Short Term Bonds Funds v Market Funds

Post on: 27 Март, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

At a time in which money market funds are yielding virtually nothing. many investors have looked to short-term bond funds as a way to boost the yield on the portion of their savings that they want to keep safe. However, investors need to be aware that short-term bond funds carry a higher degree of risk and cannot always be used as a money market fund “substitute.”

What is a Short-Term Bond Fund?

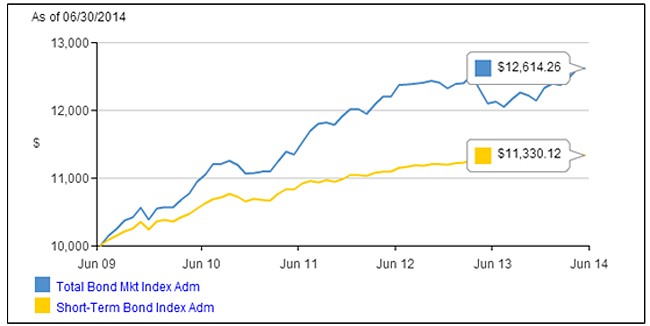

Since short-term bond funds tend to be lower risk, many investors use the funds as a higher-yielding alternative to money market funds. Money funds are the lowest risk option on the fixed income risk-reward spectrum. in the sense that they have the lowest yield and also the lowest risk. Short-term bonds funds are generally considered to be the next step up the ladder in terms of both risk and return potential.

They can be, but it’s essential that you know exactly what you’re buying. While short-term bond funds have low interest rate risk. they can have other types of risk depending upon the securities they hold in their portfolios. Many funds invest in high-quality corporate bonds or mortgage-backed securities. but this isn’t always the case. Investors learned this the hard way during the financial crisis of 2008, when many funds that had put too much money in mortgage-related securities experienced huge drops in their share prices.

Simply put, “short term ” doesn’t necessarily mean “low risk .” Read the material from the issuing company very carefully to make sure the managers haven’t loaded up the portfolio with complicated international investments or low-quality corporate bonds in an effort to boost yields, since these are the types of securities that can blow up if the investment environment sours.

Also, keep in mind that it has been a long time since the Federal Reserve has raised interest rates. As a result, it’s easy to forget that short-term bond will typically experience share price declines during the periods when the Fed is raising rates. The declines willbe modest in comparison to other types of funds, but money market funds won’t experience any downside at all.

Having said this, short-term bond funds can offer a decent yield advantage relative to money market funds (anywhere from one-half of one percent to nearly 2%, depending on their underlying investments) – a difference that can add up over time. As a result, many investors who are in a position to take on the added risk of short-term bonds can allocate a portion of their portfolios to the asset class in lieu of money market funds. However, if you need to use the money right away (within a year) or if you have an extremely low tolerance for risk. money market funds are the better option.

Ultrashort Bond Funds Are Also an Option

Investors have a growing number of options within the universe of ultrashort bond funds. The funds typically invest in bonds with maturities of between six months and one year. This represents a longer average maturity than money market funds, which typically focus on debt with maturities of a week or less, and short-term bond funds, where maturities tend to run between one and three years. Learn more about ultrashort bond funds here .

How to Invest in Short-Term Bonds

Investors who want to allocate some of their portfolios to short-term bonds have a number of options from which to choose. In addition to mutual funds such as Vanguard Short-Term Bond Index Fund (VBIRX), T. Rowe Price Short-Term Bond Fund (PRWBX), and Lord Abbett Short Duration Income Fund (LALDX), there are a growing number of exchange-traded funds (ETFs) that focus on the sector. Many short-term bond mutual funds offer check-writing privileges, as money market funds do, while ETFs do not. However, it is not recommended that investors use short-term bond funds for check writing because it creates a significant tax headache.

Among the largest ETFs that invest in short-term bonds are:

- iShares Barclays 1-3 Year Treasury Bond Fund (ticker:SHY)

- iShares Barclays 1-3 Year Credit Bond Fund (CSJ)

- Vanguard Short-Term Bond ETF (BSV)

- Vanguard Short-Term Corporate Bond ETF (VCSH)

- iShares Barclays Short Treasury Bond Fund (SHV)

- SPDR Nuveen Barclays Capital Short Term Municipal Bond ETF (SHM)

- SPDR Barclays Capital Short Term Corporate Bond (SCPB)

- PIMCO 1-5 Year US TIPS Index Fund (STPZ)

- iShares S&P Short Term National Muni Bond (SUB)

- Barclays 0-5 Year TIPS Bond Fund (STIP)

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.