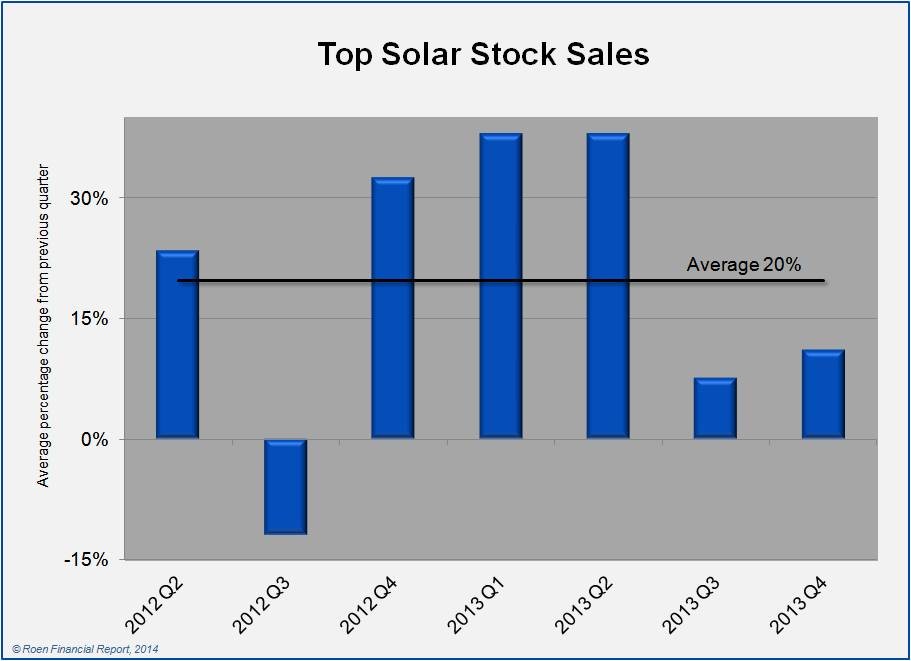

In part, New Jersey fell victim to its own success. The state’s lucrative solar incentives combined with valuable federal tax incentives combined to create a rush to build new solar systems by developers. The result led to a crash in the prices of solar credits earned by owners of the systems, drying up investment in the sector. The credits earn owners of the arrays a fluctuating price for the electricity their systems produce.

Since then, prices have somewhat rebounded and more solar is being installed in New Jersey, but the study noted that the state is still prone to a boom-and-bust cycle. For instance, the federal investment tax credit will drop from 30 percent to 10 percent in 2016, a factor that may create a new rush to install solar, once again roiling the marketplace by creating another significant overbuild, according to the consultant.

The next few months may produce somewhat of a consensus on what needs to be done, although that is far from being reached at the moment.

Some solar advocates, echoing a theme they have long advanced, endorse the approach of promoting competitive long-term contracts to install solar systems.

According to Lyle Rawlings, president and chief executive officer of Advanced Solar Products Inc. in Flemington, “It will not be possible to address the volatility, reduce costs to ratepayers, and decline the incentives for solar development without that kind of change,’’ Rawlings said.

Michael Flett, president of the Flett Exchange in Jersey City, which buys and sells solar credits, disagreed, saying the free marketplace ought to be given time to sort out problems with the solar sector. “I believe in the power of the marketplace to bring more efficiency,’’ Flett said.

Not everyone concurred.

But Jeff Tittel, director of the New Jersey Sierra Club, argued that the draft report fails to focus on how New Jersey can regain its status as a leading state in developing solar installations. “There is nothing in this report to regain the momentum, which once had,’’ Tittel said.