Shorting the Euro

Post on: 17 Апрель, 2015 No Comment

Nicholas Vardy

Stock quotes in this article:

EUO

On Monday, I recommended that shorting the European stock markets because I expected that the closer the market looked at what was agreed upon in Brussels, the less it would like it. Sure enough, the markets have since come around to the view that the measures agreed at the European Union’s (EU) make or break summit don’t go far enough to address the European debt crisis. Just don’t expect the EU to come out with anything new soon. On Tuesday, German Chancellor Angela Merkel rejected proposals to increase the size of the planned permanent bailout fund to above 500 billion euros.

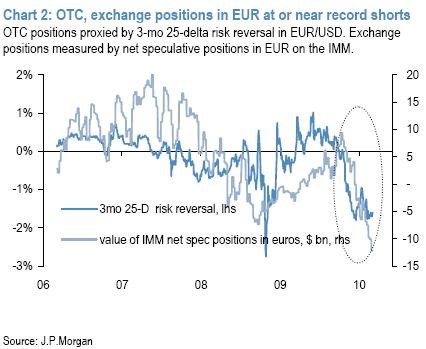

Needless to say, the euro has been hammered. The European currency hit a low of $1.30, its lowest level since mid-January and nearly $0.20 below its 2011 high in May.

realmoney.thestreet.com/articles/11/02/2011/how-play-euro this column and at Real Money conference that was held at the Nasdaq in early November in New York — that the euro may end up having a George Soros moment. That reference recalls Sept. 16, 1992, when Soros famously made $1 billion by betting against the British pound, when the British currency collapsed upon exiting the European Exchange Rate Mechanism. I recommended that you could profit from this possibility by buying a long, out-of-the-money February 2012 $20 call options on ProShares UltraShort Euro (EUO ) — a 2x leveraged bet against the daily price movement against the euro.

Well, the George Soros moment hasn’t arrived for the euro, as no country has exited the currency just yet. But with EUO trading higher — from $18.18 on Nov. 2 to $20.07 yesterday — EUO has pretty much gone straight up since I first recommended betting on its rise.

With those February call options now in the money, and time decay starting to kick in, I am recommending that you take your profits on this position now. That said, I still believe that the prospect of George Soros moment is still very much alive. And here’s why I plan to up my bets that the drop in the euro will continue over the next weeks and months.

First, there is a new Sword of Damocles hanging over Europe: the threat of mass downgrades by credit rating agencies for European sovereigns. Ratings agency Standard & Poor’s (SP) already issued a shot across the bow last week. This week Moody’s followed.

When that downgrade happens, you can expect investors to fundamentally reassess their attitudes toward the euro. Several British companies have already begun to make contingency plans for a breakup of the European common currency. Also, a downgrade by the ratings agencies threatens the ability of the indebted PIIGS nations (Portugal, Italy, Ireland, Greece and Spain) to raise money in the debt markets, and this is putting further pressure on the currency.

Second, there is a flip side to this trade as well. I believe the U.S. dollar may be entering a period of secular strength. For all its anemic growth, the U.S economy is the best among a bad bunch of global economies. And in times of uncertainty, investors rush into the U.S. dollar, just like they did in 2008. So, I’ll be looking to buy the EUO as soon as it pulls back to the $19.50 level.

At the time of publication, Vardy had no positions in the securities mentioned.