Sharpe Ratio

Post on: 6 Май, 2015 No Comment

Make Sharp Investing Decisions Using the Sharpe Ratio

As a general rule, people who invest money hope to make a profit off their investments. To this end, some invest in options with a guaranteed positive return, but the returns of such investments are often fairly low, too low for some investors. However, higher potential for positive returns generally translates as a higher risk investment. To determine how risky an investment is compared to its potential for profit, investors use the Sharpe ratio.

What is the Sharpe Ratio?

The Sharpe ratio is an economic tool which allows investors to calculate the risk of the investment relative to its return. There are a number of different versions of the equation, each of which uses slightly different numbers. The equation can be applied in retrospect to assess how a particular portfolio performed over a specific period of time. It can also be used in advance to make predictions about how things will do. In general, a higher number is better, since the higher number indicates a greater return for less risk.

The Math behind the Equation

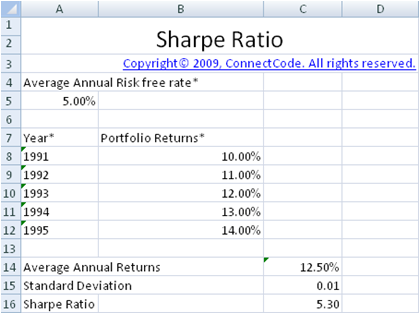

The Sharpe ratio is expressed mathematically as S = R — Rf / s. In words, the Sharpe ratio for a particular portfolio is the actual rate of return minus the risk free rate of return, divided by the standard deviation. R is the rate of return for the investment, or the amount of money the option actually made. Rf is the risk-free rate of return, or the profit that can be achieved with little to no risk. Standard deviation is a statistical term which quantifies how much the population varies over a specific period of time.

Definitions and Terms

The rate of return (ROR) or return on investment (ROI) is the gain or loss on an investment, and it is generally expressed as a percentage relative to the original investment. The risk-free return is a theoretical number, and it refers to the amount of money an investor would make on an investment without any risk. A benchmark is a standard against which the portfolio can be compared. Some of the more common benchmarks include the S&P 500, the Russell 2000 Index, and the Dow Jones Industrial Average. Two specific stocks can also be compared relative to each other or a third option.

Ex Post and Ex Ante

The Sharpe ratio can be used ex post, a Latin term meaning after the event, or ex ante, which is Latin for in advance. Ex post is typically used as a performance evaluation for a portfolio over a specific period of time. The performance of the portfolio is analyzed in terms of how much it actually earned and how much the profit margin varied over that time. When the Sharpe ratio is used ex ante, it is used to make a prediction about how the option is likely to behave. The prediction is also made based on how the portfolio has performed previously, and a fairly long period of time is used.

When searching for someone to manage investments, mutual funds, or the like, you want to be sure that they will make money. One way to determine this is to research the person’s past successes in the market. However, the amount of money an investor made is not enough to determine whether s/he is good with money, or just lucky. Using a tool like the Sharpe ratio can help determine how much money was made, relative to amount of risk taken.