Shorting Europe With ETFs

Post on: 17 Апрель, 2015 No Comment

The European debt crisis is the financial story that refuses to go away, so investors may as well figure out a way to play it to their advantage.

Uncertainty has mounted throughout the summer about the European Union’s ability to rescue its indebted members, and a meltdown of the European economy is certainly still in the cards.

As such, investors are getting itchy and looking to avoid their exposure to the whole continent or to short it outright.

ETFs are nicely designed to play these kinds of macro strategies because index funds offer broad coverage of regions like Europe, or even single European countries. Moreover, different asset-class options mean you don’t just have to go short the equities—you’re welcome to short bonds and currencies too.

The ETFs that make shorting the easiest are the inverse funds —ETFs that are designed from the outset to give the inverse, or short, returns of an index on a daily basis.

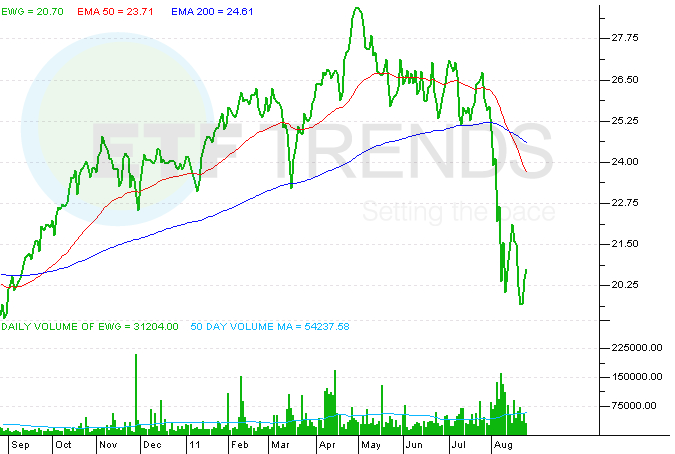

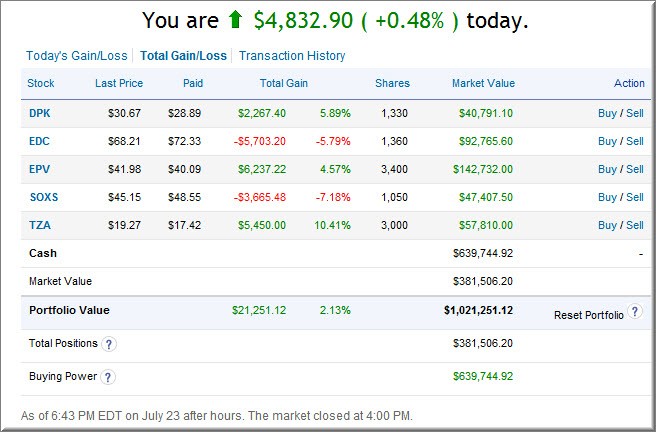

For Europe, that means the ProShares UltraShort MSCI Europe (EPV). The fund isn’t only inverse, but leveraged too, so it gives you double the inverse returns of the MSCI Europe Index. To review what that actually means, if the MSCI Europe Index returns 2 percent in a day, the ProShares UltraShort fund loses 4 percent on that day. Sounds great, but there’s a catch. Because funds like EPV are rebalanced daily, returns can diverge from the index over the long term, sometimes significantly.

Leveraged products like EPV are really aimed at institutional investors or day traders, and don’t tend to work out well for long-term holders. But unfortunately, it’s the only exchange-traded tool that makes shorting European equities as easy as placing a buy order in your brokerage account. Luckily, there are other ways to get short Europe.

Currency funds are one area with some attractive exchange-traded tools. Given a European meltdown, the euro would likely take a serious hit, and there are two inverse funds that have you covered in case that doomsday scenario comes to pass.

The first is the Market Vectors Double Short Euro ETN (DRR) and the second is the ProShares UltraShort Euro (NYSE Arca: EUO). These inverse funds also serve up double exposure, so they suffer from the same issues as EPV. But the typically lower volatility of currencies means returns probably won’t diverge as quickly as they would in equities.

That covers all the funds that are built to be shorting vehicles, but what about the long funds that are ideal to short in your own brokerage account?

Real Short-Selling

Here there are more, and better, options for retail investors. The iShares MSCI Europe Financials Sector Index Fund (EUFN) is the ideal ETF to short—granted that European banks will be the first domino to fall in a default scenario.

As we reported recently. the fund has had some big price swings lately, as Europe struggles to come up with a decisive course of action to quell its debt crisis, and has lost more than a third of its value in the past six months. Unfortunately, the fund doesn’t trade much, so executions may be less than favorable in terms of relatively wide bid/ask spreads.

Far more liquid is the Vanguard MSCI Europe ETF (VGK). which offers broad European exposure and has billions in assets. iShares also offers a suite of single-country European ETFs, including funds that cover Spain and Italy, for those who want to hone their short to just a single country.

The biggest gap in European coverage is in the fixed-income space, where there aren’t any really satisfactory options.

No one is rooting for defaults in eurozone countries, but given their likelihood—and the possibility of contagion slowing the global economy—it’s nice to know investors have options in the ETF space to hedge themselves against the worst.