Should I buy a Mutual Fund or an ETF

Post on: 29 Март, 2015 No Comment

Many people ask me when they should by mutual funds vs ETFs and I havent yet seen a good answer to this question so Ill try to write one here.

Before I answer the question, lets compare the two and make sure were talking about the same thing.

Mutual Funds

Mutual funds are the traditional choice that most people would be familiar with. In general they are easier to purchase as pretty much any investment account will allow it. In some cases you are restricted to funds from certain banks or companies which often excludes any worthwhile mutual funds.

Mutual funds come with a variety of loads (front-end, back-end, no load, etc) that may impact your trading cost. In the environment today, I dont consider anything but no-load funds for which there will be no transaction costs! With the large array of mutual funds available today I cant see any reasons to use a loaded fund.

On important thing to note about mutual funds is their internal expenses, indicated as MER, are usually higher. Typically they are in the 1.5-2.5% range, although there are some index funds as low as 0.3% with some restrictions. The MER will come straight off the gross return the fund is able to generate, reducing the return available to the investor.

There are generally two types of mutual funds: active and passively managed. Actively managed mutual funds, which I wouldnt use, pay a manager to pick stocks to try and outperform the market (but usually dont) and are typically are on the high end of the spectrum. Passively managed, or index mutual funds simply track some index, pretty much guaranteeing the investor the same return as the index less the small MER and some tracking error. Because there is no manager to pay their MERs are near the low end.

Mutual fund prices are not traded on exchanges like stocks, their prices is typically only updated at the end of the day, and there are no advanced transaction types (like short selling, or stop losses) available.

Finally, because mutual funds are not traded on traditional exchanges, you will most likely only be able to purchase mutual funds from companies in the same country as you. If your like me and dont live in the US, then most of the available mutual funds are not available to you.

Exchange Traded Funds (ETFs)

ETFs are traded on stock exchanges as you would a normal stock. For this reason they can only be purchased in investment accounts that allow stock purchases. As such you will pay a transaction commission whenever you buy and sell these, just as if you bought or sold a stock.

ETFs also have internal expenses, which is also reported as MER, but these are typically lower. An ETF can be as low as 0.1% although typically they are in the 0.2 to 0.5% range. You do need to watch out for higher MERs, especially for ETFs not on US exchanges, as some ETFs have MERs as high or higher than mutual funds.

Because ETFs are traded on stock exchanges it is easy for non-US investors to purchase US ETFs, as long as their investment account allows purchasing of stocks on US exchanges. This opens up a huge array of additional options for the investor.

Some active investors, of which I am not, like ETFs because you can carry out other transaction types like short selling, purchasing options, or using stop-losses.

But Which Should I Buy?

Back to the question of which to use. Because Mutual funds have low to zero transaction costs they are typically used with smaller investment portfolios. But because ETFs have lower MERs most investors want to switch to them as their portfolio grows. The transition point is when the transaction costs of the ETFs roughly equal the additional expense of the mutual funds. Of course this is an inexact science since it depends on your investment horizon. See this post over on Milliion Dollar Journey for a partial answer.

While most advice hinges on the size of the portfolio, Id like to suggest that almost all investors should be using both Mutual funds and ETFs. Instead of evaluating your portfolio as a whole, I look at individual transactions. For a transaction of any size with a longer time horizon an ETF probably makes more sense. On the other hand, for smaller investments including monthly contributions a Mutual fund makes more sense since their is no transaction costs.

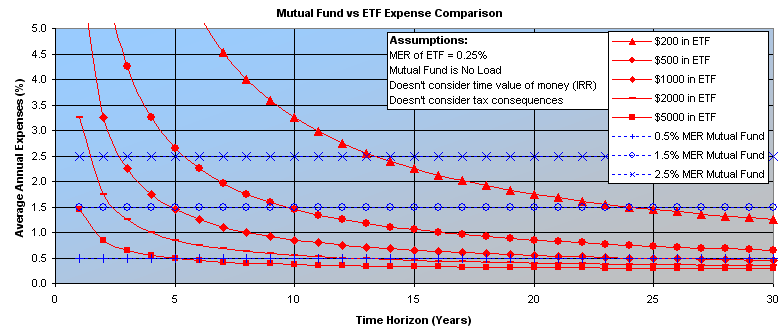

The following graph summarizes the average annual expense ratio (after internal MER, and estimated transaction costs). I use it as follows. First I pick out an ETF and Mutual fund for which to compare. For me these are almost always two passively managed indexed based funds. I then look at the solid red trace that corresponds to the amount of money I have available and follow it down to the number of years I expect to hold the fund. The blue dotted lines indicate the maximum MER for which the Mutual fund makes better sense.

For example, say I have $200 to invest and Im looking at the Barclays iShares Canadian Composite Index ETF (XIC ). It has an MER of exactly 0.25%. Lets say its for my retirement funds with at least a 15 year time horizon. I quickly scan down the solid red trace with triangle markers to the 15 year line and see that a No Load Mutual fund would have to have an MER of less than 2.25%. This is easily possible, and demonstrates that for smaller regular contributions the Mutual fund will almost always win.

But what if I had $2000 dollars available from a tax refund or other lump sum payment? In this case the mutual fund would have to have an MER below 0.3% which would not be possible. The TD e-series funds (such as the TD Canadian Index ) are close if your a DIY investor, but most other Canadian mutual funds are much higher.

The above graph was generated assuming an ETF MER of 0.25%, and a No Load mutual fund, but you can download my Mutual Fund vs ETF Comparison Spreadsheet if youd like to compare other scenarios. In addition, the analysis does not consider the timing of payments, or any tax consequences. Although actively managed mutual funds typically have higher turnover, and index mutual fund turnover should be similar to an ETF version.

The method that Ive come to use is make regular monthly payments into a Mutual fund and then when the fund has accumulated a significant value I may convert it to an ETF (as long as this doesnt trigger significant capital gains). Any non-periodic payments such as a tax refund, bonus, or lump sum contribution I consult the above graph to decide between the mutual fund or ETF.