Short Call Butterfly

Post on: 8 Апрель, 2015 No Comment

Advanced Option Strategies/Bullish Volatility

The Short Call Butterfly Spread

Andrea Kramer (akramer@sir-inc.com)

The short call butterfly spread is another options trading strategy that profits after a big price swing.

The Strategy

Who should tune in? The short call butterfly is typically employed by traders expecting a sharp move higher or lower from the underlying stock. Since the short butterfly is a volatility play, many investors implement the strategy ahead of a known event such as earnings or the release of drug-trial data, which can often act as momentum-inducing catalysts in the near term.

How does it work? Once the strategist has centered on a stock, he would purchase two at-the-money calls, while simultaneously selling one in-the-money and one out-of-the-money call. All of the options should have the same expiration month, with a resulting net credit to initiate the trade.

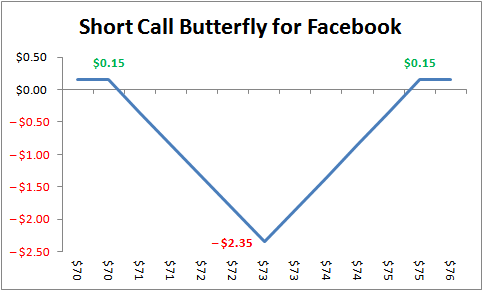

What�s in it for me? The objective is for the underlying shares to perforate one of two breakeven rails by options expiration. The lower breakeven rail is calculated by adding the lowest-strike call to the net credit, while the upper breakeven level is tallied by subtracting the initial credit from the highest-strike call. However, no matter which route the underlying security takes, the maximum potential reward for the short call butterfly is limited to the net credit received at initiation.

What do I have to lose? The worst-case scenario for the short call butterfly is for the underlying equity to remain stagnant through expiration. In this instance, the long calls and the higher-strike sold call would expire worthless, while the written lower-strike call would finish in the money. Nevertheless, the maximum potential loss on the play is limited to the difference between the long call strike and the lower-strike call, less the net credit.

(Don�t forget to include any margin requirements, brokerage fees or commission costs in your calculations. )

For Example

Meet Heidi � a veteran in the options arena who has been following stock XYZ, which is currently trading near $50. The company is slated to step into the earnings confessional next week, and Heidi wants to capitalize on any monumental price swings. However, she�s unsure which way the earnings pendulum will swing. As such, Heidi opts to initiate a short call butterfly on XYZ, in order to profit from post-earnings volatility in either direction.

To implement the trade, Heidi purchases two at-the-money November 50 calls for $1.50 each, or $3 total. At the same time, she sells one in-the-money November 45 call for $5.40, as well as one out-of-the-money November 55 call for $0.30. Since the premium received from writing the calls exceeds the premium paid for the long calls, Heidi�s short call butterfly is established for a net credit of $2.70 ([$5.40 + $0.30] � [$1.50 x 2]).

In order to retain the net credit � which represents the most Heidi can possibly gain on the play � she needs the shares of XYZ to perforate one of two breakeven rails by options expiration on Nov. 20: the $47.70 level (45 + $2.70), or the $52.30 level (55 — $2.70).

Should XYZ�s upcoming earnings report fail to spark volatility, keeping the shares subdued at the $50 level, the two long calls and the sold 55-strike call would expire worthless. Meanwhile, the sold November 45 call would be five points in the money, costing Heidi $5 to repurchase. Subtracting the credit of $2.70 received at initiation, Heidi�s loss on the short butterfly would amount to $2.30.

Before You Begin�

In conclusion, investors considering the a short call butterfly spread should single out stocks with a history of volatility. Furthermore, since it takes a notable move on the charts for this strategy to profit, consider targeting stocks with a potential catalyst on the calendar, like an upcoming date in the earnings confessional. However, if the limited reward of this volatility play isn�t appealing, you can always try your hand at similar strategies such as the long straddle, long strangle, or long guts, which feature unlimited profit potential in the wake of a move to the upside.