Should You Invest in Hedged High Yield Bond ETFs

Post on: 16 Март, 2015 No Comment

Why these funds are a solution in search of a problem

Pierre Desrosiers / Photographer’s Choice / Gettty Images

One benefit of the growing number of bond exchange-traded funds (ETFs) is that there are now portfolios covering needs that investors never even knew they had. The downside: some of the strategies can be very difficult to understand. One such category debuted in 2013: hedged high-yield bond ETFs.

Hedged High Yield Bond ETFs: The Basics

These ETFs seek to provide investors with the attractive yields of high yield bonds but without the element of interest rate risk typically associated with bond investing. The funds accomplish this by complementing their high-yield portfolios with a short position in U.S. Treasuries. A short position is an investment that rises in value when the price of a security declines. Since bond prices fall when yields rise. a short position in bonds would gain in value in an environment of rising yields. In this way, a short position in Treasuries helps “hedge” against the possibility of rising rates.

For instance, the FirstTrust High Yield Long/Short ETF (HYLS) uses leverage (i.e. borrows money) to invest about 130% of its portfolio in high yield bonds that it expects to outperform, and then it establishes an approximately 30% short position in U.S. Treasuries and/or corporate bonds. This short position acts as the “hedge” to the rest of the portfolio.

This approach enables the funds to isolate the two components of risk in high yield bonds: credit risk and interest-rate risk. Credit risk is the risk of defaults (and changes in conditions that could affect the default rate, such as economic growth or corporate earnings), whereas interest-rate risk is that changes in Treasury yields will affect performance. These funds largely eliminate the latter risk, providing “pure” exposure to credit risk.

This is all well and good when investors have a positive attitude about credit risk – for instance, when the economy is strong and corporations are performing well. On the other hand, the hedged approach is a negative when credit conditions deteriorate. In this case, credit risk becomes a liability while interest-rate risk acts as a positive performance attribute since it cushions some of the downside. This nuance may be lost on many investors given that at the time that these funds were launched – 2013 – credit conditions had been very favorable for the previous four years.

What are the Options in Hedged High Yield Bond ETFs?

Investors currently have five options from which to choose:

- WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund (HYZD) Expense ratio: 0.43%

- WisdomTree BofA Merrill Lynch High Yield Bond Negative Duration Fund (HYND), 0.48%

- First Trust High Yield Long/Short ETF (HYLS), 0.95%

- Market Vectors Treasury-Hedged High Yield Bond ETF (THHY), 0.80%

- ProShares High Yield-Interest Rate Hedged ETF (HYHG), 0.50%

- iShares Interest Rate Hedged High Yield Bond ETF (HYGH), 0.55%

Advantages and Disadvantages of Hedged High Yield Bond ETFs

The primary advantage of hedged high yield bonds funds is that they can reduce the impact of rising bond yields, allowing investors to earn attractive yields without having to worry about the likelihood that Treasury yields will rise. At the very least, this should dampen volatility compared to a traditional high yield bond fund, and in a best-case scenario it made lead to a modest performance advantage.

At the same time, however, these funds also have a number of disadvantages that can’t be overlooked:

Low interest-rate risk doesn’t mean “low risk”. Investors can’t assume that these funds are free from risk, since credit risk remains an important component of their performance. An adverse development in the global economy could cause high-yield bonds prices to fall at the same time as Treasury prices gained amid a “flight to quality .” In this scenario, both portions of the fund would experience downside, since the funds are hedged only against rising bond yields.

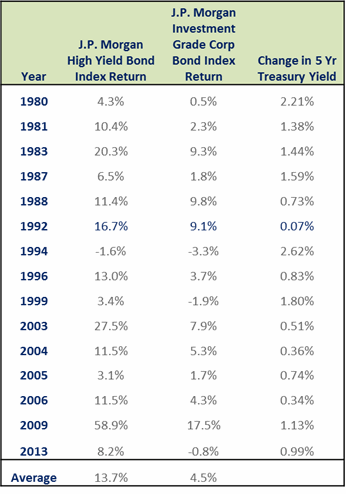

High yield bonds have limited interest-rate risk to start with. While high yield bonds have interest-rate risk, they are less interest-rate sensitive than most segments of the bond market. As a result, investors are hedging a risk that is already lower than that of the typical investment-grade bond fund.

Results will differ from the broader high yield market over time. Investors who are looking for a pure high-yield play won’t find it here. The funds may deliver returns that are fairly close to the high yield bond market on a day-to-day basis, but over time these small differences will add up – leading to returns that are far from what investors may expect.

They haven’t proven themselves in a tough environment. It’s always wise to give newer funds some time to prove themselves, and that’s particularly true in this case given that the funds haven’t experienced an extended period with the adverse combination of simultaneous losses in the long high yield and short-Treasury portfolios. Until there’s a body of evidence of how that scenario would play out, investors should give these funds a pass.

Expenses are high for HYLS and THHY. These funds carry hefty expense ratios of 0.95% and 0.80%, respectively. In contrast, the two most popular non-hedged ETFs, iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and SPDR Barclays High Yield Bond ETF (JNK) have expense ratios of 0.50% and 0.40%, respectively. Over time, these added expenses can take a meaningful bite out of any return advantage HYLS and THHY might have.

The approach assumes that Treasury yields will rise. The philosophy underlying these funds is that Treasury yields will gradually rise over time. While that’s more likely than not, it’s also no guarantee – as the lessons of Japan in the past 20-25 years teach us. Keep in mind that these funds lose a key selling point if yields in fact stay flat for many years.

The Bottom Line

Hedged high-yield bond ETFs are certainly an interesting approach, and they may indeed prove their value if Treasury yields embark on the long uptrend that many investors foresee in the coming decade. At the same time, there a number of disadvantages that indicate these funds may be a solution in search of a problem. Take care not to overestimate the value of the hedged approach.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.