ShortDuration ETF Showdown

Post on: 14 Июнь, 2015 No Comment

Actively Managed ETFs News:

Ten-year Treasury yields surged by nearly 130 basis points last year as investors fretted about a reduction to the Federal Reserves $85 billion-per-month quantitative easing program.

Those rising yields prompted losses for scores of bond exchange traded funds, catching many investors off-guard in the process. A survey released by Edward Jones in August 2013 highlighted just how surprised some investors were by the destructive effects of rising Treasury yields on the fixed income portions of their portfolios.

The survey showed 63% of Americans don’t know how rising interest rates will impact investment portfolios such as 401(k)s, IRAs and other savings platforms. [Investors Don’t Understand Rising Rates Risk]

“In fact, a full 24% say they feel completely in the dark about the potential effects,” Edward Jones said.

While investors pulled $63 billion from money market mutual funds last year, they poured $36 billion into short-duration ETFs, S&P Capital IQ noted, citing BlackRock data. One of the winners in the rush to short-duration ETFs was the Vanguard Short-Term Bond ETF (NYSEArca: BSV ). which finished 2013 ranked among the 10 best ETFs in terms of asset-gathering proficiency. [Short Duration Bond ETFs See Inflows Soar ]

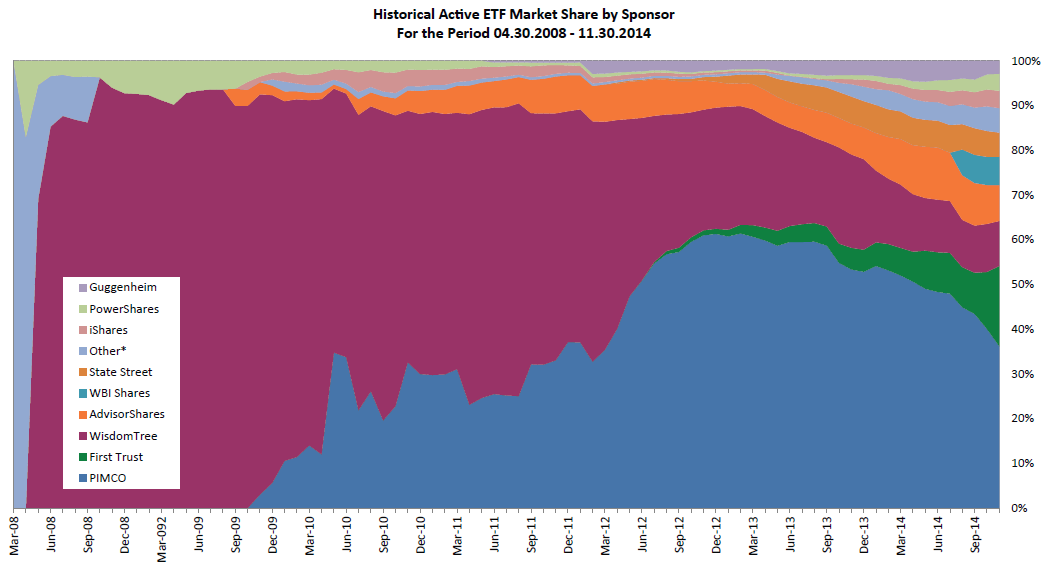

In a recent research note, S&P Capital IQ highlighted two options on the ultra-short duration side of the ETF ledger, including the PIMCO Enhanced Short Maturity ETF (NYSEArca: MINT ). one of the largest actively managed ETFs on the market today.

Despite the recent volatility we have seen in the bond market since the Fed started to slow its bond-buying program, MINT has never gained more than 2.5% or less than 0.45% in a calendar year, including a 0.70% return in 2013, said S&P Capital IQ in the note.

MINT, which is rated marketweight by S&P, holds the bulk of its assets in corporate bonds and has a duration of less than a year with a 30-day SEC yield of half a percent. [6 Ultra-Short Duration Bond ETFs]

S&P is more enthusiastic about the newly-minted iShares Short Maturity Bond ETF (NYSEArca: NEAR ). which the research firm rates overweight.

Just over three months old, NEAR does not have a long-term track record to point to like MINT, but we think it offers investors a nice alternative and has done a good job of gathering assets, said S&P Capital IQ. However, from a credit perspective, NEAR has greater exposure to BBB rated bonds and less exposure to AAA rated bonds than MINT. This ETF also has two-thirds of its assets in corporate bonds.

Like MINT, NEAR is actively managed. The iShares offering already has almost $183 million in assets under management and is inexpensive by the standards of an actively managed ETF with annual fees of just 0.25%.

PIMCO Enhanced Short Maturity