Simple Price Action Trading

Post on: 10 Апрель, 2015 No Comment

In this short text and video (scroll down for video) article I outline the Simple Price Action Trading principles that allowme to find Levels of interest that offer up what will potentially be the start of the next significant movement.

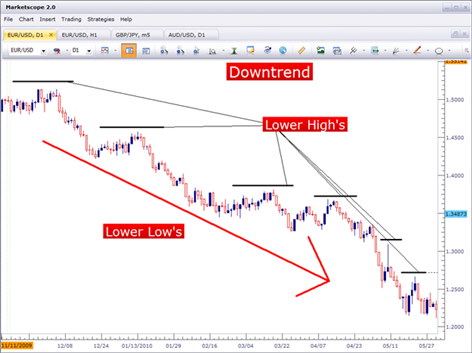

This logic can be used on any time frame and on any instrument to help to identify high probability trading locations based purely on price action.

I use this on a higher time frame to identify a potential starting location for the next potential price action movement as well as to see if there is a larger than normal volatility based target available to me.

The routine to identify these price action location is simple;

- Identify the last significant move in price action

- Find the high/low range of the bar at the start and end of the movement

- Take that high/low range across to the right hand side of the chart

- When/if price gets back to these price action based levels deploy your strategy.

- Simples!

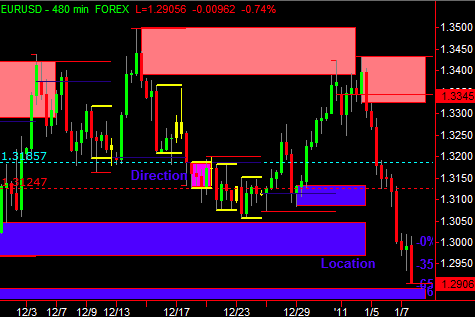

- In the chart below the blue arrow highlights the last significant move down.

- The high/low range of the bar at the start of the move down is used to identify the level of interest.

- Take the high/low level of interest across to the right hand side of the chart

- wait for price to get back to that location

The start of the move down has been highlighted and price has retraced back to that location of interest and it is now time to deploy the strategy

As price moves up the end of the move down can now be identified and used as the lower location of interest both to re-evaluate new trading opportunities and to use as a suitable targeting location

Price moves away from the upper location of interest and reacting off the lower location of interest. Trade options can now be reassessed.

As price pushed away from the lower location of interest in the chart below it is currently between levels of interest and effectively signalling a wait situation for any new trading opportunities.

Price Action eventually moves back to the upper location of interest where trading options can be reassessed and the strategy in use can be deployed once again.

As price moves down to the lower price action level of interest again. Trade options assessed and strategy deployed

Price action once again moves away from the previous lower level of interest but this time runs through the upper level of interest. The upper location can be assessed for new opportunities and deploying the strategy in this case continuation through the upper level of interest.

As price has now moved past the highlighted levels of interest the procedure can be started again to identify levels of interest near the current levels of price action activity and evaluate new trading opportunities