Should Investors Go For Leveraged ETFs

Post on: 14 Июнь, 2015 No Comment

Exchange-traded funds are the largest growing sector of the investment market, with at least $1,000 billion invested in them.

Look no further than the natural gas market, where Bloomberg reported that the equivalent to 86% of all natural gas contracts, on a given day, were held by the United States Natural Gas Fund (UNG ).

For the retail investor, an ETF like the SPDR S&P 500 ETF (SPY ) is a good choice to gain exposure to an index fund, but there’s another class of ETFs that’s best left to the professional traders. Leveraged ETFs make $1 of buying power into $2 or more. The ProShares Ultra S&P 500 (SSO ) is a leveraged ETF that moves at twice the rate of the Standard & Poor’s 500 Index.

If the index moves five points, the SSO moves as if the S&P moved 10 points (minus fees built in to the fund). Other leveraged ETFs may react as if the S&P moved 15 points. (For more, check out Leveraged ETFs: Are They Right For You? )

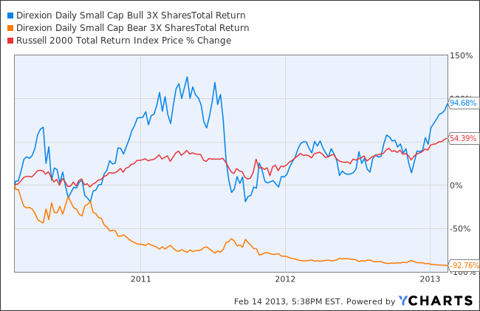

These types of ETFs can be a source of great gains, but can also be a source of great loss. Doug Kass, a professional trader for more than 20 years, calls these funds, “the new weapons of mass destruction.” Here’s why:

High Volatility

According to Bespoke Investment Group, in one 30-day period, the rate of volatility in the S&P 500 was, “up 8.31%, down 7.34%, up 5.34%, down 5.68%, up 7.38%, down 8.70%, up 7.34%, down 10.14% and up 6.65%.” If there was somebody who could time these changes perfectly, it would have resulted in a 91% gain in their portfolio, but this rate of change is too large for most retail traders to handle. If an investor held leveraged ETFs during this time, and wasn’t in a position to watch them throughout the day, the losses could have been substantial if they were sold too early or late.

High Amounts of Management

Professional traders, who track the market all day, are in a better position to manage these leveraged ETFs than a retail investor, who may not have access to their portfolio during the work day. These types of trades require constant management, which makes them inappropriate choices for most retail investors.

Hard to Understand

What’s the difference between an ETF and an exchange-traded note (ETN). What’s the VelocityShares Daily 2x VIX Short-Term ETN (TVIX ), and how exactly does it track the performance of the Chicago Board Options Exchange Market Volatility Index? For the easier to understand ProShares Ultra S&P 500, what should you know about rebalancing a fund and how does that affect the price from day to day? Some investors make the mistake of investing in a product they don’t understand, and that can lead to unexpected results.

Illiquidity