Simple and Compound Interest

Post on: 13 Июнь, 2015 No Comment

Simple and Compound Interest

The GMAT will occasionally test your facility with calculating interest. Savings accounts, checking accounts, money-market accounts, investment accounts — these are all examples of accounts that can earn interest and can therefore be fair game for GMAT test writers. Interest-based problems don’t appear with great frequency on the GMAT but when they show up they’re a great opportunity to earn points because interest isn’t that difficult when you know a trick or two.

Simple Interest

Simple interest is called “simple” for a reason. It’s a quite straightforward thing. If you invest $100 in an account that earns 7% simple annual interest, then after one year you will earn $7. If you invest $1000 in an account that earns 5% simple annual interest, then one year later you have $1050 in your account. So far, so good. But it gets a little complicated when compound interest comes into play, which is the main reason the GMAT will usually use that rather than simple interest.

Compound Interest

The amount of money initially invested in something is known as the principal. This principal will earn interest. Compound interest means that the interest earned becomes part of the principal and itself earns interest. Thus you earn interest on the interest. There’s a formula for compound interest which looks like this: Principal + compound interest = Principal. In this formula, r represents the interest rate per compounding period expressed as a decimal, and t represents the number of compounding periods.

So, for example, if you placed $100 in an account that earns 8% annual interest, compounded quarterly, we could use the formula to find out how much money would be in the account at the end of the year. In this case, t would be 4, because there are four compounding periods in a year if you compound quarterly. But be careful not to use 0.8 for r because 8% is the annual interest rate, and r represents the interest rate per compounding period. Therefore, r is 0.2 because we have 2% interest every three months. Thus our formula will look like this:

Principal + compound interest = =

=

= 108.24.

So the account would have $108.24 after one year. (Actually, equals 1.08243216, but we can round that number because we’re talking about money which in this example doesn’t get more precise than cents.)

Let’s look at another example.

If Joanie puts $500 in a savings account that earns 10 percent annual interest compounded semiannually, how much money will be in the account after one year?

A) $51.25

B) $510

C) $550

D) $551.25

E) $565

Now we could use the formula for this problem. We would set it up like this:

Principal + compound interest =

But there’s an even easier way. On the GMAT, compound interest is going to be just a little more than simple interest. So let’s first think about simple interest. 10% of 500 is 50, so simple interest would be $50 and the account would contain $550. With compound interest it will earn just a little bit more than that, so the answer must be D.

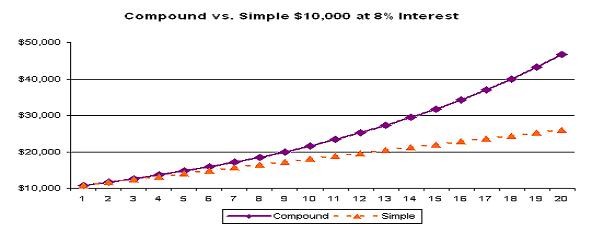

This might be surprising to you, because compound interest is often described as a very powerful force, something that can turn small sums into great fortunes. However this is only true over long time horizons. Over a period of decades, compound interest can have a very powerful effect: 50 years of 10% annual simple interest in the problem above would only increase the value of the account to $3000. But 50 years of 10% annual interest compounded semiannually would increase the value of the account to more than $65,000.

However, as mentioned, over the very short term compound interest has a negligible effect and adds only a tiny bit to simple interest. So this means that for most compound interest problems, you can just ballpark an answer rather than calculating with the formula. Given this, you may wonder if it’s worth knowing the formula at all!

One reason you might want to be familiar with the formula anyway is that the GMAT has in the past presented questions on which the answer choices weren’t amounts of money, but rather formulas. The question asked you to pick the formula that represented the correct amount of money. Although you could solve a question like that by plugging the values in the problem into the answer choices and ballparking, the easiest thing would be to know the formula and simply pick it out of the available options.