Should I use In The Money Bull Call Spread For Short Term Trading by Answers

Post on: 13 Апрель, 2015 No Comment

Star Trading System Training Course

Find Out How My Students Make Money Consistently Through Options Trading In The US Market Even During An Economic Downturn!

Answered by Mr. OppiE

Hi Luke,

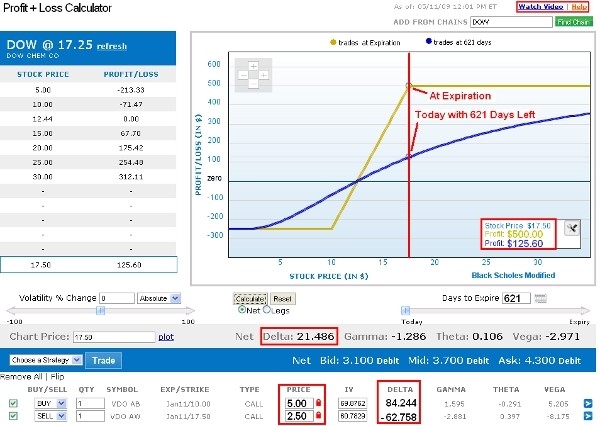

What you did is an in the money bull call spread. Which means that you buy to open a deep in the money call option (delta 0.9) and then sell to open at the money call option (delta 0.5) against it, resulting in a bull call spread with delta of 0.4.

The in the money bull call spread is a good options strategy to use when you wish to lock in the extrinsic value of the at the money call option by holding the position all the way to expiration. However, if you are merely trying to get in and out of a position quickly on very small moves on the underlying stock, I personally do not see why you should waste the commissions by placing a bull call spread at all.

Here’s what I mean.

A bull call spread makes its value best when you hold the position all the way to expiration such that the extrinsic value of the short leg erodes completely, transforming into a discount for your long leg. However, if you do not intend to hold the position all the way to expiration, you would certainly have to buy the short leg back at a loss due to the upwards movement of the stock and then still waste commissions on both sides of the trade.

Should I Use In The Money Bull Call Spread For Short Term Trading?

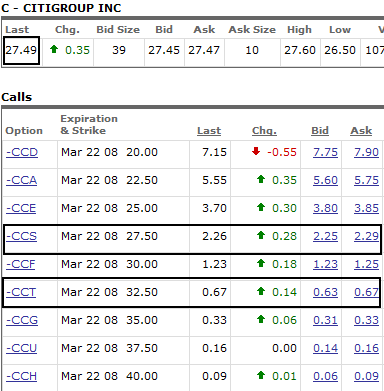

Assuming you are placing an in the money bull call spread on AAPL. AAPL is trading at $195 right now and its 0.9 delta in the money call option ($170 strike) is asking at $27.95 and its 0.5 delta at the money call option ($195 strike) is bidding at $9.50.

You put on the position for $18.45 and a net delta of 0.4.

Assuming AAPL rises to $200 within the next few days. Its $170call is now bidding at $32.45 and its $195call is now asking at $12.00. Your position is now worth $20.45, making a profit of $2.00 before commissions.

To close this position, you bought the $195calls back at a loss of $12.00 — $9.50 = $2.50 + commissions for both sides of the trade.

See the problem now? If you never intended to hold the short leg all the way to expiration, it will actually rise with the rise in the underlying stock and then you will have to close it out at a loss. It never gets to become a real discount on your long call options.

To put it another way, you are paying $18.45 for 40 delta which means that you are actually paying $0.46 per delta basis point. However, if you simply bought the 0.9 delta call options for the full 90 delta per contract, which is the $170 strike in the example above, you would be paying only $0.31 per delta basis point. So, which is actually cheaper? Yes, simply buying the in the money call options is actually cheaper! Not to mention the 2 way commissions you save on the short leg! Lets compare making the above trades using a fixed account size and see if which choice makes more money.

Should I Use In The Money Bull Call Spread For Short Term Trading?

AAPL is trading at $195 right now and its 0.9 delta in the money call option ($170 strike) is asking at $27.95 and its 0.5 delta at the money call option ($195 strike) is bidding at $9.50. You have $6000 in your account to trade with.

Buying In The Money Bull Call Spread

You put on 3 contracts for $18.45 each for a total price of $5,535 (before commissions) and a total delta of 120.

Assuming AAPL rises to $200 within the next few days. Its $170call is now bidding at $32.45 and its $195call is now asking at $12.00. Your position is now worth $6,135, making a total profit of $600.

Just Buying In The Money Call Options

You bought 2 contracts of the $170Calls for $5,590 with a total delta of 180.

Assuming AAPL rises to $200 within the next few days. Its $170call is now bidding at $32.45. Your position is now worth $6,490, making a profit of $900.

Do you see that even though you bought lesser contracts just buying the in the money call options, you would have made a higher profit on the same move and using the same amount of money as you would be buying more delta? Yes, delta is all that matters in short term directional trading and sometimes the offsetting effects of having a spread actually offsets more profitability. As such, it doesn’t really fulfill your purpose of buying more contracts at a lower price in order to make a higher profit, does it?

In fact, you would have made far lesser than $600 in the example above as you would have incurred double the commissions than you would have simply buying the in the money call options.

In fact, if you are happy with just a delta of 0.4, you would be able to buy 0.4 delta at only $7.05 per position on the $200 strike price call options for AAPL which is far cheaper than the $18.45 you are paying for the same 0.4 delta using the in the money bull call spread.

That being said, the in the money bull call spread does result in a higher profitability on the same move IF you hold the position all the way to expiration. Lets take a look at what I mean:

Should I Use In The Money Bull Call Spread For Short Term Trading?

AAPL is trading at $195 right now and its 0.9 delta in the money call option ($170 strike) is asking at $27.95 and its 0.5 delta at the money call option ($195 strike) is bidding at $9.50. You have $6000 in your account to trade with.

Buying In The Money Bull Call Spread

You put on 3 contracts for $18.45 each for a total price of $5,535 (before commissions) and a total delta of 120.

Assuming AAPL rises to $200 upon expiration. Its $170call is now bidding at $30 and its $195call is now asking at $5. Your position is now worth $7500, making a total profit of $1,965.

Just Buying In The Money Call Options

You bought 2 contracts of the $170Calls for $5,590 with a total delta of 180.

Assuming AAPL rises to $200 upon expiration. Its $170call is now bidding at $30. Your position is now worth $6,000, making a profit of $410.

As you can see above, if you hold the same move all the way to expiration, buying the in the money call options only would result in a much lesser profit due to time decay while time decay would have worked in your favor, eroding all the extrinsic value of the $195calls and INCREASING the profitability of the position and your ROI.

Make Explosive Profits From Covered Calls!

Perfect for all Options Traders! Original eBook by Optiontradingpedia.com!

This eBook Covers:

The Secret to looking for the PERFECT stock for Covered Calls